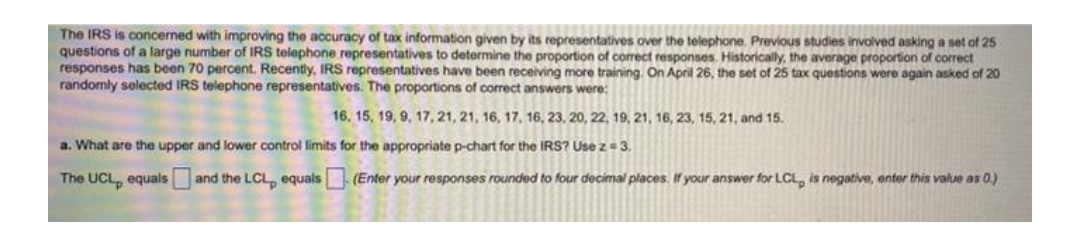

The IRS is concerned with improving the accuracy of tax information given by its representatives over the telephone. Previous studies involved asking a set of 25 questions of a large number of IRS telephone representatives to determine the proportion of correct responses. Historically, the average proportion of correct responses has been 70 percent. Recently, IRS representatives have been receiving more training. On April 26, the set of 25 tax questions were again asked of 20 randomly selected IRS telephone representatives. The proportions of correct answers were: 16, 15, 19, 9, 17, 21, 21, 16, 17, 16, 23, 20, 22, 19, 21, 16, 23, 15, 21, and 15. a. What are the upper and lower control limits for the appropriate p-chart for the IRS? Use z=3. The UCL, equals and the LCL, equals (Enter your responses rounded to four decimal places. If your answer for LCL, is negative, enter this value as 0.)

The IRS is concerned with improving the accuracy of tax information given by its representatives over the telephone. Previous studies involved asking a set of 25 questions of a large number of IRS telephone representatives to determine the proportion of correct responses. Historically, the average proportion of correct responses has been 70 percent. Recently, IRS representatives have been receiving more training. On April 26, the set of 25 tax questions were again asked of 20 randomly selected IRS telephone representatives. The proportions of correct answers were: 16, 15, 19, 9, 17, 21, 21, 16, 17, 16, 23, 20, 22, 19, 21, 16, 23, 15, 21, and 15. a. What are the upper and lower control limits for the appropriate p-chart for the IRS? Use z=3. The UCL, equals and the LCL, equals (Enter your responses rounded to four decimal places. If your answer for LCL, is negative, enter this value as 0.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 10CYU

Related questions

Question

Transcribed Image Text:The IRS is concerned with improving the accuracy of tax information given by its representatives over the telephone. Previous studies involved asking a set of 25

questions of a large number of IRS telephone representatives to determine the proportion of correct responses. Historically, the average proportion of correct

responses has been 70 percent. Recently, IRS representatives have been receiving more training. On April 26, the set of 25 tax questions were again asked of 20

randomly selected IRS telephone representatives. The proportions of correct answers were:

16, 15, 19, 9, 17, 21, 21, 16, 17, 16, 23, 20, 22, 19, 21, 16, 23, 15, 21, and 15.

a. What are the upper and lower control limits for the appropriate p-chart for the IRS? Use z = 3.

The UCL, equals and the LCL, equals (Enter your responses rounded to four decimal places. If your answer for LCL is negative, enter this value as 0.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL