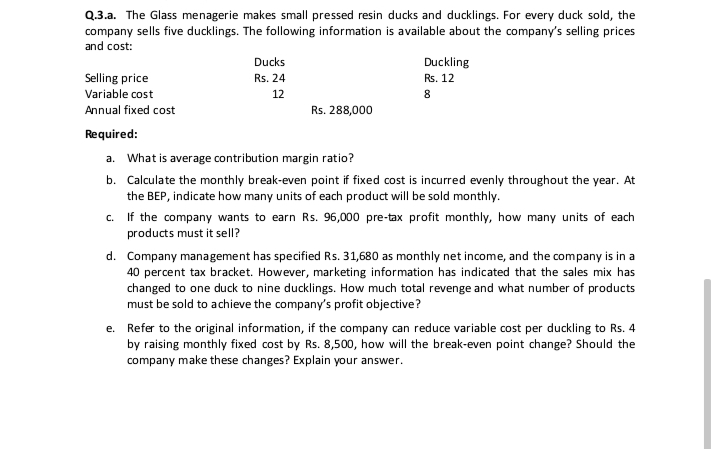

The Glass menagerie makes small pressed resin ducks and ducklings. For every duck sold, the company sells five ducklings. The following information is available about the company’s selling prices and cost: Ducks Duckling Selling price Rs. 24 Rs. 12 Variable cost 12 8 Annual fixed cost Rs. 288,000 Required: a. What is average contribution margin ratio? b. Calculate the monthly break-even point if fixed cost is incurred evenly throughout the year. At the BEP, indicate how many units of each product will be sold monthly. c. If the company wants to earn Rs. 96,000 pre-tax profit monthly, how many units of each products must it sell?

The Glass menagerie makes small pressed resin ducks and ducklings. For every duck sold, the

company sells five ducklings. The following information is available about the company’s selling prices

and cost:

Ducks

Duckling

Selling price

Rs. 24

Rs. 12

Variable cost

12

8

Annual fixed cost

Rs. 288,000

Required:

a. What is average contribution margin ratio?

b. Calculate the monthly break-even point if fixed cost is incurred evenly throughout the year. At

the BEP, indicate how many units of each product will be sold monthly.

c. If the company wants to earn Rs. 96,000 pre-tax profit monthly, how many units of each

products must it sell?

d. Company management has specified Rs. 31,680 as monthly net income, and the company is in a

40 percent tax bracket. However, marketing information has indicated that the sales mix has

changed to one duck to nine ducklings. How much total revenge and what number of products

must be sold to achieve the company’s profit objective?

e. Refer to the original information, if the company can reduce variable cost per duckling to Rs. 4

by raising monthly fixed cost by Rs. 8,500, how will the break-even point change? Should the

company make these changes? Explain your answer.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps