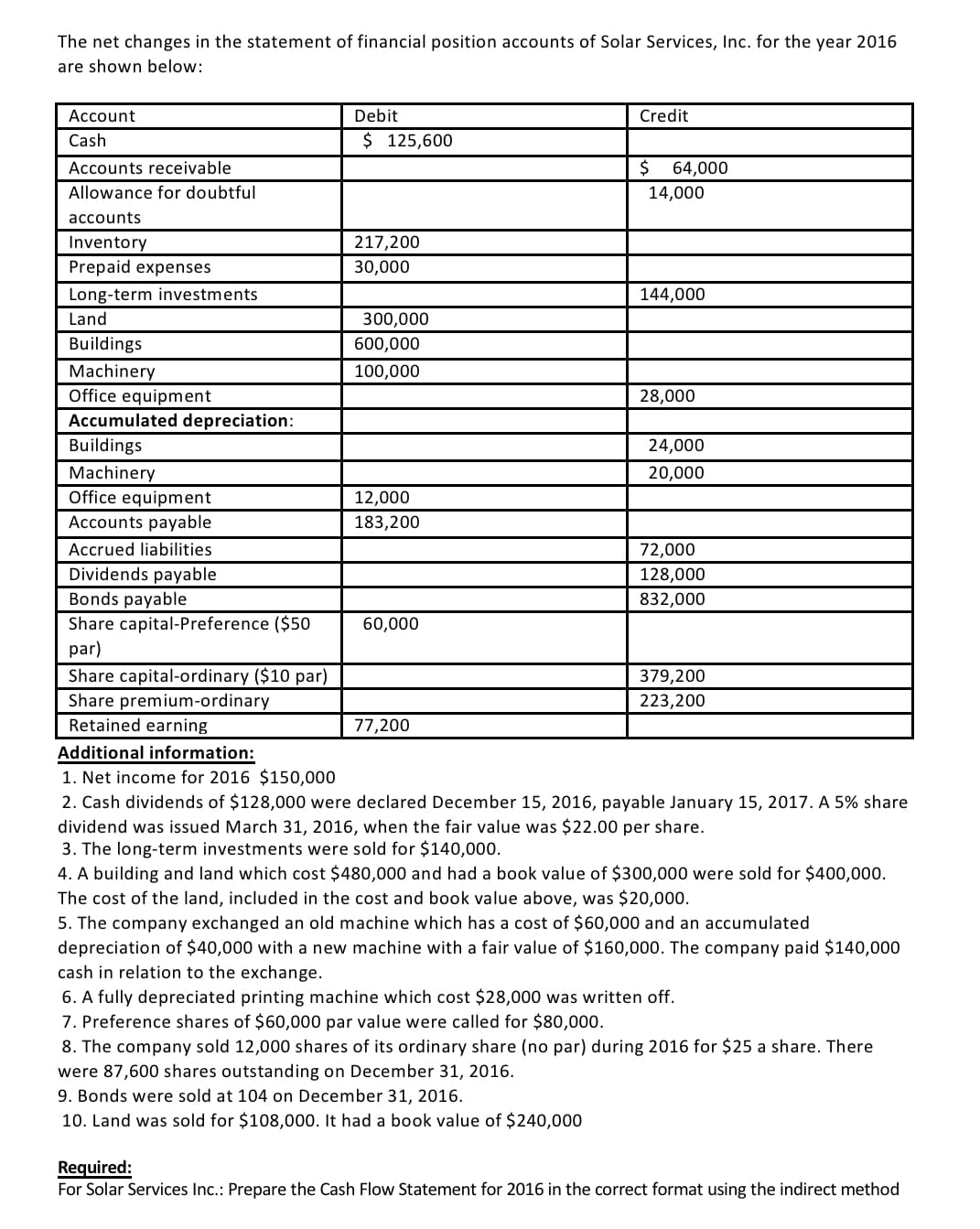

The net changes in the statement of financial position accounts of Solar Services, Inc. for the year 2016 are shown below: Account Debit Credit Cash $ 125,600 Accounts receivable 64,000 Allowance for doubtful 14,000 accounts Inventory 217,200 Prepaid expenses 30,000 Long-term investments Land 144,000 300,000 Buildings 600,000 Machinery Office equipment Accumulated depreciation: 100,000 28,000 Buildings 24,000 Machinery Office equipment Accounts payable 20,000 12,000 183,200 Accrued liabilities 72,000 Dividends payable Bonds payable Share capital-Preference ($50 128,000 832,000 60,000 par) Share capital-ordinary ($10 par) Share premium-ordinary Retained earning 379,200 223,200 77,200 Additional information: 1. Net income for 2016 $150,000 2. Cash dividends of $128,000 were declared December 15, 2016, payable January 15, 2017. A 5% share dividend was issued March 31, 2016, when the fair value was $22.00 per share. 3. The long-term investments were sold for $140,000. 4. A building and land which cost $480,000 and had a book value of $300,000 were sold for $400,000. The cost of the land, included in the cost and book value above, was $20,000. 5. The company exchanged an old machine which has a cost of $60,000 and an accumulated depreciation of $40,000 with a new machine with a fair value of $160,000. The company paid $140,000 cash in relation to the exchange. 6. A fully depreciated printing machine which cost $28,000 was written off. 7. Preference shares of $60,000 par value were called for $80,000. 8. The company sold 12,000 shares of its ordinary share (no par) during 2016 for $25 a share. There were 87,600 shares outstanding on December 31, 2016. 9. Bonds were sold at 104 on December 31, 2016. 10. Land was sold for $108,000. It had a book value of $240,000 Required: For Solar Services Inc.: Prepare the Cash Flow Statement for 2016 in the correct format using the indirect method

The net changes in the statement of financial position accounts of Solar Services, Inc. for the year 2016 are shown below: Account Debit Credit Cash $ 125,600 Accounts receivable 64,000 Allowance for doubtful 14,000 accounts Inventory 217,200 Prepaid expenses 30,000 Long-term investments Land 144,000 300,000 Buildings 600,000 Machinery Office equipment Accumulated depreciation: 100,000 28,000 Buildings 24,000 Machinery Office equipment Accounts payable 20,000 12,000 183,200 Accrued liabilities 72,000 Dividends payable Bonds payable Share capital-Preference ($50 128,000 832,000 60,000 par) Share capital-ordinary ($10 par) Share premium-ordinary Retained earning 379,200 223,200 77,200 Additional information: 1. Net income for 2016 $150,000 2. Cash dividends of $128,000 were declared December 15, 2016, payable January 15, 2017. A 5% share dividend was issued March 31, 2016, when the fair value was $22.00 per share. 3. The long-term investments were sold for $140,000. 4. A building and land which cost $480,000 and had a book value of $300,000 were sold for $400,000. The cost of the land, included in the cost and book value above, was $20,000. 5. The company exchanged an old machine which has a cost of $60,000 and an accumulated depreciation of $40,000 with a new machine with a fair value of $160,000. The company paid $140,000 cash in relation to the exchange. 6. A fully depreciated printing machine which cost $28,000 was written off. 7. Preference shares of $60,000 par value were called for $80,000. 8. The company sold 12,000 shares of its ordinary share (no par) during 2016 for $25 a share. There were 87,600 shares outstanding on December 31, 2016. 9. Bonds were sold at 104 on December 31, 2016. 10. Land was sold for $108,000. It had a book value of $240,000 Required: For Solar Services Inc.: Prepare the Cash Flow Statement for 2016 in the correct format using the indirect method

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.8E

Related questions

Question

Transcribed Image Text:The net changes in the statement of financial position accounts of Solar Services, Inc. for the year 2016

are shown below:

Account

Debit

Credit

Cash

$ 125,600

Accounts receivable

$

64,000

Allowance for doubtful

14,000

accounts

Inventory

217,200

Prepaid expenses

30,000

Long-term investments

144,000

Land

300,000

Buildings

600,000

Machinery

Office equipment

100,000

28,000

Accumulated depreciation:

Buildings

24,000

Machinery

20,000

Office equipment

12,000

Accounts payable

183,200

Accrued liabilities

72,000

Dividends payable

128,000

Bonds payable

832,000

Share capital-Preference ($50

60,000

par)

Share capital-ordinary ($10 par)

Share premium-ordinary

379,200

223,200

Retained earning

77,200

Additional information:

1. Net income for 2016 $150,000

2. Cash dividends of $128,000 were declared December 15, 2016, payable January 15, 2017. A 5% share

dividend was issued March 31, 2016, when the fair value was $22.00 per share.

3. The long-term investments were sold for $140,000.

4. A building and land which cost $480,000 and had a book value of $300,000 were sold for $400,000.

The cost of the land, included in the cost and book value above, was $20,000.

5. The company exchanged an old machine which has a cost of $60,000 and an accumulated

depreciation of $40,000 with a new machine with a fair value of $160,000. The company paid $140,000

cash in relation to the exchange.

6. A fully depreciated printing machine which cost $28,000 was written off.

7. Preference shares of $60,000 par value were called for $80,000.

8. The company sold 12,000 shares of its ordinary share (no par) during 2016 for $25 a share. There

were 87,600 shares outstanding on December 31, 2016.

9. Bonds were sold at 104 on December 31, 2016.

10. Land was sold for $108,000. It had a book value of $240,000

Required:

For Solar Services Inc.: Prepare the Cash Flow Statement for 2016 in the correct format using the indirect method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning