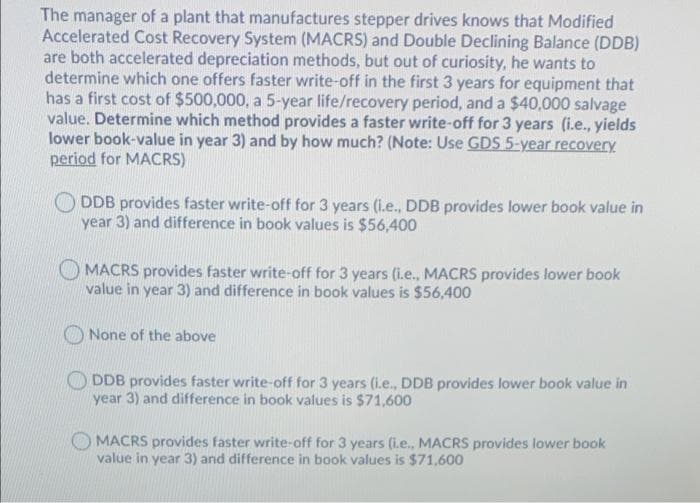

The manager of a plant that manufactures stepper drives knows that Modified Accelerated Cost Recovery System (MACRS) and Double Declining Balance (DDB) are both accelerated depreciation methods, but out of curiosity, he wants to determine which one offers faster write-off in the first 3 years for equipment that has a first cost of $500,000, a 5-year life/recovery period, and a $40,000 salvage value. Determine which method provides a faster write-off for 3 years (i.e., yields lower book-value in year 3) and by how much? (Note: Use GDS 5-year recovery period for MACRS) O DDB provides faster write-off for 3 years (i.e., DDB provides lower book value in year 3) and difference in book values is $56,400 MACRS provides faster write-off for 3 years (i.e., MACRS provides lower book value in year 3) and difference in book values is $56,400 None of the above DDB provides faster write-off for 3 years (i.e., DDB provides lower book value in year 3) and difference in book values is $71,600 O MACRS provides faster write-off for 3 years (i.e., MACRS provides lower book value in year 3) and difference in book values is $71,600

The manager of a plant that manufactures stepper drives knows that Modified Accelerated Cost Recovery System (MACRS) and Double Declining Balance (DDB) are both accelerated depreciation methods, but out of curiosity, he wants to determine which one offers faster write-off in the first 3 years for equipment that has a first cost of $500,000, a 5-year life/recovery period, and a $40,000 salvage value. Determine which method provides a faster write-off for 3 years (i.e., yields lower book-value in year 3) and by how much? (Note: Use GDS 5-year recovery period for MACRS) O DDB provides faster write-off for 3 years (i.e., DDB provides lower book value in year 3) and difference in book values is $56,400 MACRS provides faster write-off for 3 years (i.e., MACRS provides lower book value in year 3) and difference in book values is $56,400 None of the above DDB provides faster write-off for 3 years (i.e., DDB provides lower book value in year 3) and difference in book values is $71,600 O MACRS provides faster write-off for 3 years (i.e., MACRS provides lower book value in year 3) and difference in book values is $71,600

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage...

Related questions

Question

Transcribed Image Text:The manager of a plant that manufactures stepper drives knows that Modified

Accelerated Cost Recovery System (MACRS) and Double Declining Balance (DDB)

are both accelerated depreciation methods, but out of curiosity, he wants to

determine which one offers faster write-off in the first 3 years for equipment that

has a first cost of $500,000, a 5-year life/recovery period, and a $40,000 salvage

value. Determine which method provides a faster write-off for 3 years (i.e., yields

lower book-value in year 3) and by how much? (Note: Use GDS 5-year recovery

period for MACRS)

DDB provides faster write-off for 3 years (i.e., DDB provides lower book value in

year 3) and difference in book values is $56,400

MACRS provides faster write-off for 3 years (i.e., MACRS provides lower book

value in year 3) and difference in book values is $56,400

None of the above

DDB provides faster write-off for 3 years (i.e., DDB provides lower book value in

year 3) and difference in book values is $71,600

MACRS provides faster write-off for 3 years (i.e., MACRS provides lower book

value in year 3) and difference in book values is $71,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning