The Lahiri family rents a room in their home on Airbnb. They deposit all of the money that they earn into a vacation fund that earns 39 that is compounded annually. Their revenues for five years of their business are shown below. Year 1 2 3 4 5 Revenue $1,000 $850 $1,275 $1,800 $800 In year six, they did not rent their room due to extensive remodeling. How much would be in the account at the end of year 6? Click here to access the TVM Factor Table calculator.

The Lahiri family rents a room in their home on Airbnb. They deposit all of the money that they earn into a vacation fund that earns 39 that is compounded annually. Their revenues for five years of their business are shown below. Year 1 2 3 4 5 Revenue $1,000 $850 $1,275 $1,800 $800 In year six, they did not rent their room due to extensive remodeling. How much would be in the account at the end of year 6? Click here to access the TVM Factor Table calculator.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 30P

Related questions

Question

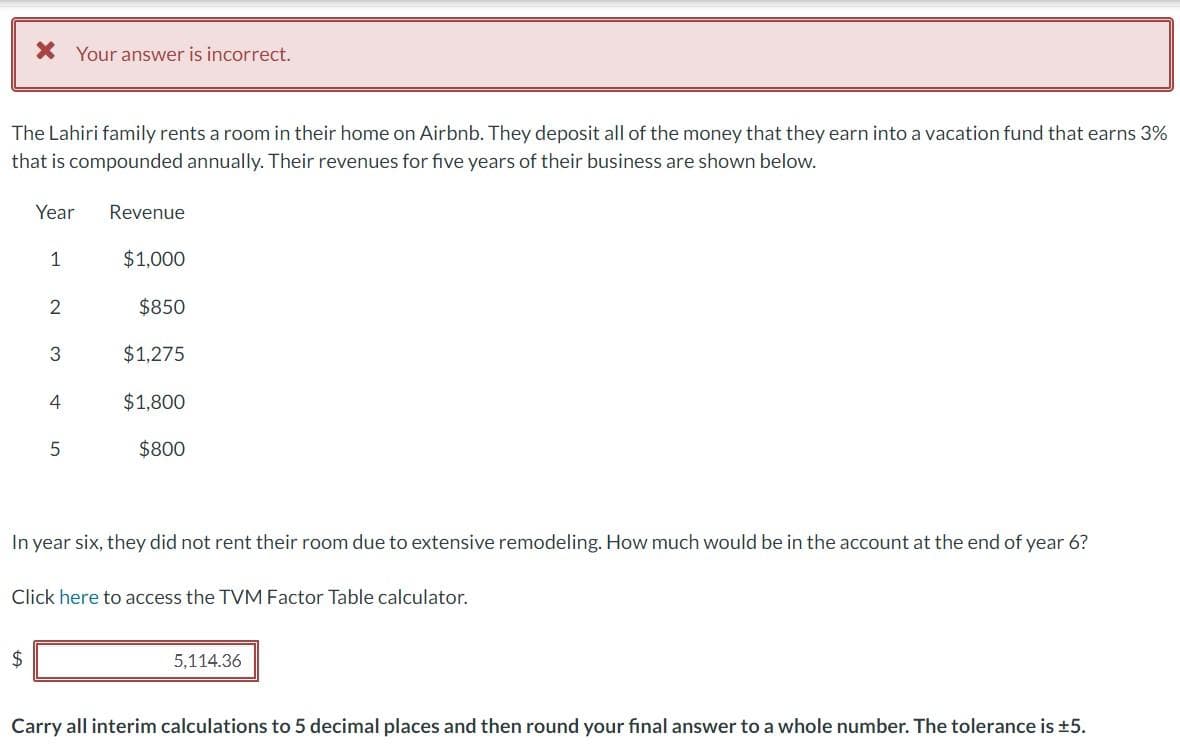

Transcribed Image Text:* Your answer is incorrect.

The Lahiri family rents a room in their home on Airbnb. They deposit all of the money that they earn into a vacation fund that earns 3%

that is compounded annually. Their revenues for five years of their business are shown below.

Year

$

1

2

3

4

5

Revenue

$1,000

$850

$1,275

$1,800

$800

In year six, they did not rent their room due to extensive remodeling. How much would be in the account at the end of year 6?

Click here to access the TVM Factor Table calculator.

5,114.36

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT