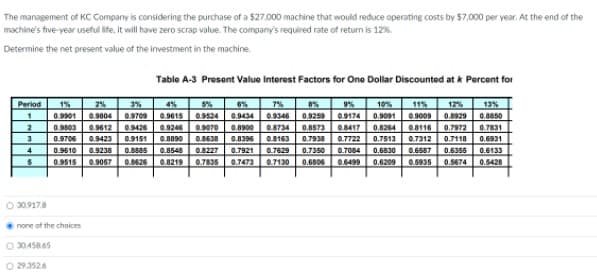

The management of KC Company is considering the purchase of a $27.000 machine that would reduce operating costs by $7,000 per year. At the end of the machine's five-year usetul life, it will have zero scrap value. The company's required rate of return is 12%. Determine the net present value of the investment in the machine. Table A-3 Present Value Interest Factors for One Dollar Discounted at k Percent for 2% % 12% 0.9091 0.9009 0.8929 Period 1% 3% 0.9709 4% 6% 0.9524 0.94340.9346 0.9259 09070 0.8900 8734 0.8573 0.3638 0.8396 0163 0.7629 9% 09174 08417 0.7722 0.7350 0.7084 8% 10% 11% 13% 0.8850 0.7831 0901 0.9804 0.9615 0.9803 0.9012 0.9426 0.9246 0.824 08116 0.7972 0.7312 0.7110 0.6587 0.9706 0.9423 0.9151 0.8890 0.7938 0.7513 0.6931 0.8227 0.7921 0.7473 0.7130 4 0.9610 0.9238 0.8885 0.8548 0.6830 0.6356 0.6133 0.9515 0.9067 0.426 0.8219 0.7835 0.6806 0.6499 0.6209 0.6935 0.5674 0.5428 O 30.917.8 none of the choices O 30.458.65 O 293526

The management of KC Company is considering the purchase of a $27.000 machine that would reduce operating costs by $7,000 per year. At the end of the machine's five-year usetul life, it will have zero scrap value. The company's required rate of return is 12%. Determine the net present value of the investment in the machine. Table A-3 Present Value Interest Factors for One Dollar Discounted at k Percent for 2% % 12% 0.9091 0.9009 0.8929 Period 1% 3% 0.9709 4% 6% 0.9524 0.94340.9346 0.9259 09070 0.8900 8734 0.8573 0.3638 0.8396 0163 0.7629 9% 09174 08417 0.7722 0.7350 0.7084 8% 10% 11% 13% 0.8850 0.7831 0901 0.9804 0.9615 0.9803 0.9012 0.9426 0.9246 0.824 08116 0.7972 0.7312 0.7110 0.6587 0.9706 0.9423 0.9151 0.8890 0.7938 0.7513 0.6931 0.8227 0.7921 0.7473 0.7130 4 0.9610 0.9238 0.8885 0.8548 0.6830 0.6356 0.6133 0.9515 0.9067 0.426 0.8219 0.7835 0.6806 0.6499 0.6209 0.6935 0.5674 0.5428 O 30.917.8 none of the choices O 30.458.65 O 293526

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 18EB: Garnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the...

Related questions

Question

NEED ASAP!!!

Transcribed Image Text:The management of KC Company is considering the purchase of a $27.000 machine that would reduce operating costs by $7,000 per year. At the end of the

machine's five-year useful life, it will have zero scrap value. The company's required rate of return is 12%.

Determine the net present value of the investment in the machine.

Table A-3 Present Value Interest Factors for One Dollar Discounted at k Percent for

11%

0.9091 0.9009 0.8929

Period

1%

2%

3%

4%

6%

8%

10%

12%

13%

0.8850

0.7831

0.9615

09174

0.8417

0.7722

0.7350 0.7084

0901

0.9804

0.9709

0.9524 0.9434

09346 0.9259

0.890008734 0.8573

2

3

0.9803

0.9612

0.9426

0.9246

0.9070

0.8264

0.8116

0.7972

0.9706

0.9423

0.9151

0.3638 0.8396 0.163

0.7938

0.7513

0.7312

0.7118

0.6931

08227

0.7629

0.7921

0.7473 0.7130

4

0.9610

0.9238

0.8885

0.8548

0.6830

0.6587

0.6355

0.6133

0.9515 0.9057

0.426

0.8219

0.7835

0.6806

0.6499

0.6209

0.6935

0.5674

0.5428

O 30.9178

none of the choices

O 30.458.65

O 29.3526

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT