Garrett Boone, Flint Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of $277,335 and will last for 15 years. It will have no salvage value at the end of its unehil life. Garrett estimates the new lathe will reduce raw materials scrap by $37,000 per year. He also believes the lathe willreduce energy costs by $3,000 per year. If he purchases the new lathe, he will be able to sell the old lathe for $4,900.

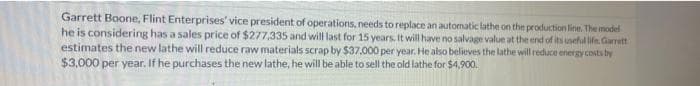

Garrett Boone, Flint Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of $277,335 and will last for 15 years. It will have no salvage value at the end of its unehil life. Garrett estimates the new lathe will reduce raw materials scrap by $37,000 per year. He also believes the lathe willreduce energy costs by $3,000 per year. If he purchases the new lathe, he will be able to sell the old lathe for $4,900.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6...

Related questions

Question

1

Transcribed Image Text:Garrett Boone, Flint Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model

he is considering has a sales price of $277,335 and will last for 15 years. It will have no salvage value at the end of its uneful life. Garrett

estimates the new lathe will reduce raw materials scrap by $37,000 per year. He also believes the lathe will reduce energy costs by

$3,000 per year. If he purchases the new lathe, he will be able to sell the old lathe for $4,900.

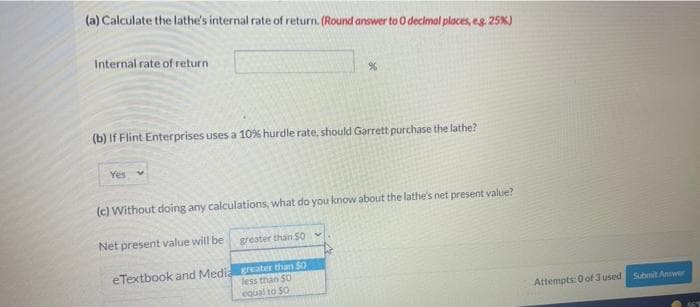

Transcribed Image Text:(a) Calculate the lathe's internal rate of return. (Round answer to O decimal places, eg. 25%)

Internal rate of return

(b) If Flint Enterprises uses a 10% hurdle rate, should Garrett purchase the lathe?

Yes

(c) Without doing any calculations, what do you know about the lathe's net present value?

Net present value will be

greater than SOv

eTextbook and Media greater than S0

less than S0

equal to 50

Attempts: 0 of 3 used Submit Anwer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,