The four alternatives described below are being evaluated: Alternative Initial Investment IRR W $100,000 16% The Incremental IRRs are: IRRW-Y = 7% X $75,000 15% Text IRRW-X = 20% Y $40,000 29% Z $200,000 14%

The four alternatives described below are being evaluated: Alternative Initial Investment IRR W $100,000 16% The Incremental IRRs are: IRRW-Y = 7% X $75,000 15% Text IRRW-X = 20% Y $40,000 29% Z $200,000 14%

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 3E

Related questions

Question

Transcribed Image Text:incremental IRR cell.

b. Determine the incremental IRR value that belongs in the overprinted cell.

с.

If MARR is 37 percent/year, which project is preferred?

d. Based on the data in the table, if MARR is 40 percent, specify whether the present worth of each project would

be positive, negative, or zero when evaluated at MARR?

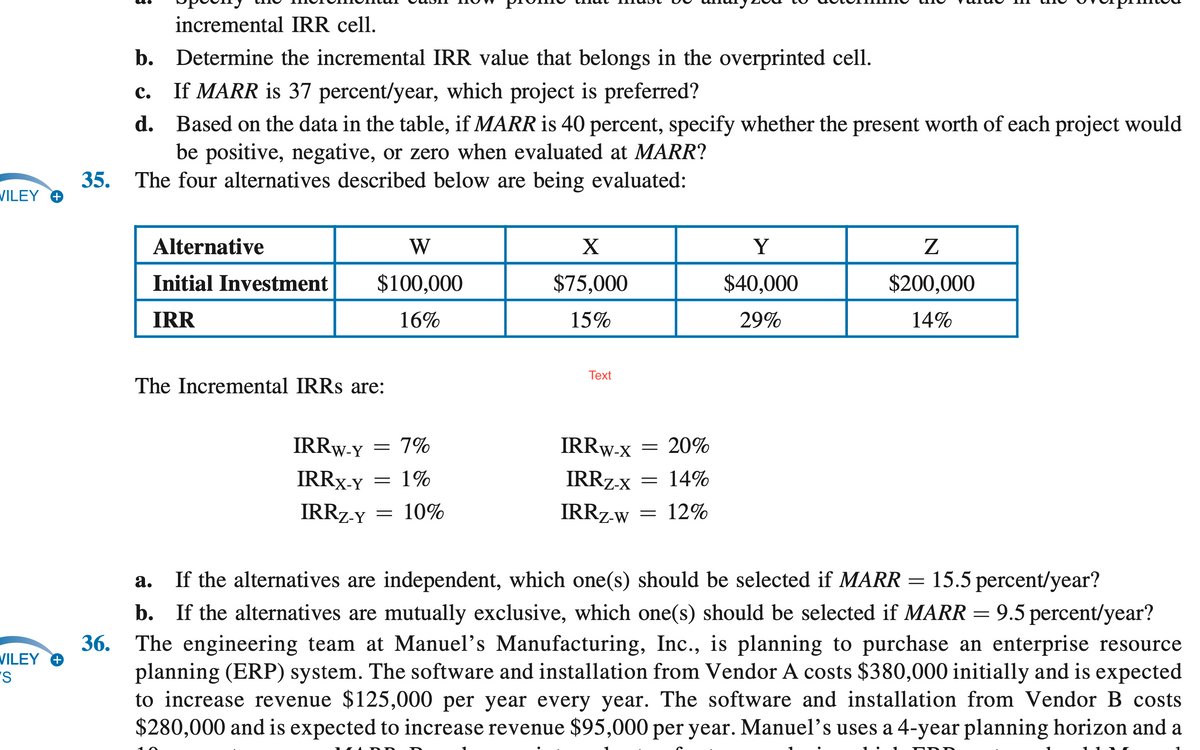

35. The four alternatives described below are being evaluated:

VILEY O

Alternative

W

X

Y

Initial Investment

$100,000

$75,000

$40,000

$200,000

IRR

16%

15%

29%

14%

Тext

The Incremental IRRS are:

IRRW-Y

7%

IRRW-x

= 20%

IRRX-Y

1%

IRRZ-x

14%

IRRZ-y = 10%

IRRZ-w

= 12%

15.5 percent/year?

9.5 percent/year?

а.

If the alternatives are independent, which one(s) should be selected if MARR =

b. If the alternatives are mutually exclusive, which one(s) should be selected if MARR =

The engineering team at Manuel's Manufacturing, Inc., is planning to purchase an enterprise resource

planning (ERP) system. The software and installation from Vendor A costs $380,000 initially and is expected

to increase revenue $125,000 per year every year. The software and installation from Vendor B costs

$280,000 and is expected to increase revenue $95,000 per year. Manuel's uses a 4-year planning horizon and a

36.

VILEY O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning