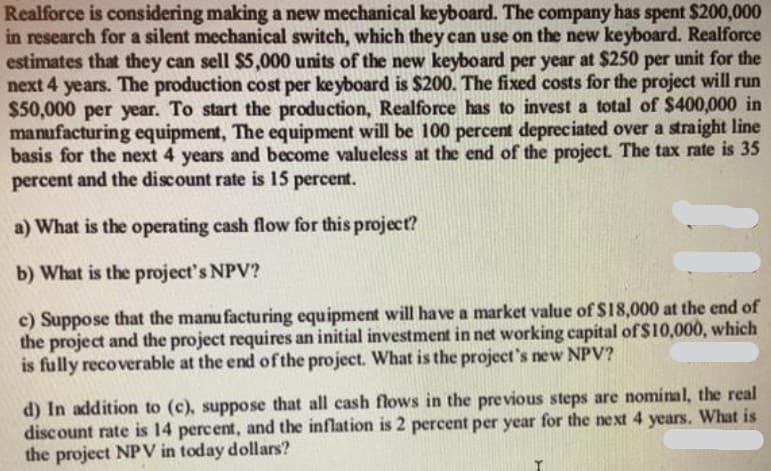

Realforce is considering making a new mechanical keyboard. The company has spent $200,000 in research for a silent mechanical switch, which they can use on the new keyboard. Realforce estimates that they can sell $5,000 units of the new keyboard per year at $250 per unit for thes next 4 years. The production cost per keyboard is $200. The fixed costs for the project will run $50,000 per year. To start the production, Realforce has to invest a total of $400,000 in manufacturing equipment, The equipment will be 100 percent depreciated over a straight line basis for the next 4 years and become valueless at the end of the project. The tax rate is 35 percent and the discount rate is 15 percent. a) What is the operating cash flow for this project? b) What is the project's NPV? c) Suppose that the manu facturing equipment will have a market value of $18,000 at the end of the project and the project requires an initial investment in net working capital of $10,000, which is fully recoverable at the end ofthe project. What is the project's new NPV? d) In addition to (c), suppose that all cash flows in the previous steps are nominal, the real discount rate is 14 percent, and the inflation is 2 percent per year for the next 4 years. What is the project NPV in today dollars?

Realforce is considering making a new mechanical keyboard. The company has spent $200,000 in research for a silent mechanical switch, which they can use on the new keyboard. Realforce estimates that they can sell $5,000 units of the new keyboard per year at $250 per unit for thes next 4 years. The production cost per keyboard is $200. The fixed costs for the project will run $50,000 per year. To start the production, Realforce has to invest a total of $400,000 in manufacturing equipment, The equipment will be 100 percent depreciated over a straight line basis for the next 4 years and become valueless at the end of the project. The tax rate is 35 percent and the discount rate is 15 percent. a) What is the operating cash flow for this project? b) What is the project's NPV? c) Suppose that the manu facturing equipment will have a market value of $18,000 at the end of the project and the project requires an initial investment in net working capital of $10,000, which is fully recoverable at the end ofthe project. What is the project's new NPV? d) In addition to (c), suppose that all cash flows in the previous steps are nominal, the real discount rate is 14 percent, and the inflation is 2 percent per year for the next 4 years. What is the project NPV in today dollars?

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1eM

Related questions

Question

Please answer part d ...need it fast

Transcribed Image Text:Realforce is considering making a new mechanical keyboard. The company has spent $200,000

in research for a silent mechanical switch, which they can use on the new keyboard. Realforce

estimates that they can sell $5,000 units of the new keyboard per year at $250 per unit for the

next 4 years. The production cost per keyboard is $200. The fixed costs for the project will run

$50,000 per year. To start the production, Realforce has to invest a total of $400,000 in

manufacturing equipment, The equipment will be 100 percent depreciated over a straight line

basis for the next 4 years and become valueless at the end of the project. The tax rate is 35

percent and the discount rate is 15 percent.

a) What is the operating cash flow for this project?

b) What is the project's NPV?

c) Suppose that the manu facturing equipment will have a market value of $18,000 at the end of

the project and the project requires an initial investment in net working capital of $10,000, which

is fully recoverable at the end of the project. What is the project's new NPV?

d) In addition to (c), suppose that all cash flows in the previous steps are nominal, the real

discount rate is 14 percent, and the inflation is 2 percent per year for the ne xt 4 years. What is

the project NPV in today dollars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College