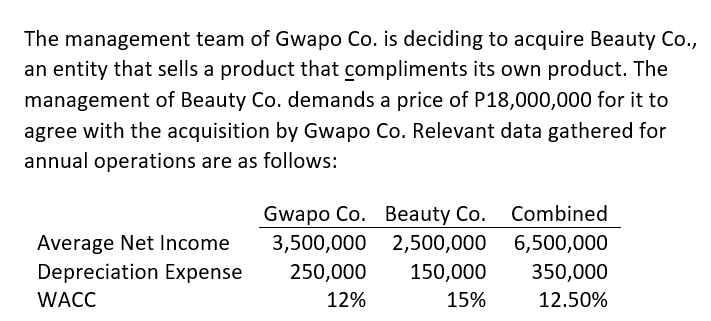

The management team of Gwapo Co. is deciding to acquire Beauty Co., an entity that sells a product that compliments its own product. The management of Beauty Co. demands a price of P18,000,000 for it to agree with the acquisition by Gwapo Co. Relevant data gathered for annual operations are as follows: Gwapo Co. Beauty Co. Combined Average Net Income Depreciation Expense 3,500,000 2,500,000 6,500,000 250,000 150,000 350,000 WACC 12% 15% 12.50%

Q: What is the carrying value of the investment property as of Dec. 31, 2018 using the cost model? B.…

A: Below are the answers:

Q: In early January, Burger Mania acquired 100% of the common stock of the Crispy Taco restaurant…

A: Explanation: 1. Trademark is an intangible asset that has an indefinite useful life as given in the…

Q: If the sale will extend beyond one year, what amount of gain or loss should the company report in…

A: On July 2014, Thunder Company is committed to a plan to sell a disposal group that represents a…

Q: Dorel Company is being purchased and has the following balance sheet as of the purchase date: $…

A: Net assets of Dorel = Current assets + Fair value of fixed assets - fair value of current…

Q: JenStar's blu-ray disc segment was held for sale at year end. There is a formal plan in place to…

A: It is the income left after incurring all expenditure from revenue. Net income is determined by…

Q: In which of the following situations would Martinez Indus-tries include goodwill in its balance…

A: Goodwill: Goodwill is an intangible asset. It is defined as the excess of cost of an acquired…

Q: On 1 July 2016, Liala ltd sold an item of plant to Jordan Ltd Ltd for $150,000 when its carrying…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Gandaph Corporation purchased a division five years ago for $ 3 million. The division has been…

A: Under ASPE, goodwill is required to be Impaired when carrying value is more than the Fair value:…

Q: On August 31, 2018, ABC purchased a building at P13,000,000 to earn rent income from operating…

A: Since ABC purchased a building to earn rental income therefore as per IAS 40 " Investment…

Q: Reward Company made the following acquisitions during the year as follows; Purchased for P5,400,000,…

A: Answer - Working Note - Calculation of Total Cost : Particular Amount Purchase Price…

Q: Greer Manufacturing purchases property that includes land, buildings and equipment for $5.3 million.…

A: Solution:- 1)Determination the total acquisition cost of this "basket purchase" as follows:-

Q: Buyer Company purchased Target Company for $800,000 cash. Target Company had total liabilities of…

A: Goodwill means the reputation which a firm enjoy because any factor like good after sale service ,…

Q: machine division, to date, has not been a profitable business segment for the cofmipany. AS 2018,…

A: GIVEN Sale value 850000 Book value 950000

Q: Leon Corporation incurred the following costs in 2021: Acquisition of R&D equipment with a useful…

A: Research and developement expenses are expenses related with making research and then developing new…

Q: On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the…

A: Particulars Amount $ Initial cost 260520 Less: Accumulated Depreciation 247494 Book value on…

Q: XY Company has recently purchased a computer system for its office. The following information was…

A: The acquisition cost of fixed assets include the purchase price, installation costs, and other…

Q: DeCento's is analyzing two mutually exclusive machines to determine which one it s machine is…

A: The machine having lower annual cost would be better considering the rate of return required on…

Q: In early January, Burger Mania acquired 100% of the common stock of the Crispy Taco restaurant…

A: Amortization: It is the process of allocating the value of the intangible assets over its estimated…

Q: Donner Company is selling a piece of land adjacent to its business premises. An appraisal reported…

A: Cost concept :— Under cost concept, aquisition of assets or any other items should be recorded at…

Q: August 31, 2018, ABC purchased a building at

A: Ans. In cost model, carrying value is ascertained by calculating the cost incurred for the asset in…

Q: On August 31, 2018, ABC purchased a building at P13,000,000 to earn rent income from operating…

A: Investment property is initially measured at cost, including transaction costs. Such cost should not…

Q: Keshav Ltd., earned a net profit of ₹4,00,000 after considering the following items: Depreciation…

A: Companies Act has prescribed certain rules for determining the remuneration payable to the managing…

Q: ccur on March 31, 2013, at an estimated gain of $375,500. The segment had actual and estimated…

A: Operating profit: Operating profit: operating profit can be defined as profit earned from ordinary…

Q: Joni Marin Inc. has the following amounts reported in its general ledger at the end of the current…

A: Definition: Intangible Assets: The Assets which does not have physical presence and cannot seen in…

Q: Gulf sands LLC Company had two operating divisions. One division manufactured washing machine and…

A: As per the requirement of the question, we will answer “c” part.

Q: Chance Company had two operating divisions, one manufacturing farm equipment and the other office…

A: An income statement can be defined as a financial statement that includes detailed information…

Q: Maltese Laboratories incurred the following research and developments costs related to its…

A: Income statement (Partial) Particulars Amount Research and development expense: Internal…

Q: Dublin Company had two operating divisions, ona manufactures machinery and the other breeds and…

A: given On December 31, 2021, the carrying amount of the assets of the horse division was…

Q: On August 31, 2018, ABC purchased a building at P13,000,000 to earn rent income from operating…

A: Yearly Depreciation = Purchase cost of building - Residual value of buildingEstimated useful…

Q: On September 15, 2020, ZTH Inc.'s Board of Directors developed a formal plan to dispose of its Horse…

A: Transactions of the Horse division must be recorded separately after the company has decided to…

Q: The management team of Gwapo Co. is deciding to acquire Beauty Co., an entity that sells a product…

A: Answer) Calculation of increase in value if Gwapo Co. acquires Beauty Co. Increase in value = Value…

Q: A building owned and previously occupied by the company was vacated and was being negotiated for…

A: As per the provision contain in PFRS 5, it applies to the following non current asset. Property…

Q: ABC Co. is acquiring XYZ Inc. XYZ has the following intangible assets: Customer list with an…

A: Intangible assets: These are the long-term assets which are not physical in nature, but possess…

Q: Nosher Co. planned to sell its product X division on June 30, 2019. The carrying amount is P5,000,00…

A: Net Income from discontinued operations = net sales value- cost - loss from disposal = $4500000…

Q: Prepare journal entries to record the acquisition and the first year’s depreciation, assuming that…

A:

Q: Cozzi Company is being purchased and has the following balance sheet as of the purchase date:…

A: Goodwill In an Acquisition: Goodwill is an intangible asset linked with the acquisition of a…

Q: Joni Metlock Inc. has the following amounts reported in its general ledger at the end of the current…

A: Intangible assets are the assets which give benefits to the organization for a number of years but…

Q: On August 31, 2018, ABC purchased a building at P13,000,000 to earn rent income from operating…

A: Total cost of the building = Purchase price + Legal fees = P13,000,000 + P500,000 = P13,500,000

Q: Broadsystems designs websites and writes bespoke software. It disclosed in its financial statements…

A: All the intangible asset acquired either in cash or in business combination for long term purpose…

Q: Prepare the necessary journal entries in 30 June 2017 to eliminate the intra-group transfer of…

A: Intra-group transactions refer to the transactions taking place within the group of entities which…

Q: Ballet Pte Ltd acquired the following items of plant and Machinery, all from GST registered traders…

A: Ballet Pte Ltd.'s Cost of purchases of assets of 1. Canon printer = $3959 2. Paper Shredder = $2880…

Q: Cozzi Company is being purchased and has the following balance sheet as of the purchase date:…

A: Goodwill is an intangible asset that accounts for the excess purchase price of another company.…

Q: Andrea Company has one division that performs machinery operations on parts that are sold to…

A:

Q: Journalize the entry to record Heartland Telecom's purchase of SamsonSamson Wireless for $400,000…

A: Goodwill: Goodwill is an intangible asset. It is defined as the excess of cost of an acquired…

Q: Robinson Company purchased Franklin Company at a price of $2,500,000. The fair market value of…

A: Given information is: Robinson Company purchased Franklin Company at a price of $2,500,000. The fair…

Q: Williams Inc. has the following amounts included in its general ledger at the end of the current…

A: Intangible assets are those assets which can not be felt or seen. For example, trademarks, goodwill,…

Should Gwapo Co. proceed with the acquisition of Beauty Co.?

yes or no

Step by step

Solved in 2 steps

- On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.Buchanan Imports purchased McLaren Corporation for $5,000,000 cash when McLaren had net assets worth $4,500,000. A. What is the amount of goodwill in this transaction? B. What is Buchanans journal entry to record the purchase of McLaren? C. What journal entry should Buchanan write when the company internally generates additional goodwill in the year following the purchase of McLaren?The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 600,000 $ 400,000 Sales 1,200,000 1,000,000 Investment income not given Cost of goods sold 600,000 500,000 Operating expenses 280,000 350,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $76,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $140,000 to Allister for $200,000. Of this amount, 15 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Inventory Sales Cost of Goods Sold…

- The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 580,000 $ 380,000 Sales 1,160,000 960,000 Investment income not given Cost of goods sold 580,000 480,000 Operating expenses 270,000 340,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $72,000 that was unrecorded on its accounting records and had a six-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $138,000 to Allister for $196,000. Of this amount, 20 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 500,000 $ 300,000 Sales 1,000,000 800,000 Investment income not given Cost of goods sold 500,000 400,000 Operating expenses 230,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary’s fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone’s book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,000. Of this amount, 10 percent remains unsold in Allister’s warehouse at year-end. Determine balances for the following items that would appear on Allister’s consolidated financial statements for 2021: What is cost of goods sold?The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 570,000 $ 370,000 Sales 1,140,000 940,000 Investment income not given Cost of goods sold 570,000 470,000 Operating expenses 265,000 335,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $70,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $137,000 to Allister for $194,000. Of this amount, 15 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:

- Following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 500,000 $300,000 Sales 1,000,000 800,000 Investment income not given Cost of goods sold 500,000 400,000 Operating expenses 230,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary’s fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a 4-year remaining life. Any remaining excess fair value over Barone’s book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,000. Of this amount, 10 percent remains unsold in Allister’s warehouse at year-end. Required: Determine balances for the following items that would appear on Allister’s consolidated financial statements for 2021: Inventory Sales…The following are several figures reported for Allister and Barone as of December 31, 2021: AllisterBaroneInventory$400,000$200,000Sales 800,000 600,000Investment incomenot given Cost of goods sold 400,000 300,000Operating expenses 180,000 250,000 Allister acquired 70 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $65,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $120,000 to Allister for $160,000. Of this amount, 20 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:BBB,Inc sells its unprofitable division A at a gain of $20,000. Before the sale, division A had a net loss of $50,000 for the period. Which of the following is true? The$20,000. Before the sale, Division U had a net loss of $50,000 for the period. Which of the following is true O The $20,000 gain on sale will be disclosed in the notes to the financial statements only, with the 550 operations. The $50,000 net loss will be a part of continuing operations and the $20,000 gain on sale will be a part of discontinued operations. The $20,000 gain on sale will be a part of continuing operations and the $50,000 net loss wil be a part of discontinued operations. Both the net loss of $50,000 as well as the gain on sale of $20,000 will be included as a part of discontinued operations.

- Following are several figures reported for Allister and Barone as of December 31, 2018: Allister BaroneInventory . . . .. . $ 500,000 $300,000Sales . . . . . . . . . 1,000,000 800,000Investment income not given Cost of goods sold 500,000 400,000Operating expenses 230,000 300,00 Allister acquired 90 percent of Barone in January 2017. In allocating the newly acquired subsidiary’s fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a 4 year remaining life. Any remaining excess fair value over Barone’s book value was attributed to goodwill. During 2018, Barone sells inventory costing $130,000 to Allister for $180,000. Of this amount, 10 percent remains unsold in Allister’s warehouse at year-end.Determine balances for the following items that would appear on Allister’s consolidated financial statements for…following are several figures reported for Allister and Barone as of December 31, 2018: Allister Barone Inventory $ 400,000 $ 200,000 Sales 800,000 600,000 Investment income not given Cost of goods sold 400,000 300,000 Operating expenses 180,000 250,000 Allister acquired 70 percent of Barone in January 2017. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $65,000 that was unrecorded on its accounting records and had a 5-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2018, Barone sells inventory costing $120,000 to Allister for $160,000. Of this amount, 20 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2018: Inventory____$_____________________…Pororo Inc. is considering acquiring Orange Company and uses the following data for analysis: Average annual sales for the past 5 years P2,000,000 Average annual operating expenses for the past 5 years 1,200,000 Average annual cost of goods sold for the past 5 years 7,200,000 Annual increase in depreciation and amortization 750,000 Expected annual increase in wages not to be recovered by increase in revenue 400,000 The book value of Orange’s net identifiable net assets is P8,500,000. The appropriate rate of return is20%. Revaluations were summarized as follows: Revaluation of inventory to fair value P500,000 Increase in allowance for bad debts 50,000 Revaluation of property, plant and equipment to fair value 250,000 Revaluation of bonds payable due to decline in interest 350,000 Fair value of patent 1,250,000 Determine the following as a result of your audit:46.How much should Pororo recognize as goodwill upon acquisition…