The road development authority is evaluating the costs and benefits of three alternative routes for a mountain road that will connect a previously Inaccessible community with the nearest town. This is a social welfare project and therefore the authority is determined to implement it even if theri no economic benehts to the authority. However, indirect economic benefts to the government and society are anticipated as indicated in the table b Three mutually exclusive plans for routing the road are being considered. All three alternatives are assumed to have an economic life of 50 years. The MARR Is assumed as 8% per year. (a) Which investment has highest B-C ratio? (b) Which alternative should be selected if the authority must Implement the project? B-CAnalysis method and glve reasons for your answer. Route X Route Y Route Z Constructi on Cost 185,000 220,000 290,000 Annual maintenance cost 2,500 3,000 4,000 Annual savings on service provision to the community Annual benefit from touri sm 10,000 10,500 15,000 7,600 8,900 9,400

The road development authority is evaluating the costs and benefits of three alternative routes for a mountain road that will connect a previously Inaccessible community with the nearest town. This is a social welfare project and therefore the authority is determined to implement it even if theri no economic benehts to the authority. However, indirect economic benefts to the government and society are anticipated as indicated in the table b Three mutually exclusive plans for routing the road are being considered. All three alternatives are assumed to have an economic life of 50 years. The MARR Is assumed as 8% per year. (a) Which investment has highest B-C ratio? (b) Which alternative should be selected if the authority must Implement the project? B-CAnalysis method and glve reasons for your answer. Route X Route Y Route Z Constructi on Cost 185,000 220,000 290,000 Annual maintenance cost 2,500 3,000 4,000 Annual savings on service provision to the community Annual benefit from touri sm 10,000 10,500 15,000 7,600 8,900 9,400

Chapter1: An Introduction To Taxation And Understanding The Federal Tax Law

Section: Chapter Questions

Problem 9DQ

Related questions

Question

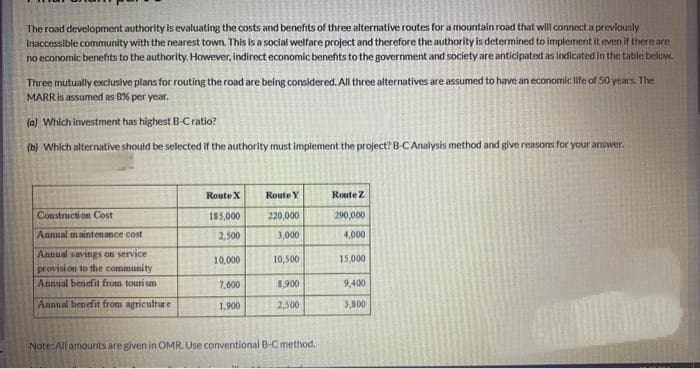

Transcribed Image Text:The road development authority is evaluating the costs and benefits of three alternative routes for a mountain road that will connect a previously

inaccessible community with the nearest town. This is a social welfare project and therefore the authority is determined to implement it even if there are

no economic benefits to the authority. However, indirect economic benefits to the government and society are anticipated as indicated in the table below.

Three mutually exclusive plans for routing the road are being considered. All three alternatives are assumed to have an economic life of 50 years. The

MARRIS assumed as 8% per year.

(a) Which investment has highest B-Cratio?

(b) Which alternative should be selected if the authority must implement the project? B-CAnalysis method and give reasons for your answer.

Route X

Route Y

Route Z

Construction Cost

185,000

220,000

290,000

Annual maintenance cost

2,500

3,000

4,000

Annual savings on service

provision to the community

Annual benefit from tourism

10,000

10,500

15,000

7,600

8,900

9,400

Annual benefit from agriculture

1,900

2,500

3,800

Note:All amounts are given in OMR, Use conventional B-C method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT