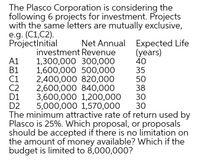

The Plasco Corporation is considering the following 6 projects for investment. Projects with the same letters are mutually exclusive, e.g. (C1,C2). ProjectInitial Net Annual Expected Life (years) 40 35 50 38 30 30 investment Revenue 1,300,000 300,000 1,600,000 500,000 2,400,000 820,000 2,600,000 840,000 3,600,000 1,200,000 5,000,000 1,570,000 The minimum attractive rate of return used by Plasco is 25%. Which proposal, or proposals should be accepted if there is no limitation on the amount of money available? Which if the budget is limited to 8,000,000? A1 B1 C1 C2 D1 D2

The Plasco Corporation is considering the following 6 projects for investment. Projects with the same letters are mutually exclusive, e.g. (C1,C2). ProjectInitial Net Annual Expected Life (years) 40 35 50 38 30 30 investment Revenue 1,300,000 300,000 1,600,000 500,000 2,400,000 820,000 2,600,000 840,000 3,600,000 1,200,000 5,000,000 1,570,000 The minimum attractive rate of return used by Plasco is 25%. Which proposal, or proposals should be accepted if there is no limitation on the amount of money available? Which if the budget is limited to 8,000,000? A1 B1 C1 C2 D1 D2

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:The Plasco Corporation is considering the

following 6 projects for investment. Projects

with the same letters are mutually exclusive,

e.g. (C1,C2).

ProjectInitial

Net Annual Expected Life

(years)

40

35

50

38

30

30

investment Revenue

1,300,000 300,000

1,600,000 500,000

2,400,000 820,000

2,600,000 840,000

3,600,000 1,200,000

5,000,000 1,570,000

The minimum attractive rate of return used by

Plasco is 25%. Which proposal, or proposals

should be accepted if there is no limitation on

the amount of money available? Which if the

budget is limited to 8,000,000?

A1

B1

C1

C2

D1

D2

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education