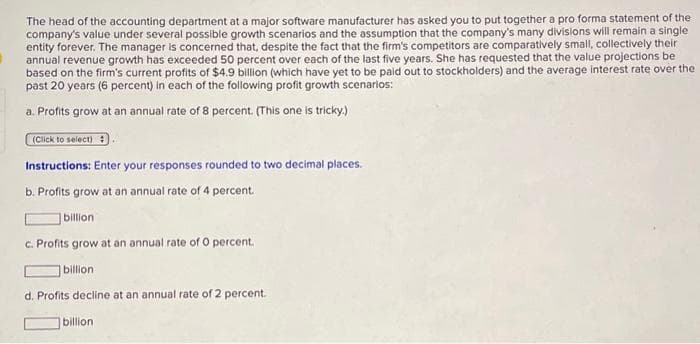

The head of the accounting department at a major software manufacturer has asked you to put together a pro forma statement of the company's value under several possible growth scenarios and the assumption that the company's many divisions will remain a single entity forever. The manager is concerned that, despite the fact that the firm's competitors are comparatively small, collectively their annual revenue growth has exceeded 50 percent over each of the last five years. She has requested that the value projections be based on the firm's current profits of $4.9 billion (which have yet to be paid out to stockholders) and the average interest rate over the past 20 years (6 percent) in each of the following profit growth scenarios: a. Profits grow at an annual rate of 8 percent. (This one is tricky.) (Click to select) : Instructions: Enter your responses rounded to two decimal places. b. Profits grow at an annual rate of 4 percent. billion c. Profits grow at an annual rate of O percent. billion d. Profits decline at an annual rate of 2 percent. billion

The head of the accounting department at a major software manufacturer has asked you to put together a pro forma statement of the company's value under several possible growth scenarios and the assumption that the company's many divisions will remain a single entity forever. The manager is concerned that, despite the fact that the firm's competitors are comparatively small, collectively their annual revenue growth has exceeded 50 percent over each of the last five years. She has requested that the value projections be based on the firm's current profits of $4.9 billion (which have yet to be paid out to stockholders) and the average interest rate over the past 20 years (6 percent) in each of the following profit growth scenarios: a. Profits grow at an annual rate of 8 percent. (This one is tricky.) (Click to select) : Instructions: Enter your responses rounded to two decimal places. b. Profits grow at an annual rate of 4 percent. billion c. Profits grow at an annual rate of O percent. billion d. Profits decline at an annual rate of 2 percent. billion

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 27P: Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over...

Related questions

Question

Solve all parts..

Transcribed Image Text:The head of the accounting department at a major software manufacturer has asked you to put together a pro forma statement of the

company's value under several possible growth scenarios and the assumption that the company's many divisions will remain a single

entity forever. The manager is concerned that, despite the fact that the firm's competitors are comparatively small, collectively their

annual revenue growth has exceeded 50 percent over each of the last five years. She has requested that the value projections be

based on the firm's current profits of $4.9 billion (which have yet to be paid out to stockholders) and the average interest rate over the

past 20 years (6 percent) in each of the following profit growth scenarios:

a. Profits grow at an annual rate of 8 percent. (This one is tricky.)

(Click to select)

Instructions: Enter your responses rounded to two decimal places.

b. Profits grow at an annual rate of 4 percent.

billion

c. Profits grow at an annual rate of O percent.

billion

d. Profits decline at an annual rate of 2 percent.

billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning