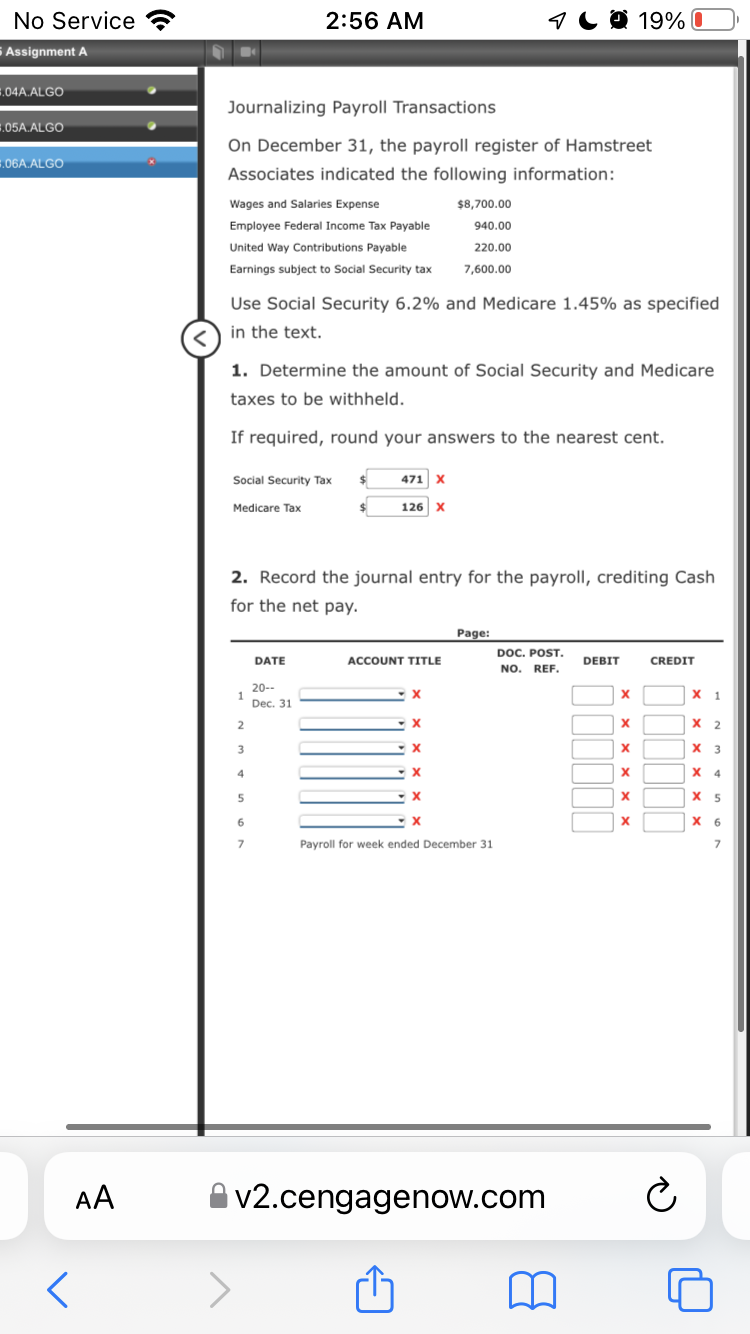

Journalizing Payroll Transactions On December 31, the payroll register of Hamstreet Associates indicated the following information: Wages and Salaries Expense $8,700.00 Employee Federal Income Tax Payable 940.00 United Way Contributions Payable 220.00 Earnings subject to Social Security tax 7,600.00 Use Social Security 6.2% and Medicare 1.45% as specified in the text. 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. Social Security Tax 471 x 126 x Medicare Tax 2. Record the journal entry for the payroll, crediting Cash for the net pay. Page: DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 20-- х 1 Dec. 31 2 X 2 3 х з 4. х 4 X 5 6 X 6 7 Payroll for week ended December 31 x x x x

Journalizing Payroll Transactions On December 31, the payroll register of Hamstreet Associates indicated the following information: Wages and Salaries Expense $8,700.00 Employee Federal Income Tax Payable 940.00 United Way Contributions Payable 220.00 Earnings subject to Social Security tax 7,600.00 Use Social Security 6.2% and Medicare 1.45% as specified in the text. 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. Social Security Tax 471 x 126 x Medicare Tax 2. Record the journal entry for the payroll, crediting Cash for the net pay. Page: DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 20-- х 1 Dec. 31 2 X 2 3 х з 4. х 4 X 5 6 X 6 7 Payroll for week ended December 31 x x x x

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.4BE

Related questions

Question

Transcribed Image Text:No Service

2:56 AM

1Ca 19%0

S Assignment A

,04A.ALGO

Journalizing Payroll Transactions

05A.ALGO

On December 31, the payroll register of Hamstreet

.06A.ALGO

Associates indicated the following information:

Wages and Salaries Expense

$8,700.00

Employee Federal Income Tax Payable

940.00

United Way Contributions Payable

220.00

Earnings subject to Social Security tax

7,600.00

Use Social Security 6.2% and Medicare 1.45% as specified

in the text.

1. Determine the amount of Social Security and Medicare

taxes to be withheld.

If required, round your answers to the nearest cent.

Social Security Tax

$4

471 x

Medicare Tax

126 X

2. Record the journal entry for the payroll, crediting Cash

for the net pay.

Page:

DOC. POST.

NO. REF.

DATE

ACCOUNT TITLE

DEBIT

CREDIT

20--

х 1

Dec. 31

2

х 2

3

х з

4

X 4

5

X 5

6

х 6

Payroll for week ended December 31

AA

v2.cengagenow.com

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage