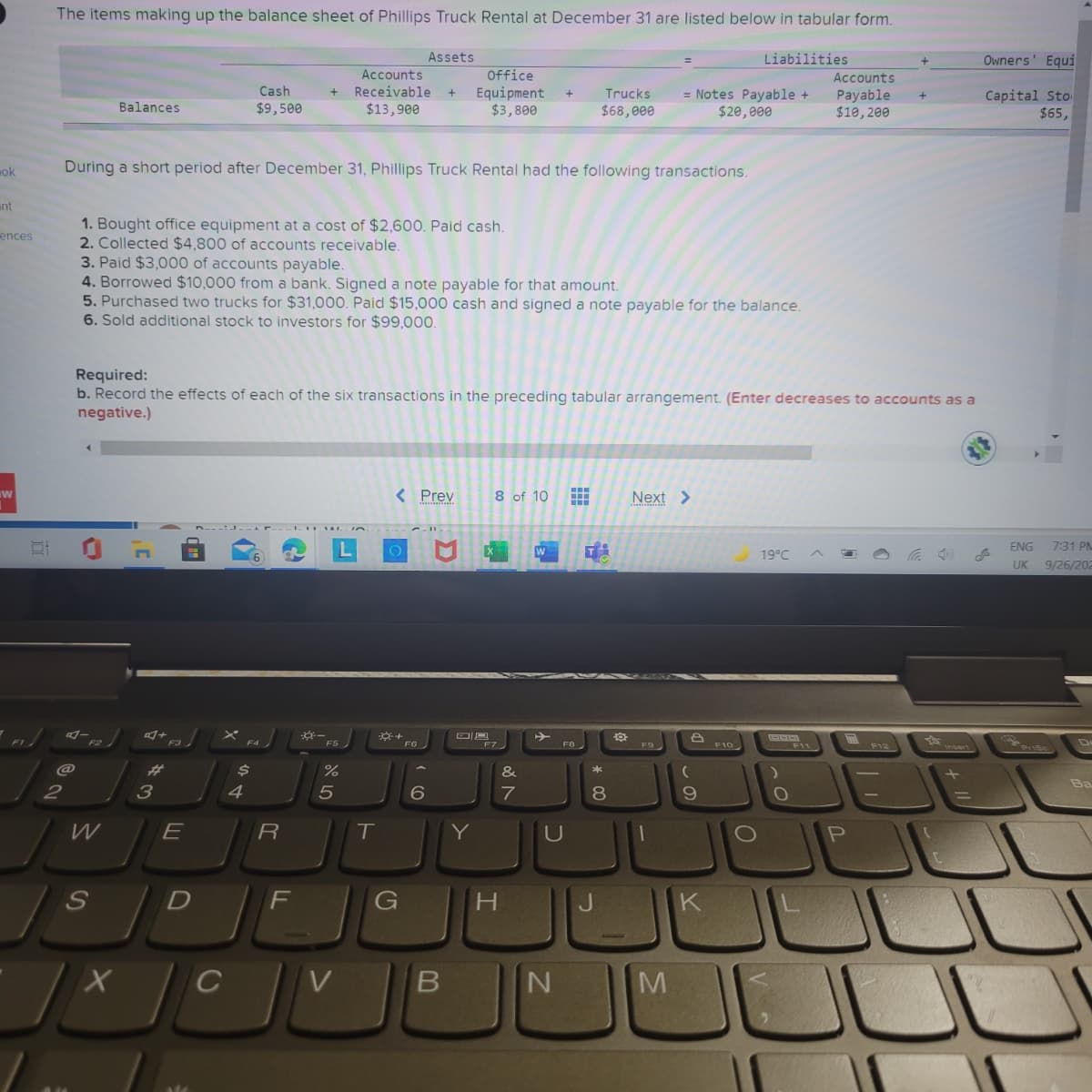

The items making up the balance sheet of Phillips Truck Rental at December 31 are listed below in tabular form. Assets Liabilities Owners' Equi Office Equipment $3,800 Accounts Accounts + Receivable $13,900 Cash Capital Sto $65, Trucks = Notes Payable + $28,000 Payable $10,200 + Balances $9,500 $68,000 During a short period after December 31, Phillips Truck Rental had the following transactions. 1. Bought office equipment at a cost of $2,600. Paid cash. 2. Collected $4,800 of accounts receivable. 3. Paid $3,000 of accounts payable. 4. Borrowed $10,000 from a bank. Signed a note payable for that amount. 5. Purchased two trucks for $31,000. Paid $15,000 cash and signed a note payable for the balance. 6. Sold additional stock to investors for $99,000. Required: b. Record the effects of each of the six transactions in the preceding tabular arrangement. (Enter decreases to accounts as a negative.)

The items making up the balance sheet of Phillips Truck Rental at December 31 are listed below in tabular form. Assets Liabilities Owners' Equi Office Equipment $3,800 Accounts Accounts + Receivable $13,900 Cash Capital Sto $65, Trucks = Notes Payable + $28,000 Payable $10,200 + Balances $9,500 $68,000 During a short period after December 31, Phillips Truck Rental had the following transactions. 1. Bought office equipment at a cost of $2,600. Paid cash. 2. Collected $4,800 of accounts receivable. 3. Paid $3,000 of accounts payable. 4. Borrowed $10,000 from a bank. Signed a note payable for that amount. 5. Purchased two trucks for $31,000. Paid $15,000 cash and signed a note payable for the balance. 6. Sold additional stock to investors for $99,000. Required: b. Record the effects of each of the six transactions in the preceding tabular arrangement. (Enter decreases to accounts as a negative.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 1PB: The trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as...

Related questions

Question

Transcribed Image Text:The items making up the balance sheet of Phillips Truck Rental at December 31 are listed below in tabular form.

Assets

Liabilities

Owners' Equi

Office

Equipment

$3,800

Accounts

Accounts

Cash

Receivable

Capital Sto

$65,

Trucks

= Notes Payable +

$20,000

Payable

$10,200

Balances

$9,500

$13,900

$68,000

mok

During a short period after December 31, Phillips Truck Rental had the following transactions.

int

1. Bought office equipment at a cost of $2,600. Paid cash.

2. Collected $4,800 of accounts receivable.

3. Paid $3,000 of accounts payable.

4. Borrowed $10,000 from a bank. Signed a note payable for that amount.

5. Purchased two trucks for $31,000. Paid $15,000 cash and signed a note payable for the balance.

6. Sold additional stock to investors for $99,000.

ences

Required:

b. Record the effects of each of the six transactions in the preceding tabular arrangement. (Enter decreases to accounts as a

negative.)

< Prev

8 of 10

Next >

W

ENG

7:31 PM

19°C

UK

9/26/202

-

F3

F5

F10

F6

F7

F8

F9

F12

%23

&

2

4

7

E

R

T

Y

U

S

F

G

H.

K

V

* 00

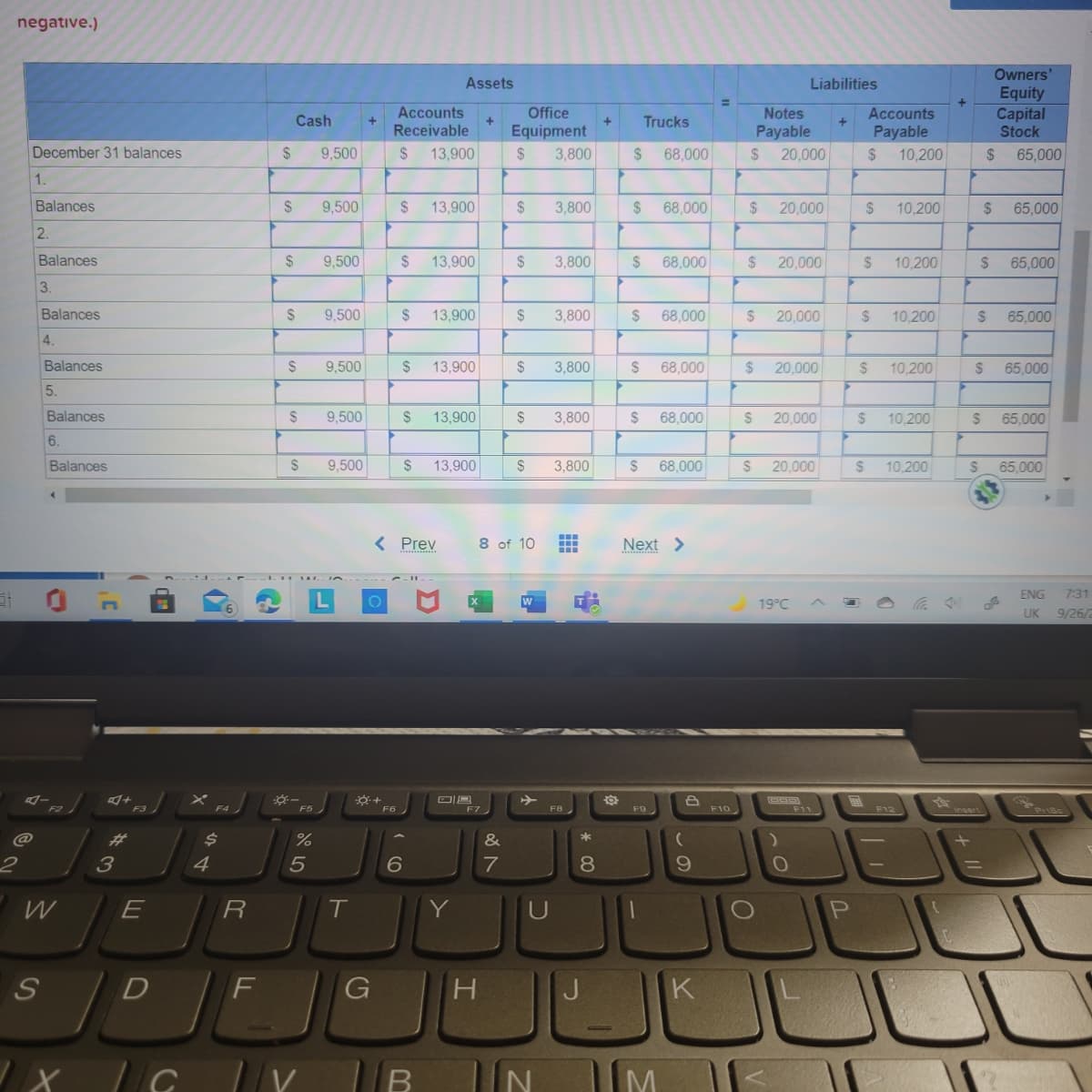

Transcribed Image Text:negative.)

Owners'

Assets

Liabilities

Notes

Payable

20,000

Equity

Capital

Stock

Accounts

Office

Accounts

Cash

+

Receivable

Trucks

Equipment

3,800

Payable

2$

December 31 balances

24

9,500

2$

13,900

$

2$

68,000

2$

10,200

$

65,000

1.

Balances

2$

9,500

2$

13,900

2$

3,800

$

68,000

2$

20,000

2$

10,200

2$

65,000

2.

Balances

24

9,500

2$

13,900

2$

3,800

$

68,000

2$

20,000

2$

10,200

65,000

3.

Balances

9,500

2$

13,900

$

3,800

2$

68,000

2$

20,000

$

10,200

$ 65,000

4.

Balances

9,500

2$

13,900

$

3,800

2$

68,000

$

20,000

10,200

65,000

5.

Balances

2$

9,500

13,900

$

3,800

2$

68,000

2$

20,000

10,200

65,000

6.

Balances

9,500

2$

13,900

$

3,800

$

68,000

20,000

10,200

65,000

< Prev

8 of 10

Next >

ENG

7:31

19°C

UK

9/26/2

F5

F7

F8

F9

F11

F12

%23

&

*

4

5

7

8

E

Y

D

F

K

IM

CG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning