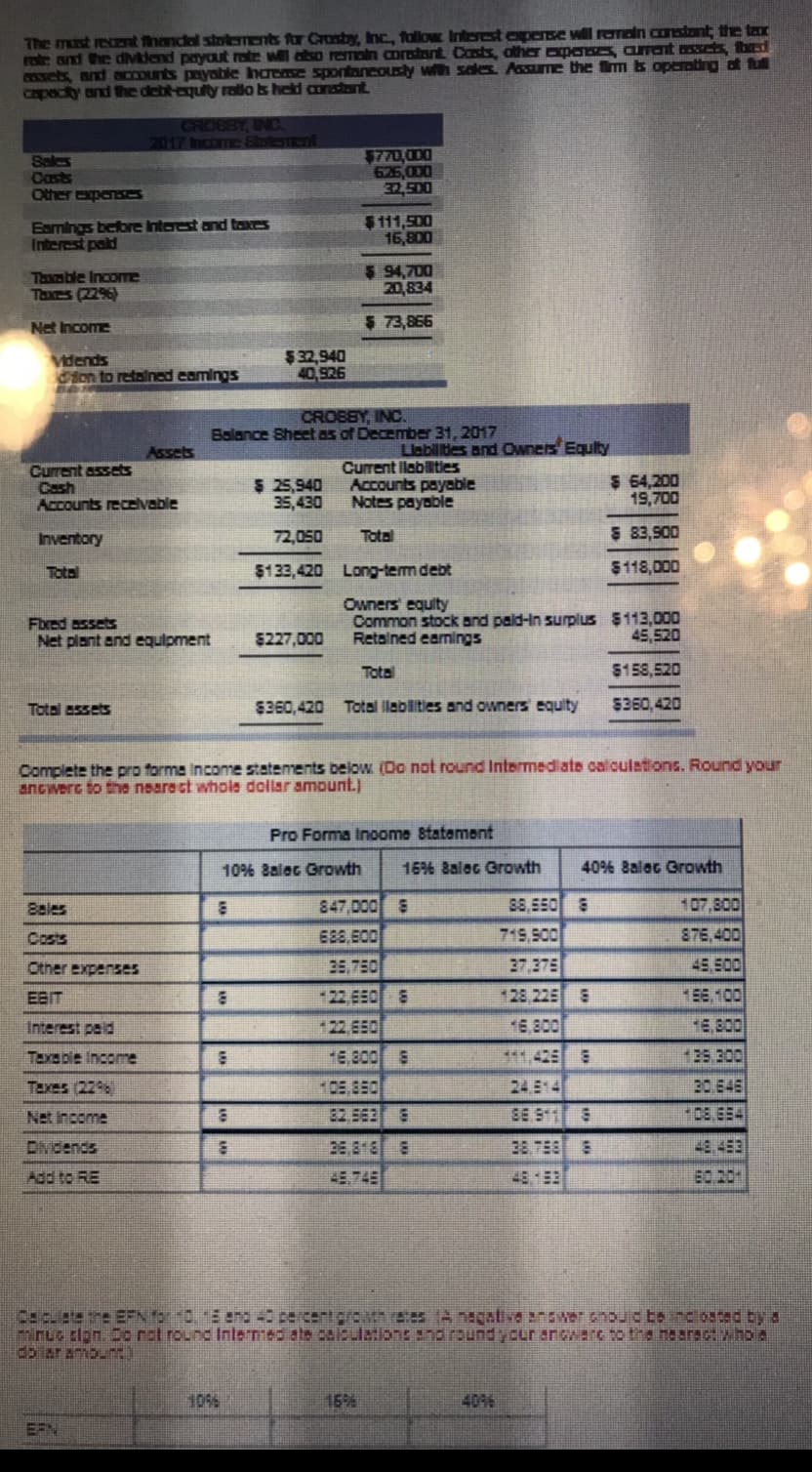

The mast recent thandal staiements for Crosby, Inc, tallow Interest expense wll remoin constant the ter capacty and the debl-equty ralo b held constent 770,000 626,000 32,500 Gasts Eamings bclore Intarest and toxeS Interest pod $111,5D0 16,800 1% Taxsble Incom Taes (2296 94,700 20,834 Net Incom 두73,866 dends ddon to retained eamings $32,940 SR6 Balance Sheet as of December 31, 2017 Equlty Current asses Current ilabilities 64,200 Cash Accounts recavabie s 25,940 Accounts payable 35,430 Notes payable 19,700 3 83,900 $118,000 Inventory $133,420 Long-term debt Owners' equity Fbed assets Common stock and pald-in surplus $113,000 45,520 5158,520 5360,420 Total ilablities and owners equity 360,420 Net plant and equipment 227,000 Retained eamings Total Total asses Complete the pro forme income statements below. (Do not round Intermediate calculations. Round your ancwerc to the nearect whole dollar amount.) Pro Forma Inoome Statement 1096 Balec Growth | 1696 Balecarowth | 40% Balec arowth 07,800 Bales Costs Other expenses 847.000 E88,E0O 719,800 876.40 28.22 E Interest psd Taable Income 29 300 Net Income vdends hdd to RE 0%

The mast recent thandal staiements for Crosby, Inc, tallow Interest expense wll remoin constant the ter capacty and the debl-equty ralo b held constent 770,000 626,000 32,500 Gasts Eamings bclore Intarest and toxeS Interest pod $111,5D0 16,800 1% Taxsble Incom Taes (2296 94,700 20,834 Net Incom 두73,866 dends ddon to retained eamings $32,940 SR6 Balance Sheet as of December 31, 2017 Equlty Current asses Current ilabilities 64,200 Cash Accounts recavabie s 25,940 Accounts payable 35,430 Notes payable 19,700 3 83,900 $118,000 Inventory $133,420 Long-term debt Owners' equity Fbed assets Common stock and pald-in surplus $113,000 45,520 5158,520 5360,420 Total ilablities and owners equity 360,420 Net plant and equipment 227,000 Retained eamings Total Total asses Complete the pro forme income statements below. (Do not round Intermediate calculations. Round your ancwerc to the nearect whole dollar amount.) Pro Forma Inoome Statement 1096 Balec Growth | 1696 Balecarowth | 40% Balec arowth 07,800 Bales Costs Other expenses 847.000 E88,E0O 719,800 876.40 28.22 E Interest psd Taable Income 29 300 Net Income vdends hdd to RE 0%

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:The

mast recent thandal staiements for Crosby, Inc, tallow Interest expense wll remoin constant the ter

capacty and the debl-equty ralo b held constent

770,000

626,000

32,500

Gasts

Eamings bclore Intarest and toxeS

Interest pod

$111,5D0

16,800

1%

Taxsble Incom

Taes (2296

94,700

20,834

Net Incom

두73,866

dends

ddon to retained eamings

$32,940

SR6

Balance Sheet as of December 31, 2017

Equlty

Current asses

Current ilabilities

64,200

Cash

Accounts recavabie

s 25,940 Accounts payable

35,430 Notes payable

19,700

3 83,900

$118,000

Inventory

$133,420

Long-term debt

Owners' equity

Fbed assets

Common stock and pald-in surplus

$113,000

45,520

5158,520

5360,420 Total ilablities and owners equity 360,420

Net plant and equipment 227,000 Retained eamings

Total

Total asses

Complete the pro forme income statements below. (Do not round Intermediate calculations. Round your

ancwerc to the nearect whole dollar amount.)

Pro Forma Inoome Statement

1096 Balec Growth | 1696 Balecarowth | 40% Balec arowth

07,800

Bales

Costs

Other expenses

847.000

E88,E0O

719,800

876.40

28.22 E

Interest psd

Taable Income

29 300

Net Income

vdends

hdd to RE

0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education