The following transactions were taken from Mating Dormitory, a pegspace and catering services business owned by RCM (a hybrid business) during the first month of operations: Chart of Accounts Accounts Payable RCM, Capital RCM, Withdrawals Cash on hand Dorm Supplies Accounts Receivable Rent Income Catering Service Income Meals Expense Laundry Expense Taxes & licenses Expense Sample: Ms. RCM invested cash of P100,000 and fumiture and fixtures amounting to P250,000. Sept. 5: Space rental income for the month: Cash P15,000 On account - 10,000 Sept. 6: Pudbased various foods on account from Super Mart for her tenants, P50,000 and paid freight, P1,000. Sept. 10: RCM withdrew P10,000 cash from her business. Sept. 15: Received cash of P60,000 for catering services. Sept. 26: Paid her account with Super Mart. Sept. 27: Collected space rental account from tenant, P10,000. (Refer to transaction on Sept.5) Sept. 28: Bought dorm supplies from Super Mart and paid P3,000. Sept. 29: Paid laundry expenses, P5,000 Sept. 30: Paid taxes and licenses, P7,000

The following transactions were taken from Mating Dormitory, a pegspace and catering services business owned by RCM (a hybrid business) during the first month of operations: Chart of Accounts Accounts Payable RCM, Capital RCM, Withdrawals Cash on hand Dorm Supplies Accounts Receivable Rent Income Catering Service Income Meals Expense Laundry Expense Taxes & licenses Expense Sample: Ms. RCM invested cash of P100,000 and fumiture and fixtures amounting to P250,000. Sept. 5: Space rental income for the month: Cash P15,000 On account - 10,000 Sept. 6: Pudbased various foods on account from Super Mart for her tenants, P50,000 and paid freight, P1,000. Sept. 10: RCM withdrew P10,000 cash from her business. Sept. 15: Received cash of P60,000 for catering services. Sept. 26: Paid her account with Super Mart. Sept. 27: Collected space rental account from tenant, P10,000. (Refer to transaction on Sept.5) Sept. 28: Bought dorm supplies from Super Mart and paid P3,000. Sept. 29: Paid laundry expenses, P5,000 Sept. 30: Paid taxes and licenses, P7,000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section: Chapter Questions

Problem 1CP

Related questions

Topic Video

Question

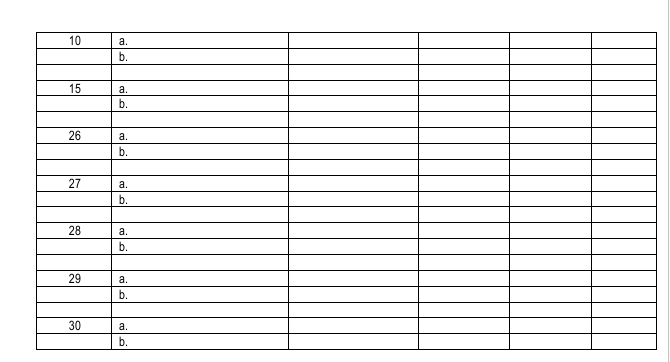

Transcribed Image Text:10

а.

b.

15

а.

b.

26

a.

b.

27

a.

b.

28

а.

b.

29

а.

b.

30

a.

b.

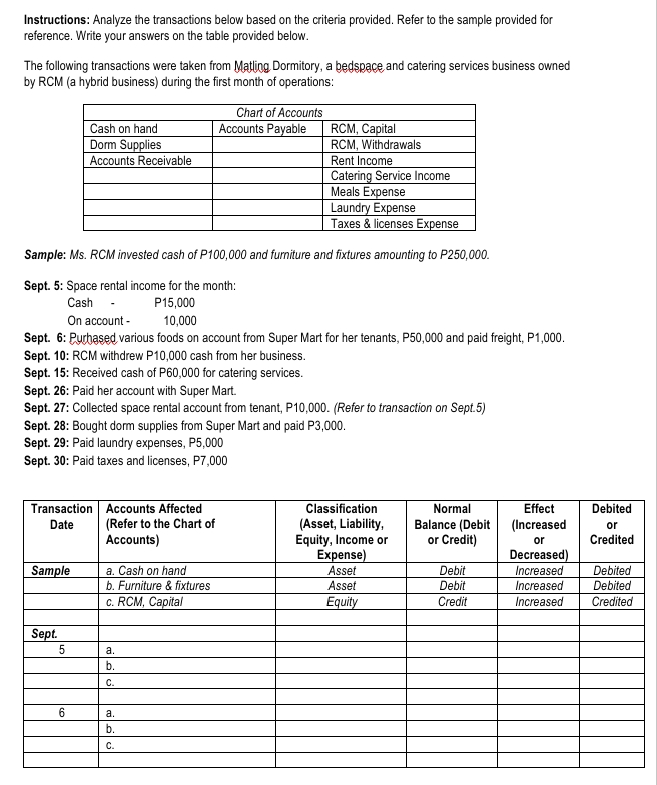

Transcribed Image Text:Instructions: Analyze the transactions below based on the criteria provided. Refer to the sample provided for

reference. Write your answers on the table provided below.

The following transactions were taken from Matling Dormitory, a bedspace and catering services business owned

by RCM (a hybrid business) during the first month of operations:

Chart of Accounts

Cash on hand

Dorm Supplies

Accounts Receivable

Accounts Payable

RCM, Capital

RCM, Withdrawals

Rent Income

Catering Service Income

Meals Expense

Laundry Expense

Taxes & licenses Expense

Sample: Ms. RCM invested cash of P100,000 and furniture and fixtures amounting to P250,000.

Sept. 5: Space rental income for the month:

Cash

P15,000

On account -

Sept. 6: Pucbased various foods on account from Super Mart for her tenants, P50,000 and paid freight, P1,000.

Sept. 10: RCM withdrew P10,000 cash from her business.

Sept. 15: Received cash of P60,000 for catering services.

Sept. 26: Paid her account with Super Mart.

Sept. 27: Collected space rental account from tenant, P10,000. (Refer to transaction on Sept.5)

Sept. 28: Bought dorm supplies from Super Mart and paid P3,000.

Sept. 29: Paid laundry expenses, P5,000

Sept. 30: Paid taxes and licenses, P7,000

10,000

Transaction Accounts Affected

(Refer to the Chart of

Accounts)

Classification

(Asset, Liability,

Equity, Income or

Expense)

Effect

(Increased

Normal

Debited

Balance (Debit

or Credit)

Date

or

or

Credited

Decreased)

Increased

Increased

Sample

a. Cash on hand

b. Furniture & fixtures

Asset

Debit

Debited

Asset

Debit

Debited

c. RCM, Capital

Equity

Credit

Increased

Credited

Sept.

a.

b.

C.

a.

b.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College