The following production data were taken from the records of the Finishing Department for June: Inventory in process, June 1 (30% completed) 6,000 units Completed units during June 62,700 units Ending inventory (62% complete) 3,900 units The number of materials equivalent units of production in the June 30 Finishing Department inventory, assuming that the first-in, first-out method is used to cost inventories and materials were added at the beginning of the process, is O 56,700

The following production data were taken from the records of the Finishing Department for June: Inventory in process, June 1 (30% completed) 6,000 units Completed units during June 62,700 units Ending inventory (62% complete) 3,900 units The number of materials equivalent units of production in the June 30 Finishing Department inventory, assuming that the first-in, first-out method is used to cost inventories and materials were added at the beginning of the process, is O 56,700

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter5: Process Cost Accounting—general Procedures

Section: Chapter Questions

Problem 7E: The records of Stone Inc. reflect the following data: Work in process, beginning of month4,000 units...

Related questions

Topic Video

Question

N1.

Account

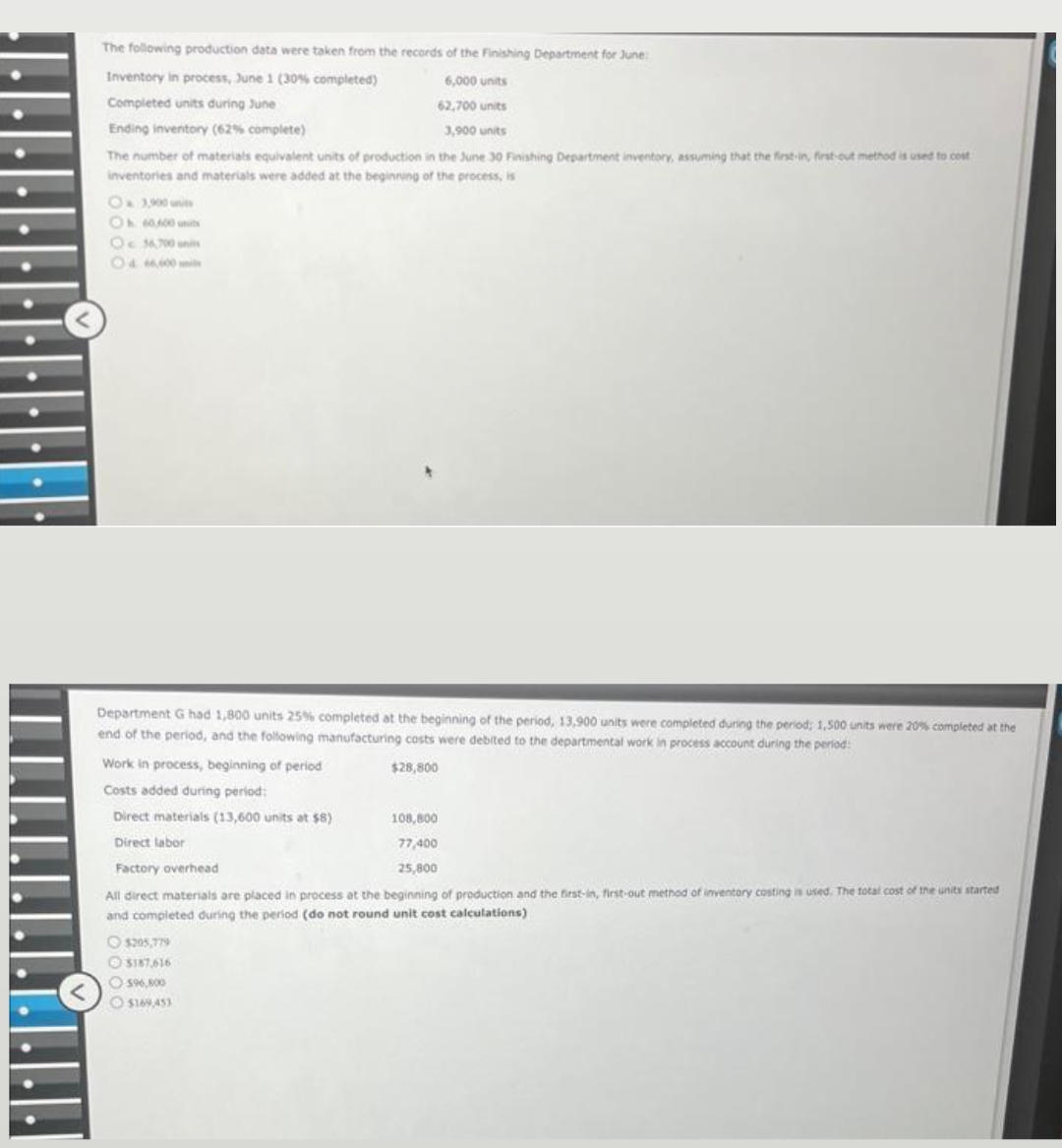

Transcribed Image Text:The following production data were taken from the records of the Finishing Department for June:

Inventory in process, June 1 (30% completed)

6,000 units

Completed units during June

62,700 units

Ending inventory (62% complete)

3,900 units

The number of materials equivalent units of production in the June 30 Finishing Department inventory, assuming that the first-in, first-out method is used to cost

inventories and materials were added at the beginning of the process, is

O 3,900 units

Oh 60,600 units

O 56,700 units

Department G had 1,800 units 25% completed at the beginning of the period, 13,900 units were completed during the period; 1,500 units were 20% completed at the

end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period:

$28,800

Work in process, beginning of period

Costs added during period:

Direct materials (13,600 units at $8)

108,800

Direct labor

77,400

25,800

Factory overhead

All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of the units started

and completed during the period (do not round unit cost calculations)

$205,779

$187,616

596,800

$169,453

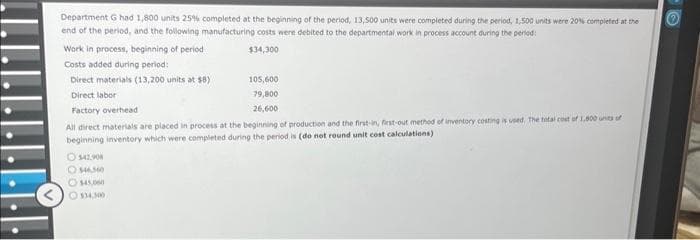

Transcribed Image Text:Department G had 1,800 units 25% completed at the beginning of the period, 13,500 units were completed during the period, 1,500 units were 20% completed at the

end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period:

$34,300

Work in process, beginning of period

Costs added during period:

105,600

79,800

26,600

All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of 1,800 units of

beginning inventory which were completed during the period is (do not round unit cost calculations)

Direct materials (13,200 units at $8)

Direct labor

Factory overhead

O $42.908

$46,340

$45,060

Ⓒ$34,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,