The following transactions of Plymouth Pharmacies occurred during 2017 and 2018: 2017 Jan. 9 Purchased computer equipment at a cost of $12,000, signing a six-month, 9% note payable for that amount. Recorded the week's sales of $63,000, three-fourths on credit and one- fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. 29 Feb. 5 Sent the last week's sales tax to the state. Jul. 9 Paid the six-month, 9% note, plus interest, at maturity. Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system. Aug. 31 Dec. 31 Accrued warranty expense, which is estimated at 4% of sales of $609,000. 31 Accrued interest on all outstanding notes payable. 2018 Feb. 28 Paid the six-month 10% note, plus interest, at maturity.

The following transactions of Plymouth Pharmacies occurred during 2017 and 2018: 2017 Jan. 9 Purchased computer equipment at a cost of $12,000, signing a six-month, 9% note payable for that amount. Recorded the week's sales of $63,000, three-fourths on credit and one- fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. 29 Feb. 5 Sent the last week's sales tax to the state. Jul. 9 Paid the six-month, 9% note, plus interest, at maturity. Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system. Aug. 31 Dec. 31 Accrued warranty expense, which is estimated at 4% of sales of $609,000. 31 Accrued interest on all outstanding notes payable. 2018 Feb. 28 Paid the six-month 10% note, plus interest, at maturity.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 62E: Recording Various Liabilities Plymouth Electronics had the following transactions that produced...

Related questions

Question

#27

Transcribed Image Text:hapter 11

Journalize the transactions in Plymouth's general journal. Explanations

required. Round to the nearest dollar.

are not

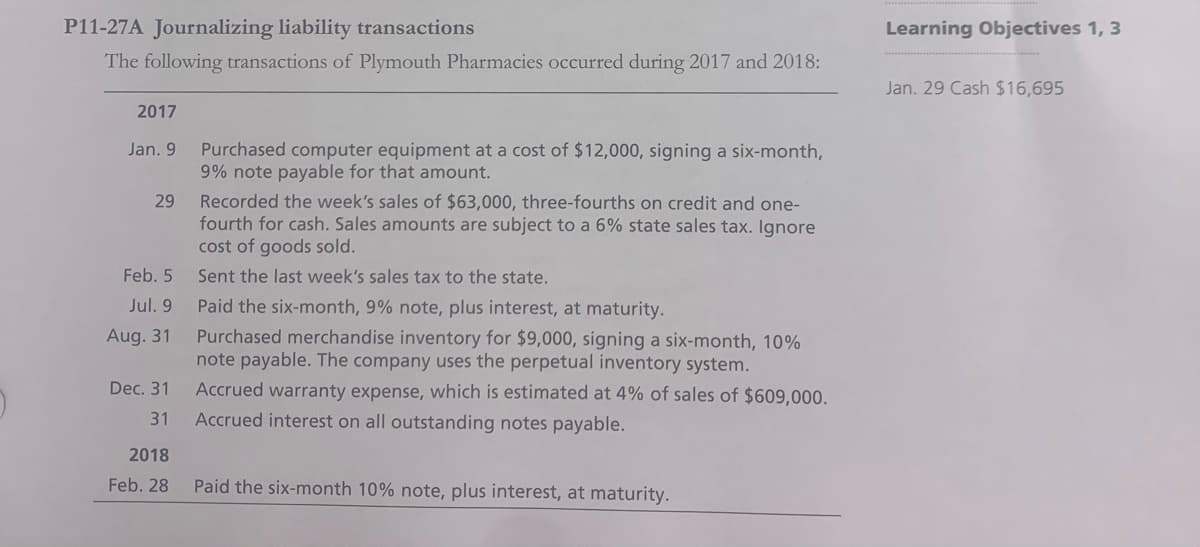

Transcribed Image Text:P11-27A Journalizing liability transactions

Learning Objectives 1, 3

The following transactions of Plymouth Pharmacies occurred during 2017 and 2018:

Jan. 29 Cash $16,695

2017

Purchased computer equipment at a cost of $12,000, signing a six-month,

9% note payable for that amount.

Jan. 9

Recorded the week's sales of $63,000, three-fourths on credit and one-

fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore

cost of goods sold.

29

Feb. 5

Sent the last week's sales tax to the state.

Jul. 9

Paid the six-month, 9% note, plus interest, at maturity.

Purchased merchandise inventory for $9,000, signing a six-month, 10%

note payable. The company uses the perpetual inventory system.

Aug. 31

Dec. 31

Accrued warranty expense, which is estimated at 4% of sales of $609,000.

31

Accrued interest on all outstanding notes payable.

2018

Feb. 28

Paid the six-month 10% note, plus interest, at maturity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning