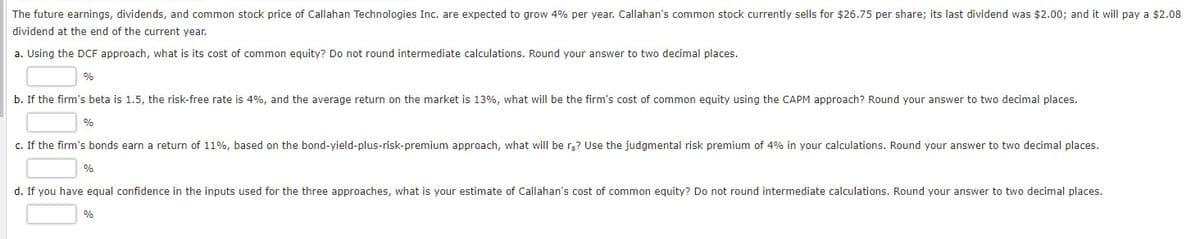

The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 4% per year. Callahan's common stock currently sells for $26.75 per share; its last dividend was $2.00; and it will pay a $2.08 dividend at the end of the current year. a. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. b. If the firm's beta is 1.5, the risk-free rate is 4%, and the average return on the market is 13%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. c. If the firm's bonds earn a return of 11%, based on the bond-yield-plus-risk-premium approach, what will be r,? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places. d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places.

The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 4% per year. Callahan's common stock currently sells for $26.75 per share; its last dividend was $2.00; and it will pay a $2.08 dividend at the end of the current year. a. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. b. If the firm's beta is 1.5, the risk-free rate is 4%, and the average return on the market is 13%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. c. If the firm's bonds earn a return of 11%, based on the bond-yield-plus-risk-premium approach, what will be r,? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places. d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 4CP

Related questions

Question

100%

Transcribed Image Text:The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 4% per year. Callahan's common stock currently sells for $26.75 per share; its last dividend was $2.00; and it will pay a $2.08

dividend at the end of the current year.

a. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places.

%

b. If the firm's beta is 1.5, the risk-free rate is 4%, and the average return on the market is 13%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places.

%

c. If the firm's bonds earn a return of 11%, based on the bond-yield-plus-risk-premium approach, what will be rg? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places.

d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning