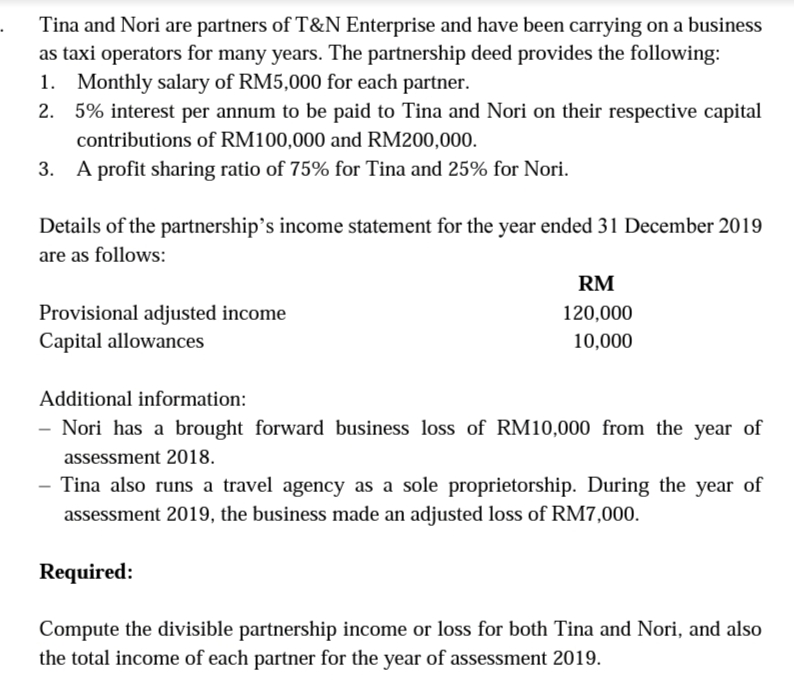

Tina and Nori are partners of T&N Enterprise and have been carrying on a business as taxi operators for many years. The partnership deed provides the following: 1. Monthly salary of RM5,000 for each partner. 2. 5% interest per annum to be paid to Tina and Nori on their respective capital contributions of RM100,000 and RM200,000. 3. A profit sharing ratio of 75% for Tina and 25% for Nori. Details of the partnership's income statement for the year ended 31 December 2019 are as follows: RM Provisional adjusted income Capital allowances 120,000 10,000 Additional information: - Nori has a brought forward business loss of RM10,000 from the year of assessment 2018. - Tina also runs a travel agency as a sole proprietorship. During the year of assessment 2019, the business made an adjusted loss of RM7,000. Required: Compute the divisible partnership income or loss for both Tina and Nori, and also the total income of each partner for the year of assessment 2019.

Tina and Nori are partners of T&N Enterprise and have been carrying on a business as taxi operators for many years. The partnership deed provides the following: 1. Monthly salary of RM5,000 for each partner. 2. 5% interest per annum to be paid to Tina and Nori on their respective capital contributions of RM100,000 and RM200,000. 3. A profit sharing ratio of 75% for Tina and 25% for Nori. Details of the partnership's income statement for the year ended 31 December 2019 are as follows: RM Provisional adjusted income Capital allowances 120,000 10,000 Additional information: - Nori has a brought forward business loss of RM10,000 from the year of assessment 2018. - Tina also runs a travel agency as a sole proprietorship. During the year of assessment 2019, the business made an adjusted loss of RM7,000. Required: Compute the divisible partnership income or loss for both Tina and Nori, and also the total income of each partner for the year of assessment 2019.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

Solve this

Transcribed Image Text:Tina and Nori are partners of T&N Enterprise and have been carrying on a business

as taxi operators for many years. The partnership deed provides the following:

1. Monthly salary of RM5,000 for each partner.

2. 5% interest per annum to be paid to Tina and Nori on their respective capital

contributions of RM100,000 and RM200,000.

3. A profit sharing ratio of 75% for Tina and 25% for Nori.

Details of the partnership’s income statement for the year ended 31 December 2019

are as follows:

RM

Provisional adjusted income

Capital allowances

120,000

10,000

Additional information:

- Nori has a brought forward business loss of RM10,000 from the year of

assessment 2018.

Tina also runs a travel agency as a sole proprietorship. During the year of

assessment 2019, the business made an adjusted loss of RM7,000.

Required:

Compute the divisible partnership income or loss for both Tina and Nori, and also

the total income of each partner for the year of assessment 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT