Payroll accounts and year-end entries

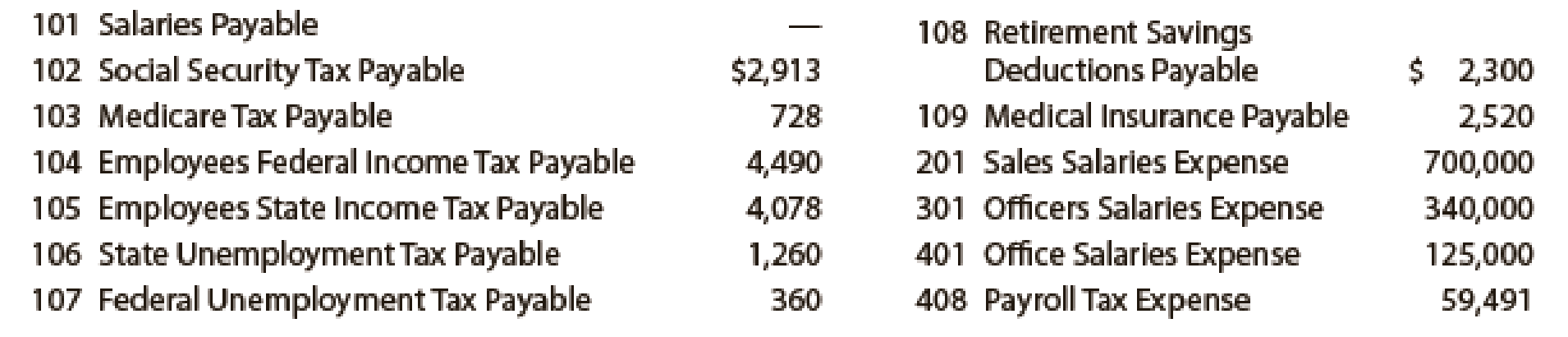

The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year:

The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December:

Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy.

1. Issued Check No. 816 to Alvarez Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees’ federal income tax due.

2. Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees.

12.

Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy.

1. Issued Check No. 816 to Alvarez Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees’ federal income tax due.

2. Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees.

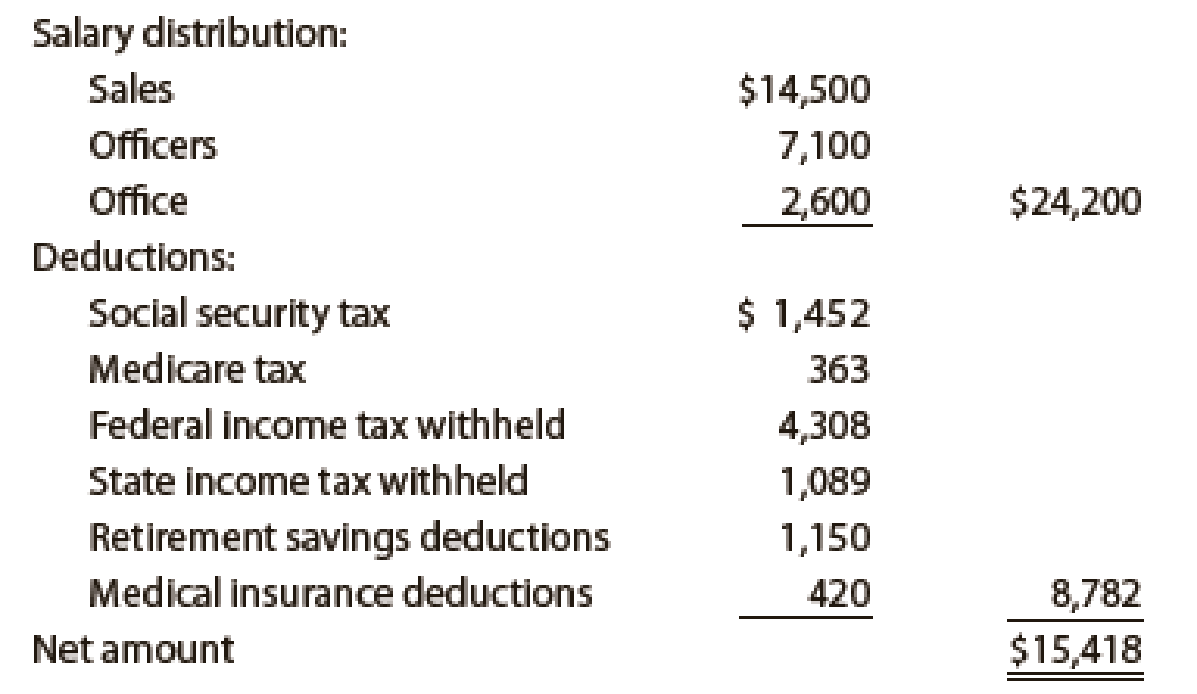

12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

12. Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund the payroll bank account.

12. Journalized the entry to record payroll taxes on employees’ earnings of December12: social security tax, $1,452; Medicare tax, $363; state

15. Issued Check No. 830 to Alvarez Bank for $7,938, in payment of $2,904 of social security tax, $726 of Medicare tax, and $4,308 of employees’ federal income tax due.

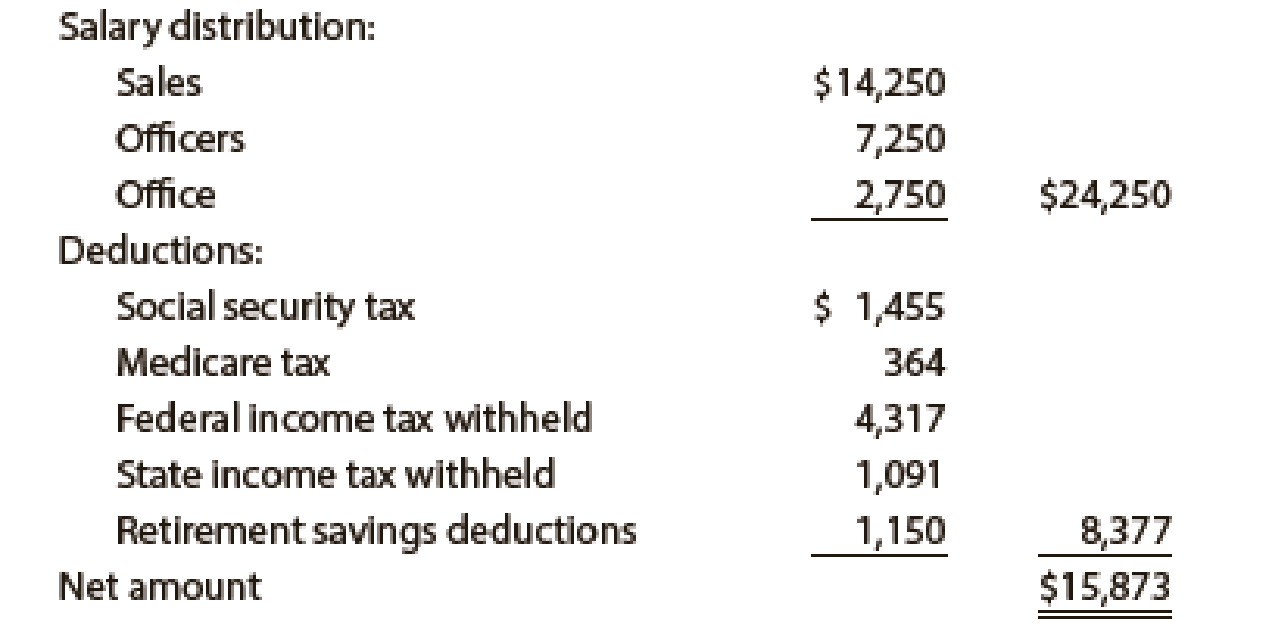

26. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

26. Issued Check No. 840 for the net amount of the biweekly payroll to fund the payroll bank account.

Dec. 26. Journalized the entry to record payroll taxes on employees’ earnings of December 26: social security tax, $1,455; Medicare tax, $364; state unemployment tax, $150; federal unemployment tax, $40.

30. Issued Check No. 851 for $6,258 to State Department of Revenue, in payment of employees’ state income tax due on December 31.

30. Issued Check No. 852 to Alvarez Bank for $2,300 to invest in a retirement savings account for employees.

31. Paid $55,400 to the employee pension plan. The annual pension cost is $65,500. (Record both the payment and the unfunded pension liability.)

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: sales salaries, $4,275; officers salaries, $2,175; office salaries, $825. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $13,350.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Financial Accounting

- Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, 4,275; officers salaries, 2,175; office salaries, 825. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 13,350.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 2. Issued Check No. 410 for 3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for 27,046, in payment of 9,273 of social security tax, 2,318 of Medicare tax, and 15,455 of employees federal income tax due. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees earnings of December13: social security tax, 4,632; Medicare tax, 1,158; state unemployment tax, 350; federal unemployment tax, 125. 16. Issued Check No. 424 to Jay Bank for 27,020, in payment of 9,264 of social security tax, 2,316 of Medicare tax, and 15,440 of employees federal income tax due. 19. Issued Check No. 429 to Sims-Walker Insurance Company for 31,500, in payment of the semiannual premium on the group medical insurance policy. 27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Journalized the entry to record payroll taxes on employees earnings of December27: social security tax, 4,668; Medicare tax, 1,167; state unemployment tax, 225; federal unemployment tax, 75. 27. Issued Check No. 543 for 20,884 to State Department of Revenue in payment of employees state income tax due on December 31. 31. Issued Check No. 545 to Jay Bank for 3,400 to invest in a retirement savings account for employees. 31. Paid 45,000 to the employee pension plan. The annual pension cost is 60,000. (Record both the payment and unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries,1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries, 1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forward

- JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees, All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQURED 1. Journalize the preceding transactions using a general journal. 2. Open accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardCALCULATING PAYROLL TAXES EXPENSE AND PREPARING JOURNAL ENTRY Selected information from the payroll register of Wrays Drug Store for the week ended July 14,20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first 7,000 of earnings. Social Security tax on the employer is 6.2% on the first 118,500 of earnings, and Medicare tax is 1.45% on gross earnings. REQUIRED 1. Calculate the total employer payroll taxes for these employees. 2. Prepare the journal entry to record the employer payroll taxes as of July 14,20--.arrow_forwardPayment and distribution of payroll The general ledger of Berskshire Mountain Manufacturing Inc. showed the following credit balances on January 15: Direct labor earnings amounted to 10,500 from January 16 to 31. Indirect labor was 5,700, and sales and administrative salaries for the same period amounted to 3,800. All wages are subject to FICA, FUTA, state unemployment taxes, and 10% income tax withholding. Required: 1. Prepare the journal entries for the following: a. Recording the payroll. b. Paying the payroll. c. Recording the employers payroll tax liability. d. Distributing the payroll costs for January 1631. 2. Prepare the journal entry to record the payment of the amounts due for the month to the government for FICA and income tax withholdings. 3. Calculate the amount of total earnings for the period from January 1 to 15. 4. Should the same person be responsible for computing the payroll, paying the payroll and making the entry to distribute the payroll? Why or why not?arrow_forward

- The totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardReviewing payroll records indicates that employee salaries that are due to be paid on January 3 include $3,575 in wages for the last week of December. There was no previous balance in the Salaries Payable account at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning