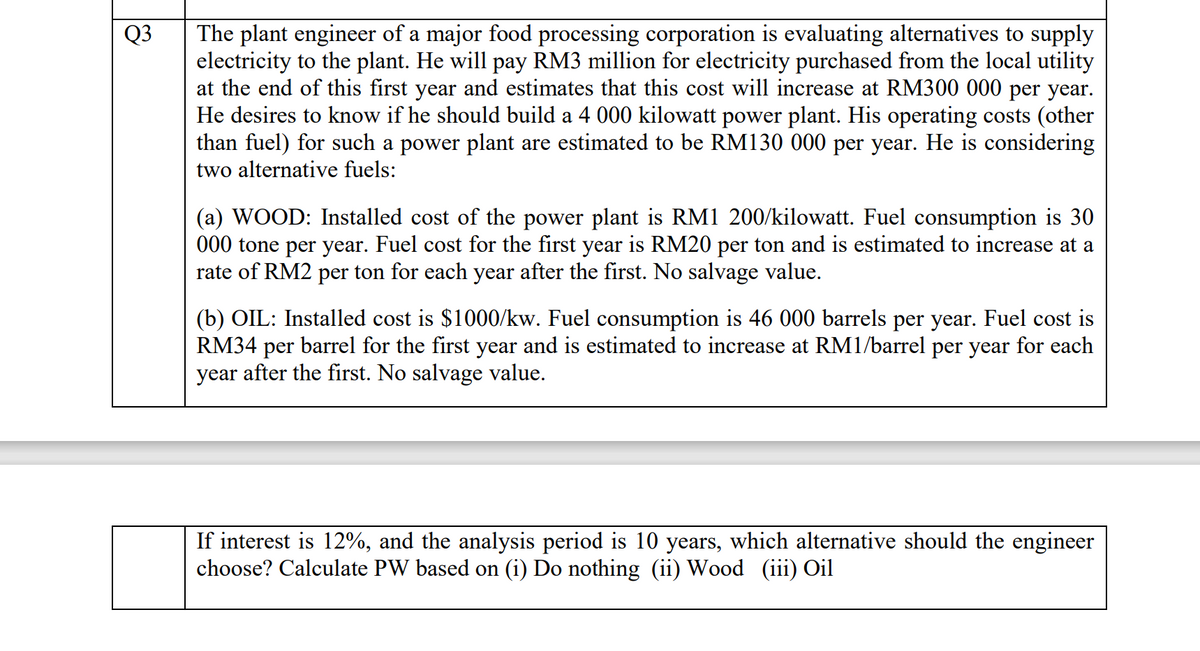

The plant engineer of a major food processing corporation is evaluating alternatives to supply electricity to the plant. He will pay RM3 million for electricity purchased from the local utility at the end of this first year and estimates that this cost will increase at RM300 000 per year. He desires to know if he should build a 4 000 kilowatt power plant. His operating costs (other than fuel) for such a power plant are estimated to be RM130 000 per year. He is considering two alternative fuels: (a) WOOD: Installed cost of the power plant is RM1 200/kilowatt. Fuel consumption is 30 000 tone per year. Fuel cost for the first year is RM20 per ton and is estimated to increase at a rate of RM2 per ton for each year after the first. No salvage value. (b) OIL: Installed cost is $1000/kw. Fuel consumption is 46 000 barrels per year. Fuel cost is RM34 per barrel for the first year and is estimated to increase at RM1/barrel per year for each year after the first. No salvage value. If interest is 12%, and the analysis period is 10 years, which alternative should the engineer choose? Calculate PW based on (i) Do nothing (ii) Wood (iii) Oil

The plant engineer of a major food processing corporation is evaluating alternatives to supply electricity to the plant. He will pay RM3 million for electricity purchased from the local utility at the end of this first year and estimates that this cost will increase at RM300 000 per year. He desires to know if he should build a 4 000 kilowatt power plant. His operating costs (other than fuel) for such a power plant are estimated to be RM130 000 per year. He is considering two alternative fuels: (a) WOOD: Installed cost of the power plant is RM1 200/kilowatt. Fuel consumption is 30 000 tone per year. Fuel cost for the first year is RM20 per ton and is estimated to increase at a rate of RM2 per ton for each year after the first. No salvage value. (b) OIL: Installed cost is $1000/kw. Fuel consumption is 46 000 barrels per year. Fuel cost is RM34 per barrel for the first year and is estimated to increase at RM1/barrel per year for each year after the first. No salvage value. If interest is 12%, and the analysis period is 10 years, which alternative should the engineer choose? Calculate PW based on (i) Do nothing (ii) Wood (iii) Oil

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1iM

Related questions

Question

Transcribed Image Text:The plant engineer of a major food processing corporation is evaluating alternatives to supply

electricity to the plant. He will pay RM3 million for electricity purchased from the local utility

at the end of this first year and estimates that this cost will increase at RM300 000 per year.

He desires to know if he should build a 4 000 kilowatt power plant. His operating costs (other

than fuel) for such a power plant are estimated to be RM130 000 per year. He is considering

two alternative fuels:

Q3

(a) WOOD: Installed cost of the power plant is RM1 200/kilowatt. Fuel consumption is 30

000 tone per year. Fuel cost for the first year is RM20 per ton and is estimated to increase at a

rate of RM2 per ton for each year after the first. No salvage value.

(b) OIL: Installed cost is $1000/kw. Fuel consumption is 46 000 barrels per year. Fuel cost is

RM34 per barrel for the first year and is estimated to increase at RM1/barrel per year for each

year after the first. No salvage value.

If interest is 12%, and the analysis period is 10 years, which alternative should the engineer

choose? Calculate PW based on (i) Do nothing (ii) Wood (iii) Oil

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning