The lease of Theme Park, Ic., is about to expire. Management must decide whether to renew the lease for another 10 years or to relocate near the site of a proposed motel. The town planning board is currently debating the merits of granting approval to the motel. A consultant has estimated the net present value of Theme Park's two alternatives under each state of nature as shown below. Suppose that the management of Theme Park, Ic., has decided that there is a 0.40 probability that the motel's application will be approved. Motel Approved $ 600,000 2,500,000 Motel Options Renew Rejected $4,500,000 300,000 Relocate a-1. If management uses maximum expected monetary value as the decision criterion, calculate expected monetary value for the alternatives "Renew" and "Relocate".

The lease of Theme Park, Ic., is about to expire. Management must decide whether to renew the lease for another 10 years or to relocate near the site of a proposed motel. The town planning board is currently debating the merits of granting approval to the motel. A consultant has estimated the net present value of Theme Park's two alternatives under each state of nature as shown below. Suppose that the management of Theme Park, Ic., has decided that there is a 0.40 probability that the motel's application will be approved. Motel Approved $ 600,000 2,500,000 Motel Options Renew Rejected $4,500,000 300,000 Relocate a-1. If management uses maximum expected monetary value as the decision criterion, calculate expected monetary value for the alternatives "Renew" and "Relocate".

Chapter19: Pricing Concepts

Section: Chapter Questions

Problem 6DRQ

Related questions

Question

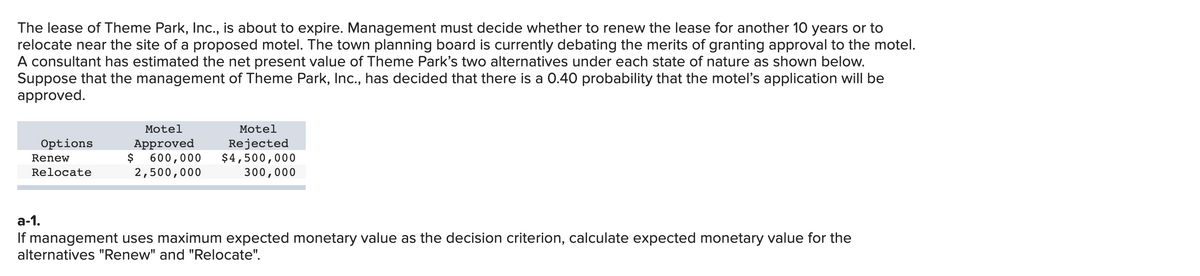

Transcribed Image Text:The lease of Theme Park, Inc., is about to expire. Management must decide whether to renew the lease for another 10 years or to

relocate near the site of a proposed motel. The town planning board is currently debating the merits of granting approval to the motel.

A consultant has estimated the net present value of Theme Park's two alternatives under each state of nature as shown below.

Suppose that the management of Theme Park, Inc., has decided that there is a 0.40 probability that the motelľ's application will be

approved.

Motel

Motel

Options

Rejected

$4,500,000

300,000

Approved

Renew

$

600,000

Relocate

2,500,000

а-1.

If management uses maximum expected monetary value as the decision criterion, calculate expected monetary value for the

alternatives "Renew" and "Relocate".

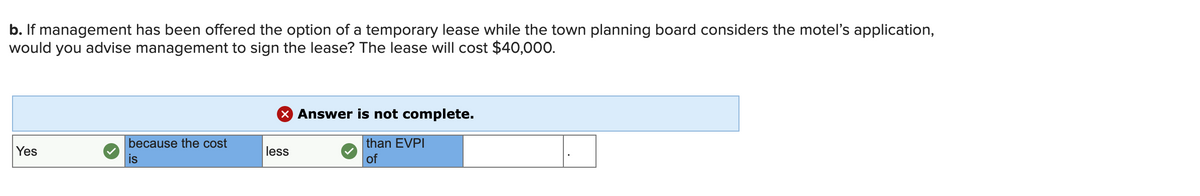

Transcribed Image Text:b. If management has been offered the option of a temporary lease while the town planning board considers the motel's application,

would you advise management to sign the lease? The lease will cost $40,000.

X Answer is not complete.

because the cost

than EVPI

Yes

less

is

of

Expert Solution

Step 1

The amount that a person would be ready to pay to obtain perfect information is known as the expected value of perfect information in decision theory. It is the variation between expected payout under certainty and expected financial value. Expected opportunity loss is also equivalent to the EVPI.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Marketing

Marketing

ISBN:

9780357033791

Author:

Pride, William M

Publisher:

South Western Educational Publishing

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Marketing

Marketing

ISBN:

9780357033791

Author:

Pride, William M

Publisher:

South Western Educational Publishing

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,