The partnership of Ray, May and Jay is to be liquidated. Their books reflect beginning cash balances of P200,000; Liabilities of P350,000, Ray Capital (30%), P300,000; May Capital (25%), P450,000 and Jay Capital, (45%), P350,000. The partnership is to be liquidated on an installment basis. The details of the first two installment sales of the partnership follow: Book Value Sales Price of Non-cash of Non-cash Liquidating Liabilities Liquidating Assets sold Assets sold Expenses P 250,000 P 205,000 Expected Expenses 1* Sale | 2nd Sale Paid P 20,000 P 150,000 P 25,000 150,000 100,000 30,000 10,000 30,000 Cash is distributed to the partners as it becomes available. In the 3rd installment sale, P200,000 of the NCAS are sold for P150,000; P30,000 of the liabilities and P10,000 liquidating expenses are paid; and P130,000 cash is distributed to the partners. Determine the capital of May after the 1* installment sale of the Non-cash assets.

The partnership of Ray, May and Jay is to be liquidated. Their books reflect beginning cash balances of P200,000; Liabilities of P350,000, Ray Capital (30%), P300,000; May Capital (25%), P450,000 and Jay Capital, (45%), P350,000. The partnership is to be liquidated on an installment basis. The details of the first two installment sales of the partnership follow: Book Value Sales Price of Non-cash of Non-cash Liquidating Liabilities Liquidating Assets sold Assets sold Expenses P 250,000 P 205,000 Expected Expenses 1* Sale | 2nd Sale Paid P 20,000 P 150,000 P 25,000 150,000 100,000 30,000 10,000 30,000 Cash is distributed to the partners as it becomes available. In the 3rd installment sale, P200,000 of the NCAS are sold for P150,000; P30,000 of the liabilities and P10,000 liquidating expenses are paid; and P130,000 cash is distributed to the partners. Determine the capital of May after the 1* installment sale of the Non-cash assets.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

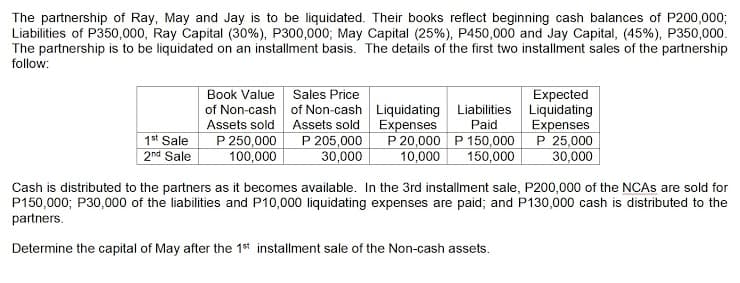

Transcribed Image Text:The partnership of Ray, May and Jay is to be liquidated. Their books reflect beginning cash balances of P200,000;

Liabilities of P350,000, Ray Capital (30%), P300,000; May Capital (25%), P450,000 and Jay Capital, (45%), P350,000.

The partnership is to be liquidated on an installment basis. The details of the first two installment sales of the partnership

follow:

Book Value Sales Price

of Non-cash of Non-cash Liquidating Liabilities Liquidating

Assets sold Assets sold Expenses

P 250,000

100,000

Expected

Paid

Expenses

1st Sale

2nd Sale

P 205,000

30,000

P 20,000 P 150,000 P 25,000

10,000

150,000

30,000

Cash is distributed to the partners as it becomes available. In the 3rd installment sale, P200,000 of the NCAS are sold for

P150,000; P30,000 of the liabilities and P10,000 liquidating expenses are paid; and P130,000 cash is distributed to the

partners.

Determine the capital of May after the 1st installment sale of the Non-cash assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College