The last request from the head of the division to you is based o millions of dollars): Assets $ Liabilities and equity 3 Deposits Liquid assets 30 Interbank loan Cash $ 35 01 5

The last request from the head of the division to you is based o millions of dollars): Assets $ Liabilities and equity 3 Deposits Liquid assets 30 Interbank loan Cash $ 35 01 5

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 7QE

Related questions

Question

H1.

Account

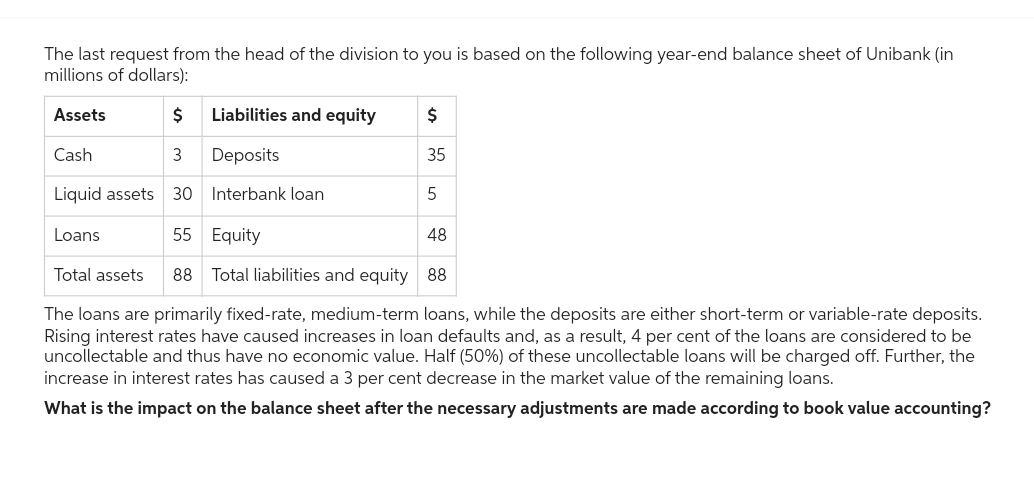

Transcribed Image Text:The last request from the head of the division to you is based on the following year-end balance sheet of Unibank (in

millions of dollars):

$ Liabilities and equity

15)

3 Deposits

Liquid assets 30 Interbank loan

55 Equity

Total assets 88 Total liabilities and equity 88

The loans are primarily fixed-rate, medium-term loans, while the deposits are either short-term or variable-rate deposits.

Rising interest rates have caused increases in loan defaults and, as a result, 4 per cent of the loans are considered to be

uncollectable and thus have no economic value. Half (50%) of these uncollectable loans will be charged off. Further, the

increase in interest rates has caused a 3 per cent decrease in the market value of the remaining loans.

What is the impact on the balance sheet after the necessary adjustments are made according to book value accounting?

Assets

Cash

Loans

$

35

5

48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT