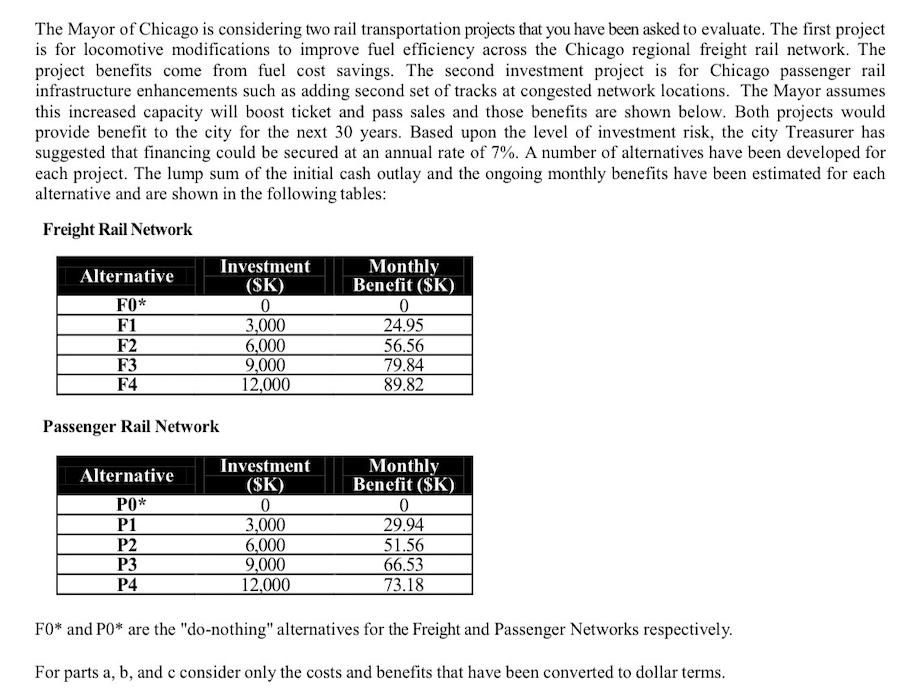

The Mayor of Chicago is considering two rail transportation projects that you have been asked to evaluate. The first project is for locomotive modifications to improve fuel efficiency across the Chicago regional freight rail network. The project benefits come from fuel cost savings. The second investment project is for Chicago passenger rail infrastructure enhancements such as adding second set of tracks at congested network locations. The Mayor assumes this increased capacity will boost ticket and pass sales and those benefits are shown below. Both projects would provide benefit to the city for the next 30 years. Based upon the level of investment risk, the city Treasurer has suggested that financing could be secured at an annual rate of 7%. A number of alternatives have been developed for each project. The lump sum of the initial cash outlay and the ongoing monthly benefits have been estimated for each alternative and are shown in the following tables: Freight Rail Network Monthly Benefit ($K) Investment Alternative ($K) FO* 3,000 6,000 9,000 12,000 24.95 56.56 79.84 89.82 F1 F2 F3 F4 Passenger Rail Network Investment Monthly Benefit ($K) Alternative (SK) PO* P1 P2 P3 3,000 6,000 9,000 12,000 29.94 51.56 66.53 73.18 P4 FO* and PO* are the "do-nothing" alternatives for the Freight and Passenger Networks respectively. For parts a, b, and c consider only the costs and benefits that have been converted to dollar terms.

The Mayor of Chicago is considering two rail transportation projects that you have been asked to evaluate. The first project is for locomotive modifications to improve fuel efficiency across the Chicago regional freight rail network. The project benefits come from fuel cost savings. The second investment project is for Chicago passenger rail infrastructure enhancements such as adding second set of tracks at congested network locations. The Mayor assumes this increased capacity will boost ticket and pass sales and those benefits are shown below. Both projects would provide benefit to the city for the next 30 years. Based upon the level of investment risk, the city Treasurer has suggested that financing could be secured at an annual rate of 7%. A number of alternatives have been developed for each project. The lump sum of the initial cash outlay and the ongoing monthly benefits have been estimated for each alternative and are shown in the following tables: Freight Rail Network Monthly Benefit ($K) Investment Alternative ($K) FO* 3,000 6,000 9,000 12,000 24.95 56.56 79.84 89.82 F1 F2 F3 F4 Passenger Rail Network Investment Monthly Benefit ($K) Alternative (SK) PO* P1 P2 P3 3,000 6,000 9,000 12,000 29.94 51.56 66.53 73.18 P4 FO* and PO* are the "do-nothing" alternatives for the Freight and Passenger Networks respectively. For parts a, b, and c consider only the costs and benefits that have been converted to dollar terms.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 20P: The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting,...

Related questions

Question

Given the scope of each project, what other costs and/or benefits might not be fully captured in the tables above? That is, a cost and/or benefit that might not be accurately reduced to dollar terms.

Transcribed Image Text:The Mayor of Chicago is considering two rail transportation projects that you have been asked to evaluate. The first project

is for locomotive modifications to improve fuel efficiency across the Chicago regional freight rail network. The

project benefits come from fuel cost savings. The second investment project is for Chicago passenger rail

infrastructure enhancements such as adding second set of tracks at congested network locations. The Mayor assumes

this increased capacity will boost ticket and pass sales and those benefits are shown below. Both projects would

provide benefit to the city for the next 30 years. Based upon the level of investment risk, the city Treasurer has

suggested that financing could be secured at an annual rate of 7%. A number of alternatives have been developed for

each project. The lump sum of the initial cash outlay and the ongoing monthly benefits have been estimated for each

alternative and are shown in the following tables:

Freight Rail Network

Monthly

Benefit ($K)

Investment

Alternative

(SK)

F0*

3,000

6,000

9,000

12,000

24.95

56.56

79.84

89.82

F1

F2

F3

F4

Passenger Rail Network

Investment

Monthly

Benefit ($K)

Alternative

|($K)

PO*

3,000

6,000

9,000

12,000

29.94

P1

P2

P3

P4

51.56

66.53

73.18

FO* and PO* are the "do-nothing" alternatives for the Freight and Passenger Networks respectively.

For parts a, b, and c consider only the costs and benefits that have been converted to dollar terms.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub