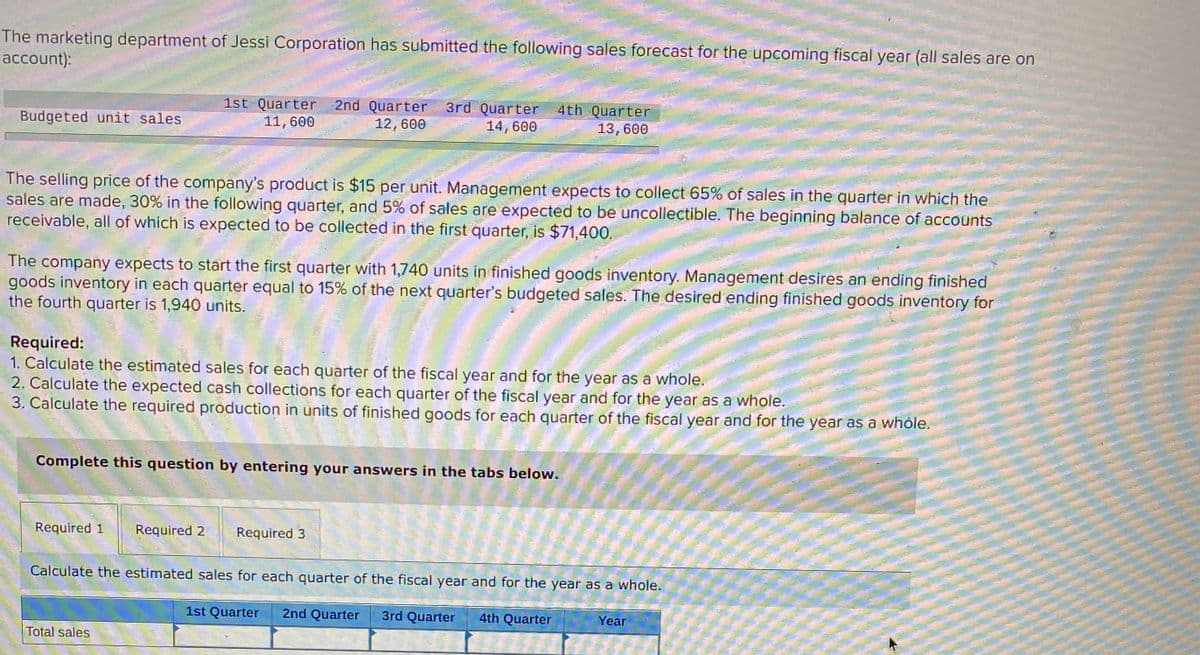

The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 2nd Quarter 1st Quarter 11, 600 4th Quarter 13, 600 3rd Quarter Budgeted unit sales 12,600 14, 600 The selling price of the company's product is $15 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $71,400. The company expects to start the first quarter with 1,740 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,940 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whóle. Complete this question by entering your answerr in

The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 2nd Quarter 1st Quarter 11, 600 4th Quarter 13, 600 3rd Quarter Budgeted unit sales 12,600 14, 600 The selling price of the company's product is $15 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $71,400. The company expects to start the first quarter with 1,740 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,940 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whóle. Complete this question by entering your answerr in

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 1E: The sales department of Macro Manufacturing Co. has forecast sales for its single product to be...

Related questions

Question

Transcribed Image Text:The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on

account):

1st Quarter

11, 600

2nd Quarter

12,600

3rd Quarter

14,600

4th Quarter

13, 600

Budgeted unit sales

The selling price of the company's product is $15 per unit. Management expects to collect 65% of sales in the quarter in which the

sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts

receivable, all of which is expected to be collected in the first quarter, is $71,400.

The company expects to start the first quarter with 1,740 units in finished goods inventory. Management desires an ending finished

goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for

the fourth quarter is 1,940 units.

Required:

1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole.

2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole.

3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whóle.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole.

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Year

Total sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,