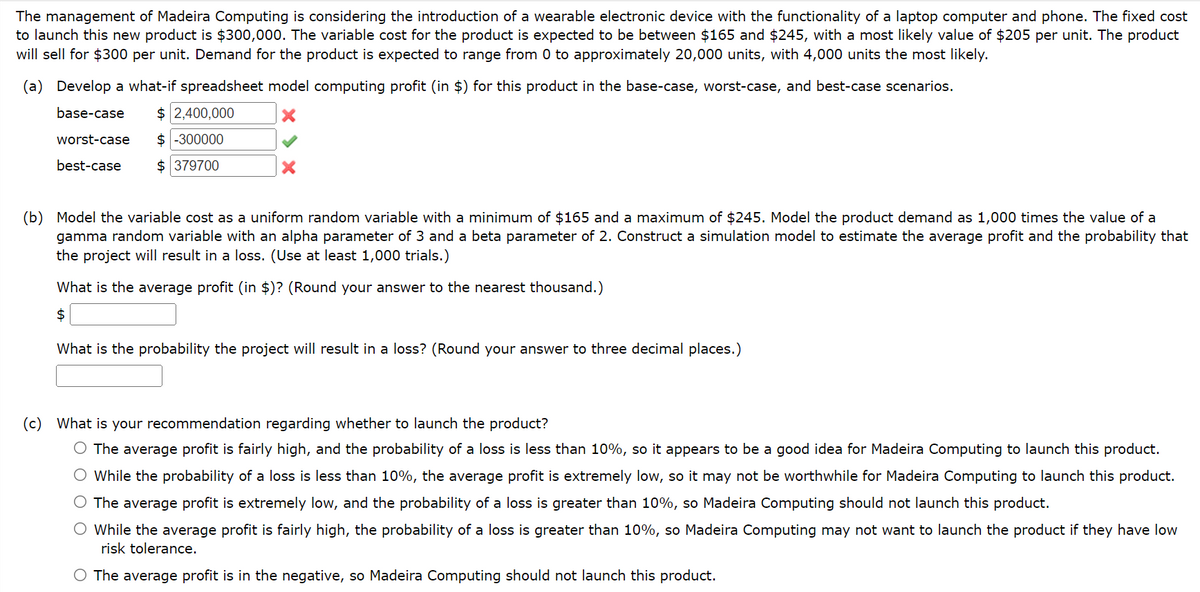

The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $165 and $245, with a most likely value of $205 per unit. The product will sell for $300 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit (in $) for this product in the base-case, worst-case, and best-case scenarios. base-case $ 2,400,000 worst-case $ -300000 best-case $ 379700 (b) Model the variable cost as a uniform random variable with a minimum of $165 and a maximum of $245. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. (Use at least 1,000 trials.) What is the average profit (in $)? (Round your answer to the nearest thousand.) $ What is the probability the project will result in a loss? (Round your answer to three decimal places.) (c) What is your recommendation regarding whether to launch the product? O The average profit is fairly high, and the probability of a loss is less than 10%, so it appears to be a good idea for Madeira Computing to launch this product. O While the probability of a loss is less than 10%, the average profit is extremely low, so it may not be worthwhile for Madeira Computing to launch this product. O The average profit is extremely low, and the probability of a loss is greater than 10%, so Madeira Computing should not launch this product. O While the average profit is fairly high, the probability of a loss is greater than 10%, so Madeira Computing may not want to launch the product if they have low risk tolerance. O The average profit is in the negative, so Madeira Computing should not launch this product.

The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $165 and $245, with a most likely value of $205 per unit. The product will sell for $300 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit (in $) for this product in the base-case, worst-case, and best-case scenarios. base-case $ 2,400,000 worst-case $ -300000 best-case $ 379700 (b) Model the variable cost as a uniform random variable with a minimum of $165 and a maximum of $245. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. (Use at least 1,000 trials.) What is the average profit (in $)? (Round your answer to the nearest thousand.) $ What is the probability the project will result in a loss? (Round your answer to three decimal places.) (c) What is your recommendation regarding whether to launch the product? O The average profit is fairly high, and the probability of a loss is less than 10%, so it appears to be a good idea for Madeira Computing to launch this product. O While the probability of a loss is less than 10%, the average profit is extremely low, so it may not be worthwhile for Madeira Computing to launch this product. O The average profit is extremely low, and the probability of a loss is greater than 10%, so Madeira Computing should not launch this product. O While the average profit is fairly high, the probability of a loss is greater than 10%, so Madeira Computing may not want to launch the product if they have low risk tolerance. O The average profit is in the negative, so Madeira Computing should not launch this product.

College Algebra (MindTap Course List)

12th Edition

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:R. David Gustafson, Jeff Hughes

Chapter6: Linear Systems

Section6.CR: Chapter Review

Problem 70E: A company manufactures two fertilizers, x and y. Each 50-pound bag of fertilizer requires three...

Related questions

Question

Transcribed Image Text:The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost

to launch this new product is $300,000. The variable cost for the product is expected to be between $165 and $245, with a most likely value of $205 per unit. The product

will sell for $300 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely.

(a) Develop a what-if spreadsheet model computing profit (in $) for this product in the base-case, worst-case, and best-case scenarios.

base-case

$ 2,400,000

worst-case

$ -300000

best-case

$ 379700

(b) Model the variable cost as a uniform random variable with a minimum of $165 and a maximum of $245. Model the product demand as 1,000 times the value of a

gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that

the project will result in a loss. (Use at least 1,000 trials.)

What is the average profit (in $)? (Round your answer to the nearest thousand.)

What is the probability the project will result in a loss? (Round your answer to three decimal places.)

(c) What is your recommendation regarding whether to launch the product?

O The average profit is fairly high, and the probability of a loss is less than 10%, so it appears to be a good idea for Madeira Computing to launch this product.

O While the probability of a loss is less than 10%, the average profit is extremely low, so it may not be worthwhile for Madeira Computing to launch this product.

O The average profit is extremely low, and the probability of a loss is greater than 10%, so Madeira Computing should not launch this product.

While the average profit is fairly high, the probability of a loss is greater than 10%, so Madeira Computing may not want to launch the product if they have low

risk tolerance.

O The average profit is in the negative, so Madeira Computing should not launch this product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning