The graph shows the market for flashlights when the government imposes a tax of $6 per flashlight on sellers. Next question Price (dollars per flashlight) 16- Who pays the tax? 14 12 Draw a point to show the price of a flashlight with no tax. Label it 1. Draw a point to show the price paid by buyers following the tax. Label it 2 10 8- Draw a point to show the price received by sellers following the tax. Label it 3. 6- The tax is 4- O A. split between the seller and the buyer, and the buyer pays more than the seller O B. paid by the sellers because it is imposed on the sellers by the government 2- O C. split evenly between the seller and the buyer to O D. paid by the buyers because tax is always added to the sale price at the check-out Quantity (millions of flashlights per year) >>> Draw only the objects specified in the question.

The graph shows the market for flashlights when the government imposes a tax of $6 per flashlight on sellers. Next question Price (dollars per flashlight) 16- Who pays the tax? 14 12 Draw a point to show the price of a flashlight with no tax. Label it 1. Draw a point to show the price paid by buyers following the tax. Label it 2 10 8- Draw a point to show the price received by sellers following the tax. Label it 3. 6- The tax is 4- O A. split between the seller and the buyer, and the buyer pays more than the seller O B. paid by the sellers because it is imposed on the sellers by the government 2- O C. split evenly between the seller and the buyer to O D. paid by the buyers because tax is always added to the sale price at the check-out Quantity (millions of flashlights per year) >>> Draw only the objects specified in the question.

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 4PA

Related questions

Question

Question 4

Transcribed Image Text:This question: 1 point(s) possible

Next question

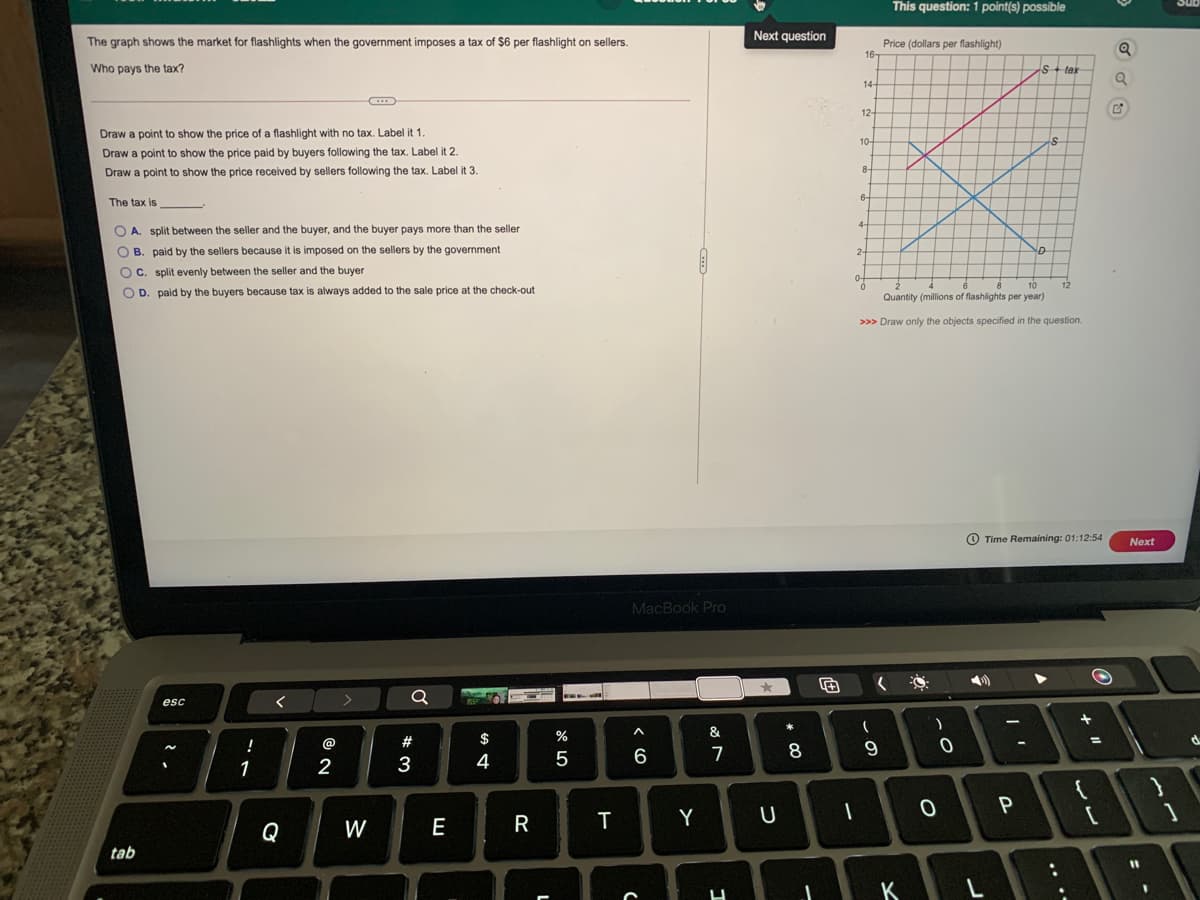

The graph shows the market for flashlights when the government imposes a tax of $6 per flashlight on sellers.

Price (dollars per flashlight)

16-

Who pays the tax?

S+tex

14-

12-

Draw a point to show the price of a flashlight with no tax. Label it 1.

10-

Draw a point to show the price paid by buyers following the tax. Label it 2.

8-

Draw a point to show the price received by sellers following the tax. Label it 3.

6-

The tax is

4-

O A. split between the seller and the buyer, and the buyer pays more than the seller

O B. paid by the sellers because it is imposed on the sellers by the government

2-

O C. split evenly between the seller and the buyer

10

Quantity (millions of flashlights per year)

12

O D. paid by the buyers because tax is always added to the sale price at the check-out

>>> Draw only the objects specified in the question.

O Time Remaining: 01:12:54

Next

MacBook Pro

esc

@

#

$

%

!

1

2

3

4

5

6

Q

W

E

R

T

Y

tab

K

レレ

.. **

ーの

* 00

つ

エ

Expert Solution

Step 1

Meaning of Tax Imposition:

The term tax imposition or the tax hike refers to the situation under which the central authority or the government increases the tax slabs further from the original state, thus the tax imposition forces the individuals to pay more and extra from their income to the government.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning