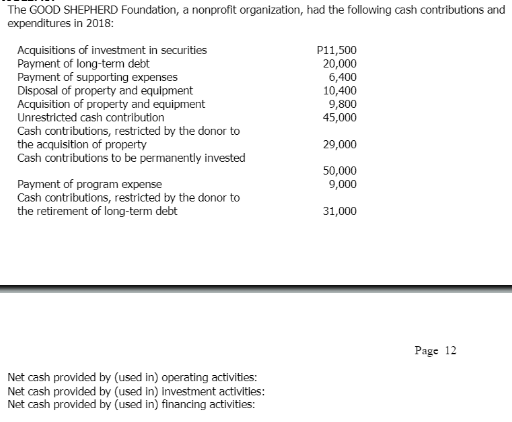

The GOOD SHEPHERD Foundation, a nonprofit organization, had the following cash contributions and expenditures in 2018: Acquisitions of investment in securities Payment of long-term debt Payment of supporting expenses Disposal of property and equipment Acquisition of property and equipment Unrestricted cash contributlon Cash contributions, restricted by the donor to the acquisition of property Cash contributions to be permanently invested P11,500 20,000 6,400 10,400 9,800 45,000 29,000 50,000 9,000 Payment of program expense Cash contributions, restricted by the donor to the retirement of long-term debt 31,000 Page 12 Net cash provided by (used in) operating activities: Net cash provided by (used in) Investment activities: Net cash provided by (used in) financing activities:

The GOOD SHEPHERD Foundation, a nonprofit organization, had the following cash contributions and expenditures in 2018: Acquisitions of investment in securities Payment of long-term debt Payment of supporting expenses Disposal of property and equipment Acquisition of property and equipment Unrestricted cash contributlon Cash contributions, restricted by the donor to the acquisition of property Cash contributions to be permanently invested P11,500 20,000 6,400 10,400 9,800 45,000 29,000 50,000 9,000 Payment of program expense Cash contributions, restricted by the donor to the retirement of long-term debt 31,000 Page 12 Net cash provided by (used in) operating activities: Net cash provided by (used in) Investment activities: Net cash provided by (used in) financing activities:

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 15DQ

Related questions

Question

100%

Transcribed Image Text:The GOOD SHEPHERD Foundation, a nonprofit organization, had the following cash contributions and

expenditures in 2018:

Acquisitions of investment in securities

Payment of long-term debt

Payment of supporting expenses

Disposal of property and equipment

Acquisition of property and equipment

Unrestricted cash contribution

Cash contributions, restricted by the donor to

the acquisition of property

Cash contributions to be permanently invested

P11,500

20,000

6,400

10,400

9,800

45,000

29,000

50,000

9,000

Payment of program expense

Cash contributions, restricted by the donor to

the retirement of long-term debt

31,000

Page 12

Net cash provided by (used in) operating activities:

Net cash provided by (used in) investment activities:

Net cash provided by (used in) financing activities:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you