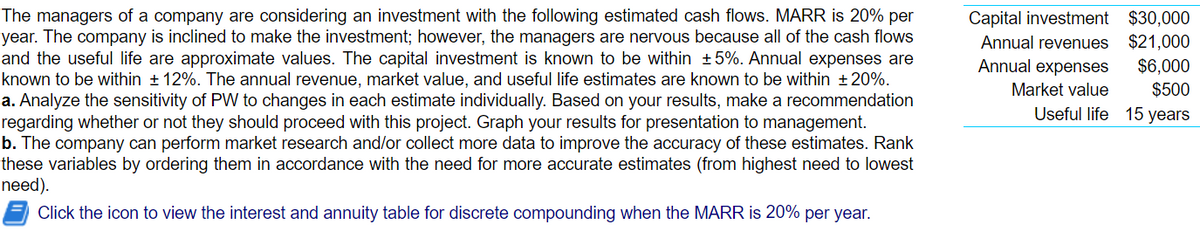

The managers of a company are considering an investment with the following estimated cash flows. MARR is 20% per vear. The company is inclined to make the investment; however, the managers are nervous because all of the cash flows and the useful life are approximate values. The capital investment is known to be within +5%. Annual expenses are known to be within +12%. The annual revenue, market value, and useful life estimates are known to be within ±20%. a. Analyze the sensitivity of PW to changes in each estimate individually. Based on your results, make a recommendation egarding whether or not they should proceed with this project. Graph your results for presentation to management. o. The company can perform market research and/or collect more data to improve the accuracy of these estimates. Rank hese variables by ordering them in accordance with the need for more accurate estimates (from highest need to lowest need). Capital investment $30,000 Annual revenues $21,000 Annual expenses $6,000 Market value $500 Useful life 15 years Click the icon to view the interest and annuity table for discrete compounding when the MARR is 20% per year.

The managers of a company are considering an investment with the following estimated cash flows. MARR is 20% per vear. The company is inclined to make the investment; however, the managers are nervous because all of the cash flows and the useful life are approximate values. The capital investment is known to be within +5%. Annual expenses are known to be within +12%. The annual revenue, market value, and useful life estimates are known to be within ±20%. a. Analyze the sensitivity of PW to changes in each estimate individually. Based on your results, make a recommendation egarding whether or not they should proceed with this project. Graph your results for presentation to management. o. The company can perform market research and/or collect more data to improve the accuracy of these estimates. Rank hese variables by ordering them in accordance with the need for more accurate estimates (from highest need to lowest need). Capital investment $30,000 Annual revenues $21,000 Annual expenses $6,000 Market value $500 Useful life 15 years Click the icon to view the interest and annuity table for discrete compounding when the MARR is 20% per year.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 7E

Related questions

Question

Please show your work through formulas not just in a Excel spreadsheet

Transcribed Image Text:The managers of a company are considering an investment with the following estimated cash flows. MARR is 20% per

year. The company is inclined to make the investment; however, the managers are nervous because all of the cash flows

and the useful life are approximate values. The capital investment is known to be within +5%. Annual expenses are

known to be within + 12%. The annual revenue, market value, and useful life estimates are known to be within +20%.

a. Analyze the sensitivity of PW to changes in each estimate individually. Based on your results, make a recommendation

regarding whether or not they should proceed with this project. Graph your results for presentation to management.

b. The company can perform market research and/or collect more data to improve the accuracy of these estimates. Rank

these variables by ordering them in accordance with the need for more accurate estimates (from highest need to lowest

need).

Capital investment $30,000

Annual revenues $21,000

$6,000

$500

Useful life 15 years

Annual expenses

Market value

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 20% per year.

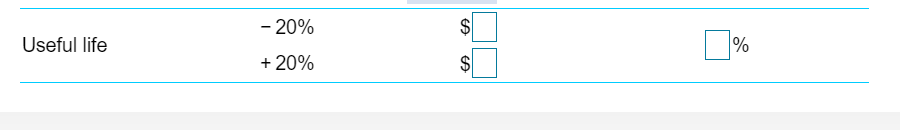

Transcribed Image Text:- 20%

$4

Useful life

%

+ 20%

$4

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning