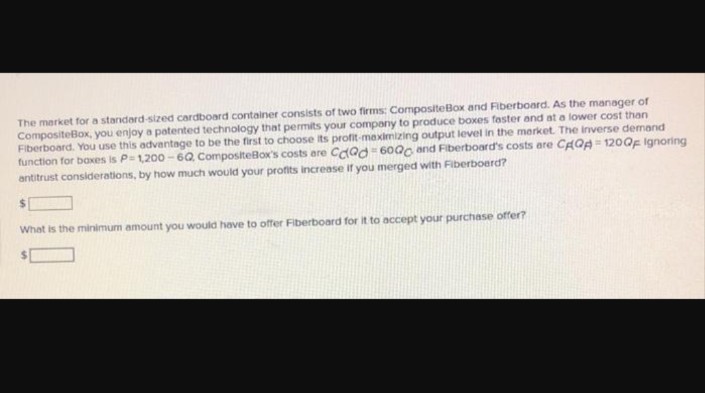

The market for a standard-sized cardboard container consists of two firms: CompositeBox and Fiberboard. As the manager of CompositeBox, you enjoy a patented technology that permits your company to produce boxes faster and at a lower cost than Fiberboard. You use this advantage to be the first to choose its profit-meximizing output level in the market. The inverse demand function for baxes is P-1200-6Q CompositeBox's costs are Caad 6000 and Fiberboard's costs are CAQA=1200F Ignoring antitrust considerations, by how much would your profits increase if you merged with Fiberboerd? What is the minimum amount you would have to offer Fiberboard for it to accept your purchase offer?

The market for a standard-sized cardboard container consists of two firms: CompositeBox and Fiberboard. As the manager of CompositeBox, you enjoy a patented technology that permits your company to produce boxes faster and at a lower cost than Fiberboard. You use this advantage to be the first to choose its profit-meximizing output level in the market. The inverse demand function for baxes is P-1200-6Q CompositeBox's costs are Caad 6000 and Fiberboard's costs are CAQA=1200F Ignoring antitrust considerations, by how much would your profits increase if you merged with Fiberboerd? What is the minimum amount you would have to offer Fiberboard for it to accept your purchase offer?

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.10P: Wonopoly and natural resource prices Suppose that a firm is the sole owner of a stock of a natural...

Related questions

Question

Nn1

Transcribed Image Text:The market for a standard-sized cardboard container consists of two firms: CompositeBox and Fiberboard. As the manager of

CompositeBox, you enjoy a patented technology that permits your company to produce boxes faster and at a lower cost than

Fiberboard. You use this advantage to be the first to choose its profit-maximizing output level in the market. The inverse demand

function for baxes is P=1,200-6Q CompositeBox's costs are Caad 6000 and Fiberboard's costs are CAQA=120QF Ignoring

antitrust considerations, by how much would your profits increase if you merged with Fiberboard?

What is the minimum amount you would have to offer Fiberboard for it to accept your purchase offer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning