Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Plz do exactly like they ask in question i attached everything here

Transcribed Image Text:Complete this assignment using Microsoft Excel and submit it below. Please submit it as a single file.

Assignment

Perform financial analysis for a project using the format provided in Figure 4-5 in the text. Assume the costs

and benefits for this project are spread over four years as follows:

• Estimated costs are $200,000 in Year 1 and $30,000 in Years 2, 3, and 4.

• Estimated benefits are $0 in Year 1 and $100,000 each year in Years 2, 3, and 4.

• Use a 9% discount rate, and round the discount factors to two decimal places.

Create a spreadsheet to calculate and clearly display the NPV, ROI, and year in which payback occurs. Based

on the financial analysis, please write a few lines on the spreadsheet explaining whether you would

recommend investing in this project. (Tip: Use the spreadsheet format given and limit the table to 4 years.

The discount factors should start with 0.92 in year 1.)

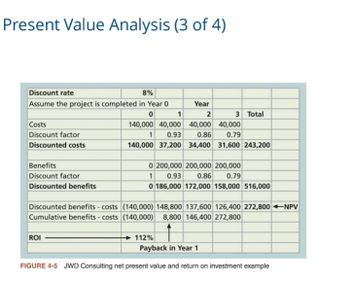

Transcribed Image Text:Present Value Analysis (3 of 4)

Discount rate

8%

Assume the project is completed in Year 0

0

Costs

Discount factor

Discounted costs

Benefits

Discount factor

Discounted benefits

Discounted benefits - costs

Cumulative benefits - costs

ROI

1

140,000 40,000

1

0.93

140,000 37,200

Year

2

3 Total

40,000

40,000

0.86

0.79

34,400 31,600 243,200

0 200,000 200,000 200,000

1

0.93

0.86

0.79

0 186,000 172,000 158,000 516,000

(140,000) 148,800 137,600 126,400 272,800+NPV

(140,000) 8,800 146,400 272,800

112%

Payback in Year 1

FIGURE 4-5 JWD Consulting net present value and return on investment example

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- I have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardMa1 . Who benefits most from Peace of Mind®? Complex return filers. EITC filers. Clients with refunds. All clients.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardin text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forwardal Acco X M Question 4 - Comprehensive Pr + heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252F ve Problem 5 i Saved Required information [The following information applies to the questions displayed below.] Jasper Company, a machine tooling firm, has several plants. One plant, located in Saint Cloud, Minnesota, uses a job order costing system for its batch production processes. The Saint Cloud plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $242,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the Saint Cloud plant for the past year are as follows: Budgeted department overhead (excludes plantwide overhead) Actual…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education