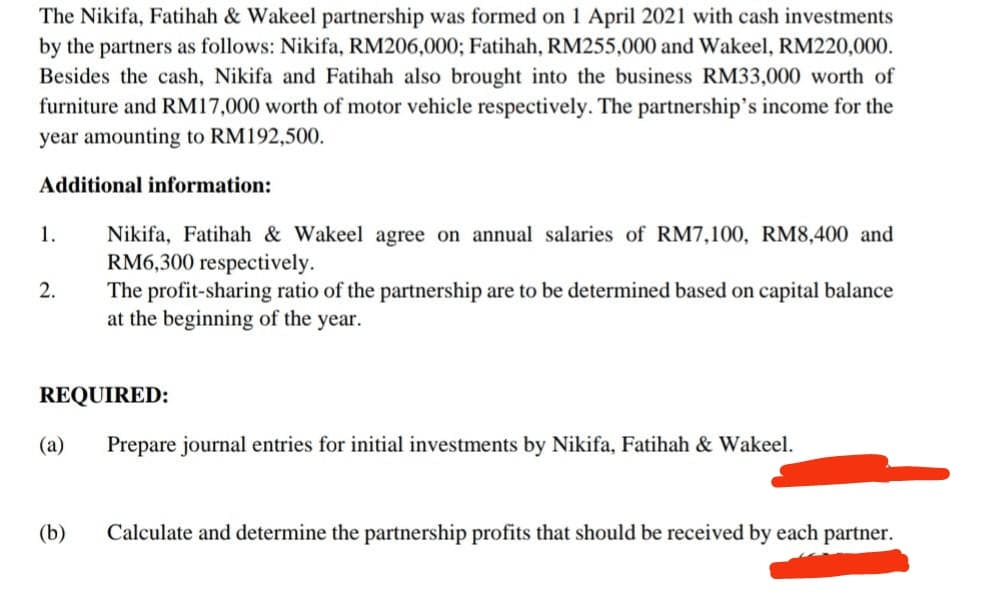

The Nikifa, Fatihah & Wakeel partnership was formed on 1 April 2021 with cash investments by the partners as follows: Nikifa, RM206,000; Fatihah, RM255,000 and Wakeel, RM220,000. Besides the cash, Nikifa and Fatihah also brought into the business RM33,000 worth of furniture and RM17,000 worth of motor vehicle respectively. The partnership's income for the year amounting to RM192,500. Additional information: Nikifa, Fatihah & Wakeel agree on annual salaries of RM7,100, RM8,400 and RM6,300 respectively. The profit-sharing ratio of the partnership are to be determined based on capital balance at the beginning of the year. 1. 2. REQUIRED: (a) Prepare journal entries for initial investments by Nikifa, Fatihah & Wakeel. (b) Calculate and determine the partnership profits that should be received by each partner.

The Nikifa, Fatihah & Wakeel partnership was formed on 1 April 2021 with cash investments by the partners as follows: Nikifa, RM206,000; Fatihah, RM255,000 and Wakeel, RM220,000. Besides the cash, Nikifa and Fatihah also brought into the business RM33,000 worth of furniture and RM17,000 worth of motor vehicle respectively. The partnership's income for the year amounting to RM192,500. Additional information: Nikifa, Fatihah & Wakeel agree on annual salaries of RM7,100, RM8,400 and RM6,300 respectively. The profit-sharing ratio of the partnership are to be determined based on capital balance at the beginning of the year. 1. 2. REQUIRED: (a) Prepare journal entries for initial investments by Nikifa, Fatihah & Wakeel. (b) Calculate and determine the partnership profits that should be received by each partner.

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:The Nikifa, Fatihah & Wakeel partnership was formed on 1 April 2021 with cash investments

by the partners as follows: Nikifa, RM206,000; Fatihah, RM255,000 and Wakeel, RM220,000.

Besides the cash, Nikifa and Fatihah also brought into the business RM33,000 worth of

furniture and RM17,000 worth of motor vehicle respectively. The partnership's income for the

year amounting to RM192,500.

Additional information:

Nikifa, Fatihah & Wakeel agree on annual salaries of RM7,100, RM8,400 and

RM6,300 respectively.

The profit-sharing ratio of the partnership are to be determined based on capital balance

at the beginning of the year.

1.

2.

REQUIRED:

(a)

Prepare journal entries for initial investments by Nikifa, Fatihah & Wakeel.

(b)

Calculate and determine the partnership profits that should be received by each partner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT