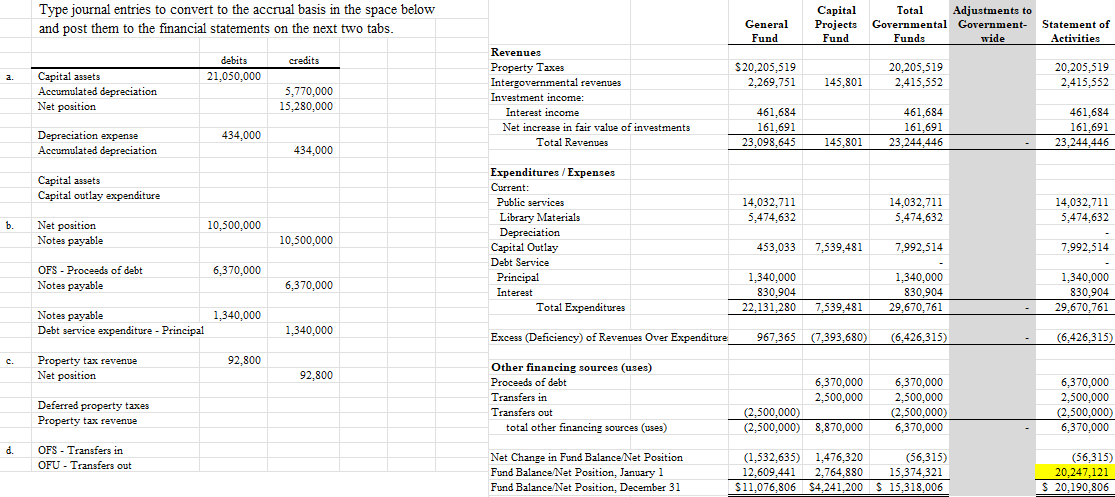

The fund-basis financial statements of Cherokee Library District (a special-purpose government engaged only in governmental activities) have been completed for the year 2020 and appear in the second and third tabs of the Excel spreadsheet provided with this exercise. The following information is also available: a. Capital Assets Capital assets purchased in previous years through governmental-type funds total $21,050,000 and had accumulated depreciation of $5,770,000. Depreciation on capital assets used in governmental-type activities amounted to $434,000 for 2020. No capital assets were sold or disposed of in 2020, and all purchases are properly reflected in the fund-basis statements as capital expenditures. b. Long-Term Debt There were $10,500,000 of outstanding long-term notes associated with governmental-type funds as of January 1, 2020. Interest is paid monthly. December 31, 2020, notes with a face value of $6,370,000 were issued at par. In addition, principal payments totaled $1,340,000. The notes, and any retained percentage on construction contracts, are associated with the purchase of capital assets. c. Deferred Inflows Deferred inflows are comprised solely of property taxes expected to be collected more than 60 days after year-end. The balance of deferred taxes at the end of 2019 was $92,000. d. Transfers: Transfers were between governmental-type funds. e. Beginning net position for the government-wide statements totaled $20,247,121 as January 1, 2020. This amount has already been entered in the Statement of Activities. Required: Use the Excel template provided to complete the following requirements. A separate tab is provided for each requirement: a. Prepare the journal entries necessary to convert the governmental fund financial statements to the accrual basis of accounting.

9-12.

The fund-basis financial statements of Cherokee Library District (a special-purpose government engaged only in governmental activities) have been completed for the year 2020 and appear in the second and third tabs of the Excel spreadsheet provided with this exercise. The following information is also available:

a. Capital Assets

- Capital assets purchased in previous years through governmental-type funds total $21,050,000 and had accumulated

depreciation of $5,770,000. - Depreciation on capital assets used in governmental-type activities amounted to $434,000 for 2020.

- No capital assets were sold or disposed of in 2020, and all purchases are properly reflected in the fund-basis statements as capital expenditures.

b. Long-Term Debt

- There were $10,500,000 of outstanding long-term notes associated with governmental-type funds as of January 1, 2020. Interest is paid monthly.

- December 31, 2020, notes with a face value of $6,370,000 were issued at par. In addition, principal payments totaled $1,340,000.

- The notes, and any retained percentage on construction contracts, are associated with the purchase of capital assets.

c. Deferred Inflows

- Deferred inflows are comprised solely of property taxes expected to be collected more than 60 days after year-end. The balance of

deferred taxes at the end of 2019 was $92,000.

d. Transfers: Transfers were between governmental-type funds.

e. Beginning net position for the government-wide statements totaled $20,247,121 as January 1, 2020. This amount has already been entered in the Statement of Activities.

Required:

Use the Excel template provided to complete the following requirements. A separate tab is provided for each requirement:

a. Prepare the

b.

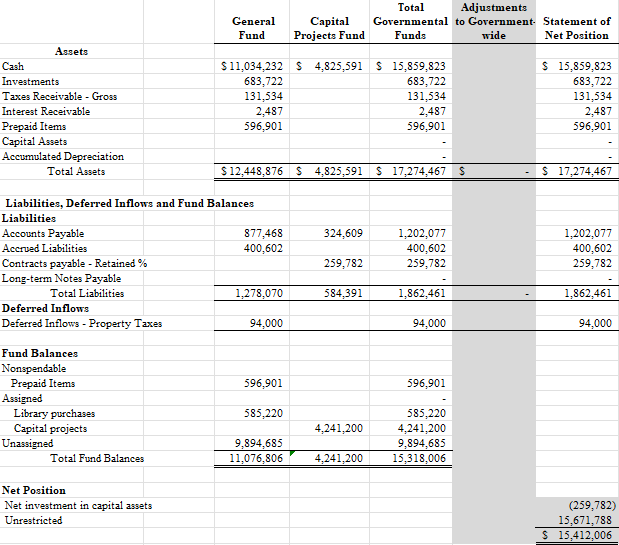

c. Post the journal entries to the (shaded) Adjustments column to produce a Statement of Net Position. Calculate the appropriate amounts for the Net Position accounts, assuming there are restricted net position.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images