The journal entry to record the payroll from Figure 6.1, on pages 6-2 and 6-3, would be: Debit Credit Wages Expense 24,762.70 FICA Taxes Payable-OASDI 1,535.29 FICA Taxes Payable-HI 359.06 FIT Payable 3,714.00 SIT Payable 55.25 Group Insurance Payments W/H 54.70 Cash 19,044.40

The journal entry to record the payroll from Figure 6.1, on pages 6-2 and 6-3, would be: Debit Credit Wages Expense 24,762.70 FICA Taxes Payable-OASDI 1,535.29 FICA Taxes Payable-HI 359.06 FIT Payable 3,714.00 SIT Payable 55.25 Group Insurance Payments W/H 54.70 Cash 19,044.40

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.2.3MBA

Related questions

Question

100%

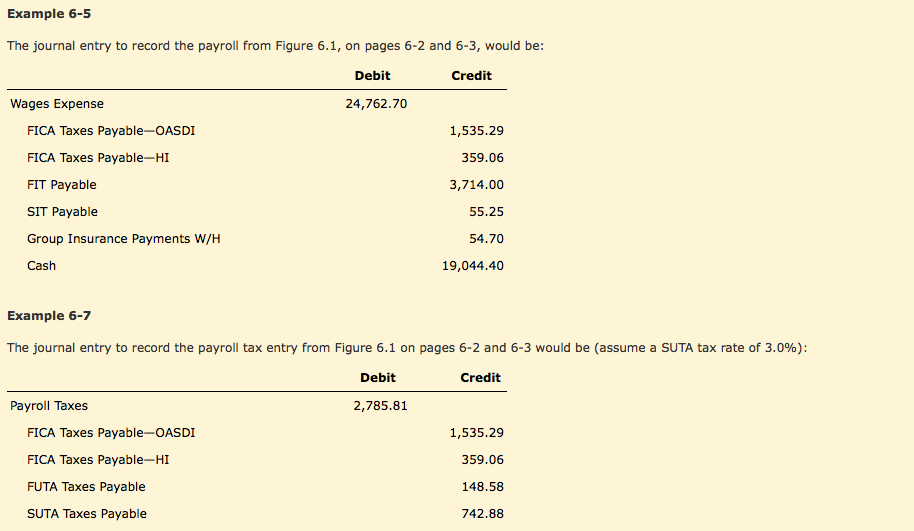

Transcribed Image Text:Example 6-5

The journal entry to record the payroll from Figure 6.1, on pages 6-2 and 6-3, would be:

Debit

Credit

Wages Expense

24,762.70

FICA Taxes Payable-OASDI

1,535.29

FICA Taxes Payable-HI

359.06

FIT Payable

3,714.00

SIT Payable

55.25

Group Insurance Payments W/H

54.70

Cash

19,044.40

Example 6-7

The journal entry to record the payroll tax entry from Figure 6.1 on pages 6-2 and 6-3 would be (assume a SUTA tax rate of 3.0%):

Debit

Credit

Payroll Taxes

2,785.81

FICA Taxes Payable-OASDI

1,535.29

FICA Taxes Payable-HI

359.06

FUTA Taxes Payable

148.58

SUTA Taxes Payable

742.88

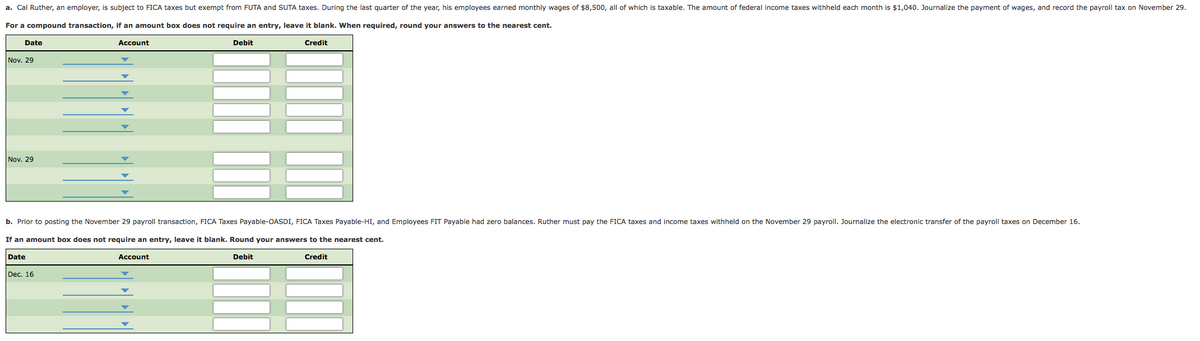

Transcribed Image Text:a. Cal Ruther, an employer, is subject to FICA taxes but exempt from FUTA and SUTA taxes. During the last quarter of the year, his employees earned monthly wages of $8,500, all of which is taxable. The amount of federal income taxes withheld each month is $1,040. Journalize the payment of wages, and record the payroll tax on November 29.

For a compound transaction, if an amount box does not require an entry, leave it blank. When required, round your answers to the nearest cent.

Date

Account

Debit

Credit

Nov. 29

Nov. 29

b. Prior to posting the November 29 payroll transaction, FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable had zero balances. Ruther must pay the FICA taxes and income taxes withheld on the November 29 payroll. Journalize the electronic transfer of the payroll taxes on December 16.

If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.

Date

Account

Debit

Credit

Dec. 16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage