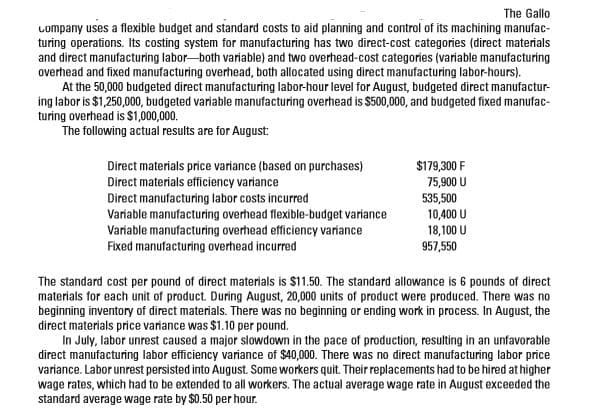

The Gallo Lompany uses a flexible budget and standard costs to aid planning and control of its machining manufac- turing operations. Its costing system for manufacturing has two direct-cost categories (direct materials and direct manufacturing labor-both variable) and two overhead-cost categories (variable manufacturing overhead and fixed manufacturing overhead, both allocated using direct manufacturing labor-hours). At the 50,000 budgeted direct manufacturing labor-hour level for August, budgeted direct manufactur- ing labor is $1,250,000, budgeted variable manufacturing overhead is $500,000, and budgeted fixed manufac- turing overhead is $1,000,000. The following actual results are for August: $179,300 F 75,900 U 535,500 10,400 U 18,100 U 957,550 Direct materials price variance (based on purchases) Direct materials efficiency variance Direct manufacturing labor costs incurred Variable manufacturing overhead flexible-budget variance Variable manufacturing overhead efficiency variance Fixed manufacturing overhead incurred The standard cost per pound of direct materials is $11.50. The standard allowance is 6 pounds of direct materials for each unit of product. During August, 20,000 units of product were produced. There was no beginning inventory of direct materials. There was no beginning or ending work in process. In August, the direct materials price variance was $1.10 per pound. In July, labor unrest caused a major slowdown in the pace of production, resulting in an unfavorable direct manufacturing labor efficiency variance of $40,000. There was no direct manufacturing labor price variance. Labor unrest persisted into August. Some workers quit. Their replacements had to be hired at higher wage rates, which had to be extended to all workers. The actual average wage rate in August exceeded the standard average wage rate by $0.50 per hour.

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Compute the Total number of pounds of excess direct materials used for August

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images