Using the key value driver formula, what is the enterprise value in each scenario?

Using the key value driver formula, what is the enterprise value in each scenario?

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

A colleague recommends a shortcut to value the company in the question in attached photo. Rather than compute each scenario separately, the colleague recommends averaging each input, such that growth equals 4 percent and ROIC equals 12 percent. Will this lead to the same enterprise value as you found in the question attached in the photo? Which method is correct? Why?

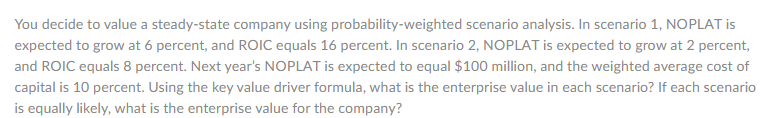

Transcribed Image Text:You decide to value a steady-state company using probability-weighted scenario analysis. In scenario 1, NOPLAT is

expected to grow at 6 percent, and ROIC equals 16 percent. In scenario 2, NOPLAT is expected to grow at 2 percent,

and ROIC equals 8 percent. Next year's NOPLAT is expected to equal $100 million, and the weighted average cost of

capital is 10 percent. Using the key value driver formula, what is the enterprise value in each scenario? If each scenario

is equally likely, what is the enterprise value for the company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning