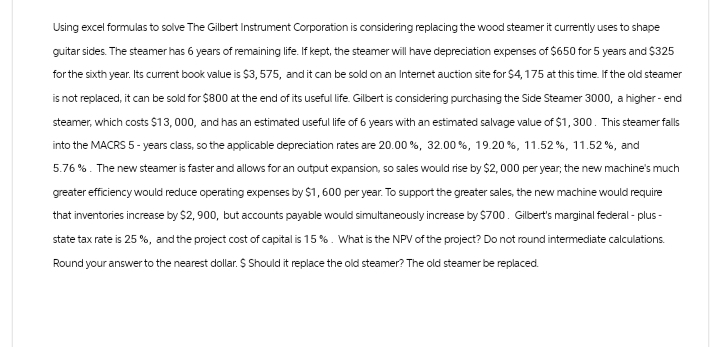

Using excel formulas to solve The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the sixth year. Its current book value is $3,575, and it can be sold on an Internet auction site for $4,175 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00 %, 32.00 %, 19.20%, 11.52%, 11.52 %, and 5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus- state tax rate is 25 %, and the project cost of capital is 15%. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Should it replace the old steamer? The old steamer be replaced.

Using excel formulas to solve The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the sixth year. Its current book value is $3,575, and it can be sold on an Internet auction site for $4,175 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00 %, 32.00 %, 19.20%, 11.52%, 11.52 %, and 5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus- state tax rate is 25 %, and the project cost of capital is 15%. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Should it replace the old steamer? The old steamer be replaced.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

Don't provide hand writing solution

Transcribed Image Text:Using excel formulas to solve The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape

guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325

for the sixth year. Its current book value is $3,575, and it can be sold on an Internet auction site for $4,175 at this time. If the old steamer

is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end

steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls

into the MACRS 5-years class, so the applicable depreciation rates are 20.00 %, 32.00 %, 19.20%, 11.52%, 11.52 %, and

5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much

greater efficiency would reduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require

that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-

state tax rate is 25 %, and the project cost of capital is 15%. What is the NPV of the project? Do not round intermediate calculations.

Round your answer to the nearest dollar. $ Should it replace the old steamer? The old steamer be replaced.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning