Corporation has the following adjusted trial balance at December 31. Debit Credit Cash $ 1,230 Accounts Receivable 2,000 Prepaid Insurance 2,300 Notes Receivable (long-term) 3,000 Equipment 12,000 Accumulated Depreciation $ 2,600 Accounts Payable 5,420 Salaries and Wages Payable 1,000 Income Taxes Payable 2,900 Deferred Revenue 600 Common Stock 2,400 Retained Earnings 1,000 Dividends 300 Sales Revenue 42,030 Rent Revenue 300 Salaries and Wages Expense 21,600 Depreciation Expense 1,300 Utilities Expense 4,220 Insurance Expense 1,400 Rent Expense 6,000 Income Tax Expense 2,900 Total $ 58,250 $ 58,250

Corporation has the following adjusted trial balance at December 31. Debit Credit Cash $ 1,230 Accounts Receivable 2,000 Prepaid Insurance 2,300 Notes Receivable (long-term) 3,000 Equipment 12,000 Accumulated Depreciation $ 2,600 Accounts Payable 5,420 Salaries and Wages Payable 1,000 Income Taxes Payable 2,900 Deferred Revenue 600 Common Stock 2,400 Retained Earnings 1,000 Dividends 300 Sales Revenue 42,030 Rent Revenue 300 Salaries and Wages Expense 21,600 Depreciation Expense 1,300 Utilities Expense 4,220 Insurance Expense 1,400 Rent Expense 6,000 Income Tax Expense 2,900 Total $ 58,250 $ 58,250

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 5MC: Which of these accounts would be present in the closing entries? A. Dividends B. Accounts Receivable...

Related questions

Question

The Sky Blue Corporation has the following adjusted

| Debit | Credit | |||||||

| Cash | $ | 1,230 | ||||||

| 2,000 | ||||||||

| Prepaid Insurance | 2,300 | |||||||

| Notes Receivable (long-term) | 3,000 | |||||||

| Equipment | 12,000 | |||||||

| $ | 2,600 | |||||||

| Accounts Payable | 5,420 | |||||||

| Salaries and Wages Payable | 1,000 | |||||||

| Income Taxes Payable | 2,900 | |||||||

| Deferred Revenue | 600 | |||||||

| Common Stock | 2,400 | |||||||

| 1,000 | ||||||||

| Dividends | 300 | |||||||

| Sales Revenue | 42,030 | |||||||

| Rent Revenue | 300 | |||||||

| Salaries and Wages Expense | 21,600 | |||||||

| Depreciation Expense | 1,300 | |||||||

| Utilities Expense | 4,220 | |||||||

| Insurance Expense | 1,400 | |||||||

| Rent Expense | 6,000 | |||||||

| Income Tax Expense | 2,900 | |||||||

| Total | $ | 58,250 | $ | 58,250 | ||||

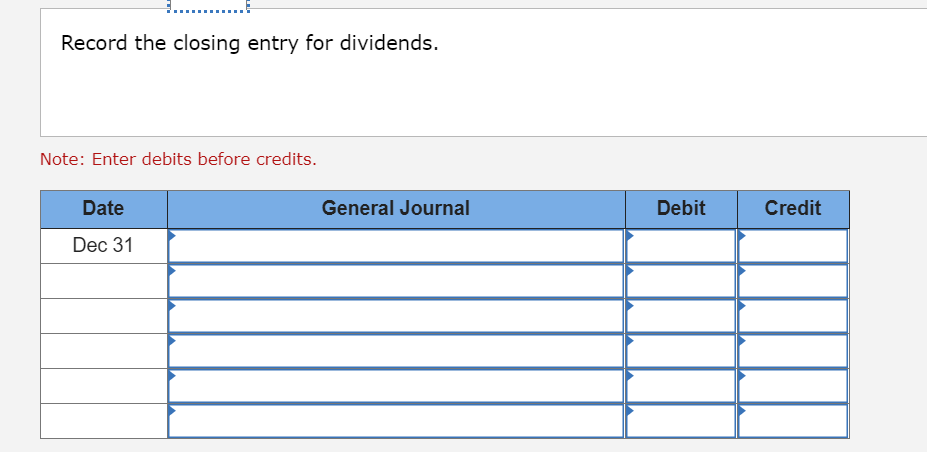

Transcribed Image Text:Record the closing entry for dividends.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning