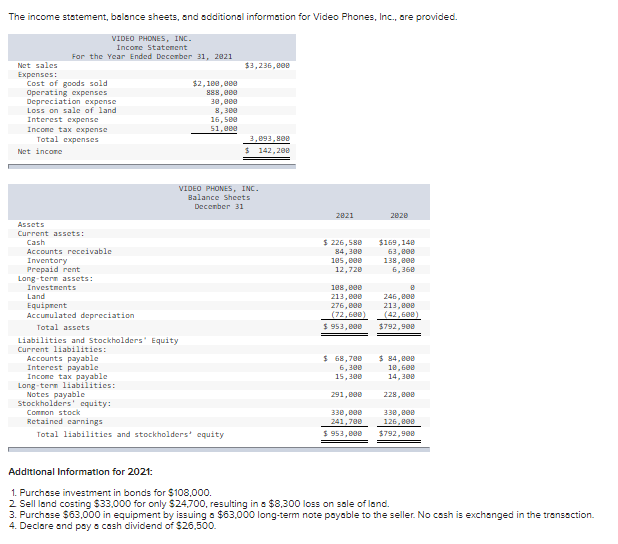

The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. VIDEO PHONES, INC. Incore Statement Far the Year Ended Decerber 31, 2021 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses $3,236, 000 $2,100,000 888, eee 30,000 8,300 16, see 51,eee 3,093, s00 Net incone $ 142, 200 VIDEO PHONES, INC. Balance Sheets Decenber 31 2021 2020 Assets Current assets: Cash $ 226,580 84,300 1a5, eee 12,720 $169,148 63,e00 138, e00 6,360 Accounts receivable Inventory Prepaid rent Lang -term assets: Investments 108, e0e 213,000 276, 000 Land Equipnent Accumulated depreciation Total assets 246, e00 213, e0e (72,6ae) $ 953, 000 (42,600) $792,900 Liabilities and Stackholders Equity Current liabilities: $ 68,700 6, 300 15, 300 $ 84, 000 10,600 14,300 Accounts payable Interest payable Income tax payable Lang tern liabilities: Notes payable Stockholders' equity: Comnon stock Retained earnings 291,000 228, e00 330, e0e 241,700 $ 953, eee 330, eee 126,200 $792,900 Total liabilities and stockholders' equity Additional Information for 2021: 1. Purchase investment in bonds for $108,000. 2 Sell land costing $33,000 for only $24,700, resulting in a $8,300 loss on sale of land. 3. Purchase $63,000 in equipment by issuing a $63,000 long-term note payable to the seller. No cash is exchanged in the transaction. 4. Declare and pay a cash dividend of $26,500.

The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. VIDEO PHONES, INC. Incore Statement Far the Year Ended Decerber 31, 2021 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses $3,236, 000 $2,100,000 888, eee 30,000 8,300 16, see 51,eee 3,093, s00 Net incone $ 142, 200 VIDEO PHONES, INC. Balance Sheets Decenber 31 2021 2020 Assets Current assets: Cash $ 226,580 84,300 1a5, eee 12,720 $169,148 63,e00 138, e00 6,360 Accounts receivable Inventory Prepaid rent Lang -term assets: Investments 108, e0e 213,000 276, 000 Land Equipnent Accumulated depreciation Total assets 246, e00 213, e0e (72,6ae) $ 953, 000 (42,600) $792,900 Liabilities and Stackholders Equity Current liabilities: $ 68,700 6, 300 15, 300 $ 84, 000 10,600 14,300 Accounts payable Interest payable Income tax payable Lang tern liabilities: Notes payable Stockholders' equity: Comnon stock Retained earnings 291,000 228, e00 330, e0e 241,700 $ 953, eee 330, eee 126,200 $792,900 Total liabilities and stockholders' equity Additional Information for 2021: 1. Purchase investment in bonds for $108,000. 2 Sell land costing $33,000 for only $24,700, resulting in a $8,300 loss on sale of land. 3. Purchase $63,000 in equipment by issuing a $63,000 long-term note payable to the seller. No cash is exchanged in the transaction. 4. Declare and pay a cash dividend of $26,500.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 40E

Related questions

Question

Transcribed Image Text:The income statement, balance sheets, and additional information for Video Phones, Inc., are provided.

VIDEO PHONES, INC.

Incore Statement

Far the Year Ended Decerber 31, 2021

Net sales

$3,236, e00

Expenses:

Cost of goods sold

Operating expenses

Depreciation expense

Loss on sale of land

$2, 180,e00

888,eee

30,eee

8,300

16, 500

51,000

Interest expense

Income taх ехреnse

Total expenses

3,093, 80e

Net incone

$ 142,200

VIDEO PHONES, INC.

Balance Sheets

Decenber 31

2021

2020

Assets

Current assets:

Cash

$ 226, 580

84,300

105, e00

12,720

$169,148

63, e00

138, 000

6, 368

Accounts receivable

Inventory

Prepaid rent

Long-term assets:

Investments

Land

Equiprent

Accumulated depreciation

188, e00

213,e00

276, 000

246, B00

213,e00

(42,608)

(72,680)

$ 953, 800

Total assets

$792,900

Liabilities and Stockholders' iquity

Current liabilities:

$ 68,700

6,300

$ 84, e00

Accounts payable

Interest payable

Income tax payable

Lang tern liabilities:

Notes payable

Stockholders' equity:

18,600

14,300

15,380

291, 000

228, e00

Common stock

330, e00

Retained earnings

330,e00

241,700

126, e00

Total liabilitics and stockholders' equity

$ 953, e00

$792,900

Additional Information for 2021:

1. Purchase investment in bonds for $108,000.

2 Sell land costing $33,000 for only $24,700, resulting in a $8,300 loss on sale of land.

3. Purchase $63,000 in equipment by issuing a $63,000 long-term note payable to the seller. No cash is exchanged in the transaction.

4. Declare and pay a cash dividend of $26,500.

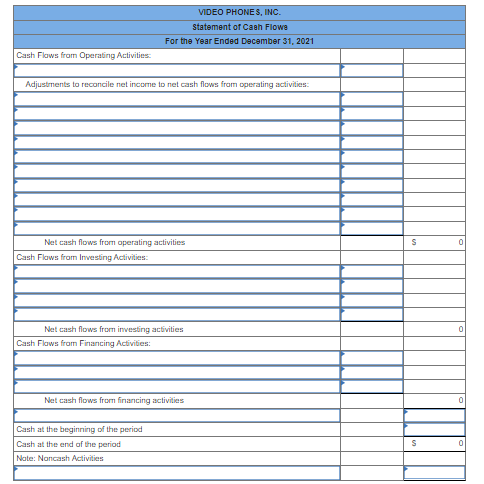

Transcribed Image Text:VIDEO PHONES, INC.

statement of Caah Flowe

For the Year Ended December 31, 2021

Cash Flaws from Operating Activities:

Adjustments to reconcile net income to net cash flows fram operating activities:

Net cash flows from operating activities

Cash Flaws from Investing Activities:

Net cash flows from investing activities

Cash Flaws from Financing Activities:

Net cash flows from financing activities

Cash at the beginning of the period

Cash at the end of the period

Nate: Nancash Activities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,