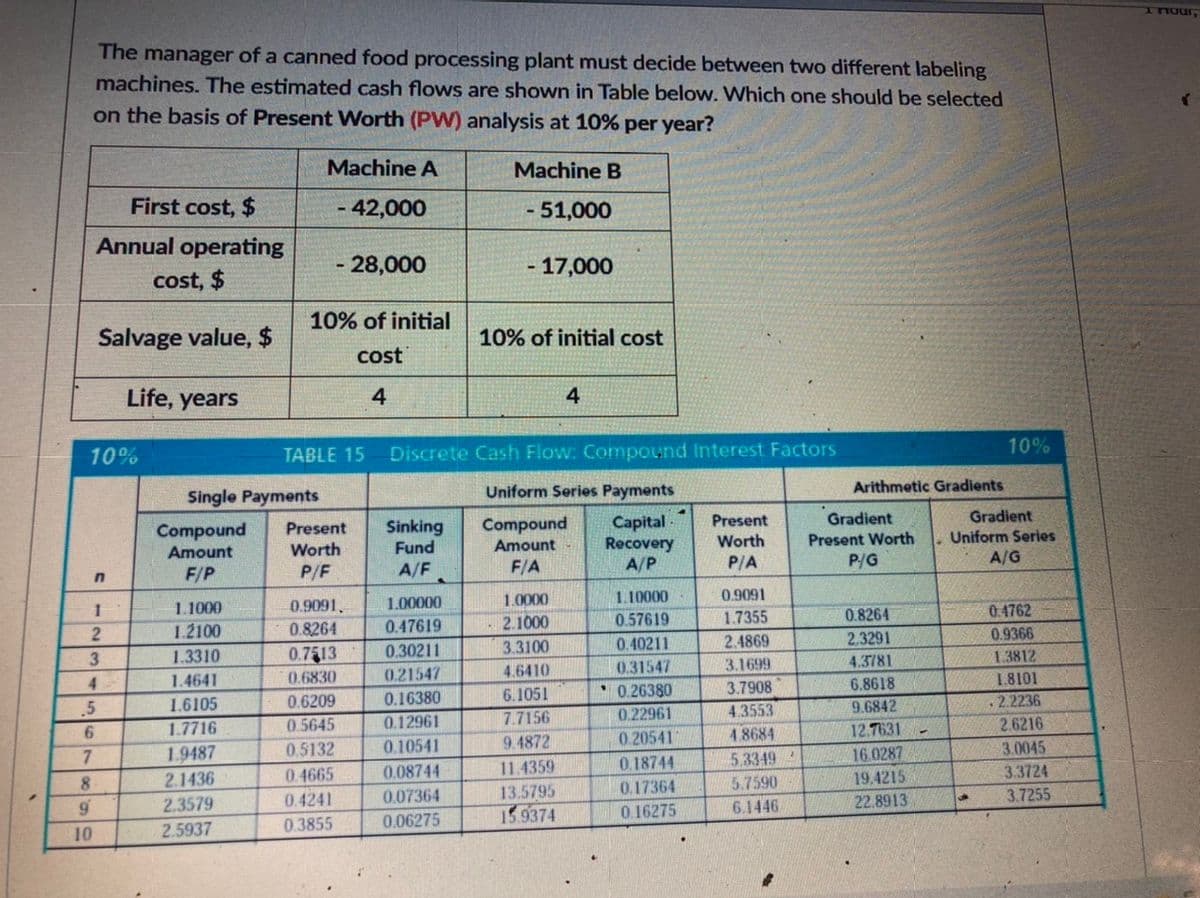

The manager of a canned food processing plant must decide between two different labeling machines. The estimated cash flows are shown in Table below. Which one should be selected on the basis of Present Worth (PW) analysis at 10% per year? Machine A Machine B First cost, $ - 42,000 - 51,000 Annual operating - 28,000 - 17,000 cost, $ 10% of initial Salvage value, $ 10% of initial cost cost Life, years 4 4 10% 10% TABLE 15 Discrete Cash Flow: Compound Interest Factors Uniform Series Payments Arithmetic Gradients Single Payments Capital Recovery A/P Gradient Present Worth P/G Gradient Uniform Series A/G Compound Present Compound Amount Present Worth Sinking Fund Amount Worth P/F A/F F/A P/A F/P 1.1000 0.9091. 1.00000 1.0000 1.10000 0.9091 0.4762 0.47619 2.1000 0.57619 1.7355 0.8264 1.2100 0.8264 0.9366 3.3100 0.40211 2.4869 2.3291 1.3310 0.7513 0.30211 1.3812 0.31547 3.1699 4.3781 1.4641 0.6830 0.21547 4.6410 1.8101 4. 6.8618 9.6842 12.7631 3.7908 0.16380 0.12961 6.1051 7.7156 • 0.26380 0.22961 .5 1.6105 0.6209 4.3553 .2.2236 1.7716 0.5645 2.6216 6. 9.4872 0.20541 4.8684 0.10541 3.0045 3.3724 1.9487 0.5132 16.0287 19.4215 11.4359 0.18744 5.3349 0.4665 0.08744 2.1436 2.3579 8 0.17364 5.7590 0.4241 0.07364 13.5795 22.8913 3.7255 6.1446 0.06275 15.9374 0.16275 2.5937 0.3855 10

The manager of a canned food processing plant must decide between two different labeling machines. The estimated cash flows are shown in Table below. Which one should be selected on the basis of Present Worth (PW) analysis at 10% per year? Machine A Machine B First cost, $ - 42,000 - 51,000 Annual operating - 28,000 - 17,000 cost, $ 10% of initial Salvage value, $ 10% of initial cost cost Life, years 4 4 10% 10% TABLE 15 Discrete Cash Flow: Compound Interest Factors Uniform Series Payments Arithmetic Gradients Single Payments Capital Recovery A/P Gradient Present Worth P/G Gradient Uniform Series A/G Compound Present Compound Amount Present Worth Sinking Fund Amount Worth P/F A/F F/A P/A F/P 1.1000 0.9091. 1.00000 1.0000 1.10000 0.9091 0.4762 0.47619 2.1000 0.57619 1.7355 0.8264 1.2100 0.8264 0.9366 3.3100 0.40211 2.4869 2.3291 1.3310 0.7513 0.30211 1.3812 0.31547 3.1699 4.3781 1.4641 0.6830 0.21547 4.6410 1.8101 4. 6.8618 9.6842 12.7631 3.7908 0.16380 0.12961 6.1051 7.7156 • 0.26380 0.22961 .5 1.6105 0.6209 4.3553 .2.2236 1.7716 0.5645 2.6216 6. 9.4872 0.20541 4.8684 0.10541 3.0045 3.3724 1.9487 0.5132 16.0287 19.4215 11.4359 0.18744 5.3349 0.4665 0.08744 2.1436 2.3579 8 0.17364 5.7590 0.4241 0.07364 13.5795 22.8913 3.7255 6.1446 0.06275 15.9374 0.16275 2.5937 0.3855 10

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:The manager of a canned food processing plant must decide between two different labeling

machines. The estimated cash flows are shown in Table below. Which one should be selected

on the basis of Present Worth (PW) analysis at 10% per year?

Machine A

Machine B

First cost, $

- 42,000

- 51,000

Annual operating

- 28,000

- 17,000

cost, $

10% of initial

Salvage value, $

10% of initial cost

cost

Life, years

4

4

10%

10%

TABLE 15

Discrete Cash Flow: Compound Interest Factors

Single Payments

Uniform Series Payments

Arithmetic Gradients

Gradient

Uniform Series

Gradient

Capital

Recovery

A/P

Present

Sinking

Fund

Compound

Amount

Compound

Present

Worth

Present Worth

Amount

Worth

P/A

P/G

A/G

F/P

P/F

A/F

F/A

1.0000

1.10000

0.9091

1.1000

0.9091,

1.00000

0.4762

2.1000

0.57619

1.7355

0.8264

1.2100

0.8264

0.47619

0.9366

0.40211

2.4869

2.3291

3

1.3310

0.7513

0.30211

3.3100

1.3812

0.31547

3.1699

4.3781

1.4641

0.6830

0.21547

4.6410

1.8101

4.

0.26380

3.7908

6.8618

1.6105

0.6209

0.16380

6.1051

9.6842

2.2236

.5

7.7156

0.22961

4.3553

1.7716

0.5645

0.12961

12.7631

2.6216

9.4872

0.20541

4.8684

7.

1.9487

0.5132

0.10541

16.0287

3.0045

11.4359

0.18744

5.3349

0.08744

3.3724

0.4665

0.4241

8.

2.1436

5.7590

19.4215

0.07364

13.5795

0.17364

3.7255

9.

2.3579

6.1446

22.8913

0.06275

15.9374

0.16275

2.5937

0.3855

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning