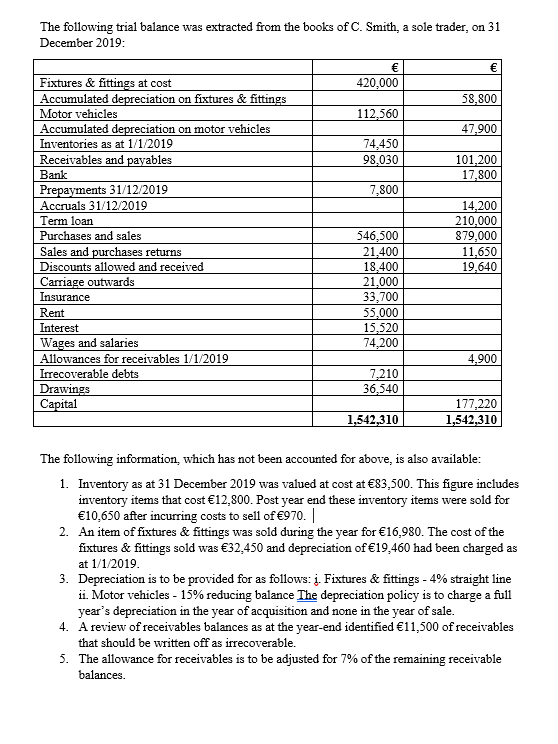

The following trial balance was extracted from the books of C. Smith, a sole trader, on 31 December 2019: € Fixtures & fittings at cost Accumulated depreciation on fixtures & fittings Motor vehicles 420,000 58,800 112,560 Accumulated depreciation on motor vehicles 47,900 74,450 98,030 Inventories as at 1/1/2019 Receivables and payables 101,200 17,800 Bank Prepayments 31/12/2019 7,800 Accruals 31/12/2019 14,200 210,000 879,000 11,650 19,640 Term loan 546,500 21,400 18,400 21,000 33,700 55,000 15,520 74,200 Purchases and sales Sales and purchases returns Discounts allowed and received Carriage outwards Insurance Rent Interest Wages and salaries Allowances for receivables 1/1/2019 4,900 7,210 36,540 Irrecoverable debts Drawings Capital 177,220 1,542,310 1,542,310 The following information, which has not been accounted for above, is also available: 1. Inventory as at 31 December 2019 was valued at cost at €83,500. This figure includes inventory items that cost €12,800. Post year end these inventory items were sold for €10,650 after incurring costs to sell of €970. || 2. An item of fixtures & fittings was sold during the year for €16,980. The cost of the fixtures & fittings sold was €32,450 and depreciation of €19,460 had been charged as at 1/1/2019. 3. Depreciation is to be provided for as follows: į. Fixtures & fittings - 4% straight line ii. Motor vehicles - 15% reducing balance The depreciation policy is to charge a full year's depreciation in the year of acquisition and none in the year of sale. 4. A review of receivables balances as at the year-end identified €11,500 of receivables that should be written off as irrecoverable. 5. The allowance for receivables is to be adjusted for 7% of the remaining receivable balances.

The following trial balance was extracted from the books of C. Smith, a sole trader, on 31 December 2019: € Fixtures & fittings at cost Accumulated depreciation on fixtures & fittings Motor vehicles 420,000 58,800 112,560 Accumulated depreciation on motor vehicles 47,900 74,450 98,030 Inventories as at 1/1/2019 Receivables and payables 101,200 17,800 Bank Prepayments 31/12/2019 7,800 Accruals 31/12/2019 14,200 210,000 879,000 11,650 19,640 Term loan 546,500 21,400 18,400 21,000 33,700 55,000 15,520 74,200 Purchases and sales Sales and purchases returns Discounts allowed and received Carriage outwards Insurance Rent Interest Wages and salaries Allowances for receivables 1/1/2019 4,900 7,210 36,540 Irrecoverable debts Drawings Capital 177,220 1,542,310 1,542,310 The following information, which has not been accounted for above, is also available: 1. Inventory as at 31 December 2019 was valued at cost at €83,500. This figure includes inventory items that cost €12,800. Post year end these inventory items were sold for €10,650 after incurring costs to sell of €970. || 2. An item of fixtures & fittings was sold during the year for €16,980. The cost of the fixtures & fittings sold was €32,450 and depreciation of €19,460 had been charged as at 1/1/2019. 3. Depreciation is to be provided for as follows: į. Fixtures & fittings - 4% straight line ii. Motor vehicles - 15% reducing balance The depreciation policy is to charge a full year's depreciation in the year of acquisition and none in the year of sale. 4. A review of receivables balances as at the year-end identified €11,500 of receivables that should be written off as irrecoverable. 5. The allowance for receivables is to be adjusted for 7% of the remaining receivable balances.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 7P: Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset,...

Related questions

Question

Need to Convert from

Transcribed Image Text:The following trial balance was extracted from the books of C. Smith, a sole trader, on 31

December 2019:

€

Fixtures & fittings at cost

Accumulated depreciation on fixtures & fittings

420,000

58,800

Motor vehicles

112,560

Accumulated depreciation on motor vehicles

47,900

Inventories as at 1/1/2019

74,450

Receivables and payables

101,200

17,800

98,030

Bank

Prepayments 31/12/2019

7,800

Accruals 31/12/2019

14,200

210,000

879,000

11,650

19,640

Term loan

546,500

21,400

18,400

21,000

33,700

Purchases and sales

Sales and purchases returns

Discounts allowed and received

Carriage outwards

Insurance

Rent

55,000

15,520

74,200

Interest

Wages and salaries

Allowances for receivables 1/1/2019

4,900

Irrecoverable debts

7,210

36,540

Drawings

Capital

177,220

1,542,310

1,542,310

The following information, which has not been accounted for above, is also available:

1. Inventory as at 31 December 2019 was valued at cost at €83,500. This figure includes

inventory items that cost €12,800. Post year end these inventory items were sold for

€10,650 after incurring costs to sell of €970. |

2. An item of fixtures & fittings was sold during the year for €16,980. The cost of the

fixtures & fittings sold was €32,450 and depreciation of €19,460 had been charged as

at 1/1/2019.

3. Depreciation is to be provided for as follows: į. Fixtures & fittings - 4% straight line

ii. Motor vehicles - 15% reducing balance The depreciation policy is to charge a full

year's depreciation in the year of acquisition and none in the year of sale.

4. A review of receivables balances as at the year-end identified €11,500 of receivables

that should be written off as irrecoverable.

5. The allowance for receivables is to be adjusted for 7% of the remaining receivable

balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning