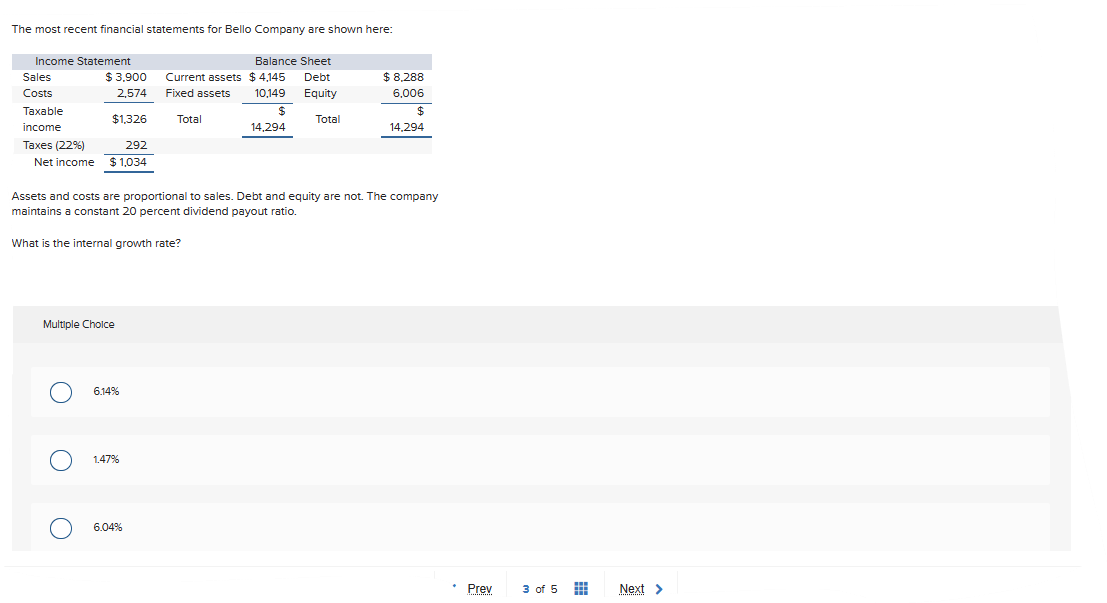

The most recent financial statements for Bello Company are shown here: Income Statement Sales Costs Taxable income Taxes (22%) Net income $ 3,900 2,574 $1,326 292 $1,034 Multiple Choice O What is the internal growth rate? O Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 20 percent dividend payout ratio. 6.14% O 1.47% Current assets Fixed assets Total 6.04% Balance Sheet Debt Equity Total $4,145 10,149 $ 14,294 $ 8,288 6,006 $ 14.294

The most recent financial statements for Bello Company are shown here: Income Statement Sales Costs Taxable income Taxes (22%) Net income $ 3,900 2,574 $1,326 292 $1,034 Multiple Choice O What is the internal growth rate? O Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 20 percent dividend payout ratio. 6.14% O 1.47% Current assets Fixed assets Total 6.04% Balance Sheet Debt Equity Total $4,145 10,149 $ 14,294 $ 8,288 6,006 $ 14.294

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 13P

Related questions

Question

Fast pls solve this question correctly in 5 min pls I will give u like for sure

Subrbh

Transcribed Image Text:The most recent financial statements for Bello Company are shown here:

Income Statement

Sales

Costs

Taxable

income

Taxes (22%)

Net income

$3,900

2,574

$1,326

O

292

$1,034

Multiple Choice

O

What is the internal growth rate?

O

Assets and costs are proportional to sales. Debt and equity are not. The company

maintains a constant 20 percent dividend payout ratio.

6.14%

Current assets

Fixed assets

1.47%

Total

6.04%

Balance Sheet

$4,145 Debt

10,149

Equity

$

Total

14,294

$ 8,288

6,006

$

14,294

Prev

3 of 5

w

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,