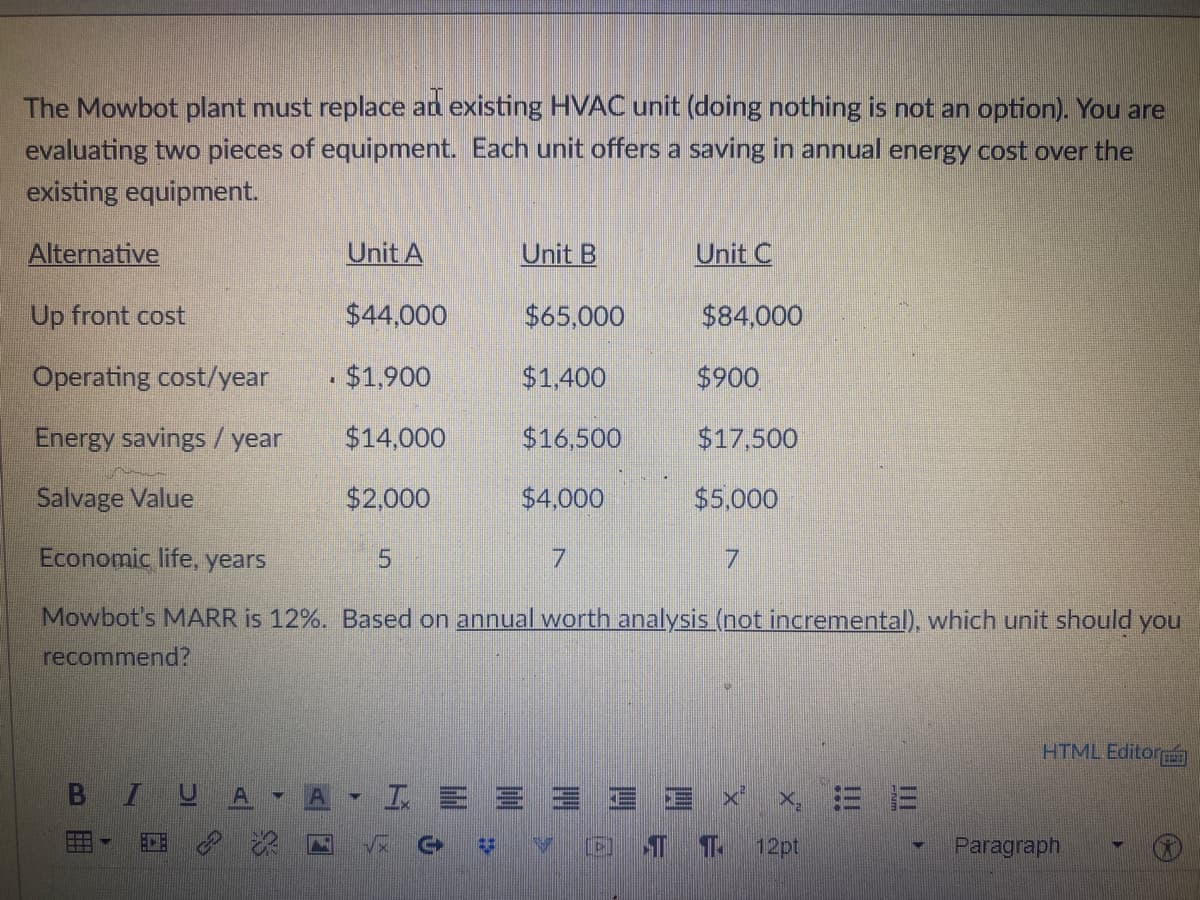

The Mowbot plant must replace ad existing HVAC unit (doing nothing is not an option). You are evaluating two pieces of equipment. Each unit offers a saving in annual energy cost over the existing equipment. Alternative Unit A Unit B Unit C Up front cost $44,000 $65,000 $84,000 Operating cost/year $1,900 $1,400 $900 Energy savings/ year $14,000 $16,500 $17,500 Salvage Value $2,000 $4,000 $5,000 Economic life, years 7 7. Mowbot's MARR is 12%. Based on annual worth analysis (not incremental), which unit should you recommend?

The Mowbot plant must replace ad existing HVAC unit (doing nothing is not an option). You are evaluating two pieces of equipment. Each unit offers a saving in annual energy cost over the existing equipment. Alternative Unit A Unit B Unit C Up front cost $44,000 $65,000 $84,000 Operating cost/year $1,900 $1,400 $900 Energy savings/ year $14,000 $16,500 $17,500 Salvage Value $2,000 $4,000 $5,000 Economic life, years 7 7. Mowbot's MARR is 12%. Based on annual worth analysis (not incremental), which unit should you recommend?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 1MAD: Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with...

Related questions

Question

Transcribed Image Text:The Mowbot plant must replace an existing HVAC unit (doing nothing is not an option). You are

evaluating two pieces of equipment. Each unit offers a saving in annual energy cost over the

existing equipment.

Alternative

Unit A

Unit B

Unit C

Up front cost

$44,000

$65,000

$84,000

Operating cost/year

$1.900

$1.400

$900

Energy savings / year

$14,000

$16,500

$17,500

Salvage Value

$2,000

$4,000

$5,000

Economic life, years

7.

7.

Mowbot's MARR is 12%. Based on annual worth analysis (not incremental), which unit should you

recommend?

HTML Editora

BI

工E三

E三xi

x ミ =

ECE

12pt

Paragraph

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning