the information below, answer questions from #18 to #19 Bianca White, a hotel owner, desires to know the amount of money that must be invested today to accumulate $1,000,000 after five years. She found different options which pay compound interest. You need to calculate each option. (Round your answer to the nearest whole number.) How much does she have to invest today at a quarterly rate of interest of 2%? O $672,971 $620,921 $783,526 O $613,913

the information below, answer questions from #18 to #19 Bianca White, a hotel owner, desires to know the amount of money that must be invested today to accumulate $1,000,000 after five years. She found different options which pay compound interest. You need to calculate each option. (Round your answer to the nearest whole number.) How much does she have to invest today at a quarterly rate of interest of 2%? O $672,971 $620,921 $783,526 O $613,913

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 8EA: You put $250 in the bank for S years at 12%. A. If interest is added at the end of the year, how...

Related questions

Question

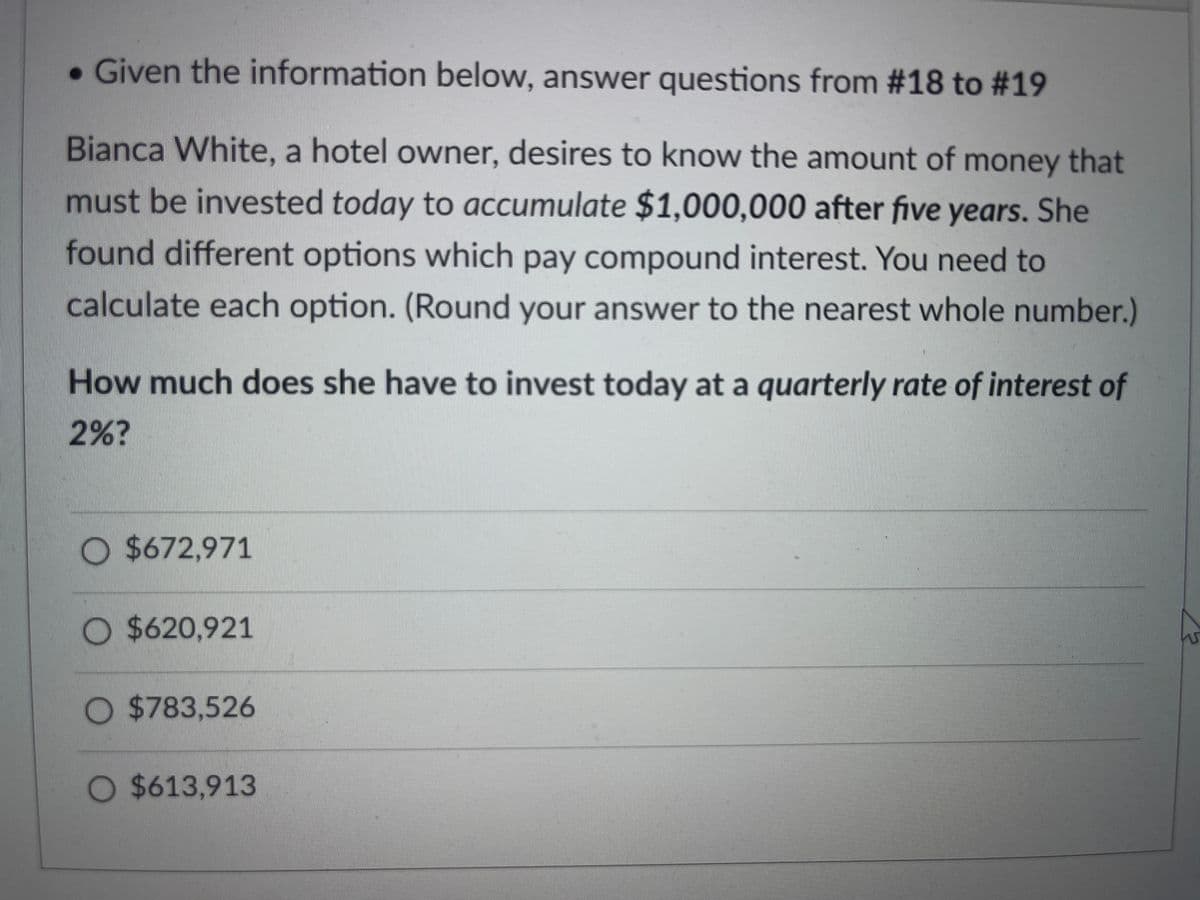

Transcribed Image Text:. Given the information below, answer questions from #18 to #19

Bianca White, a hotel owner, desires to know the amount of money that

must be invested today to accumulate $1,000,000 after five years. She

found different options which pay compound interest. You need to

calculate each option. (Round your answer to the nearest whole number.)

How much does she have to invest today at a quarterly rate of interest of

2%?

O $672,971

O$620,921

O $783,526

O $613,913

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning