The population mean is $ 1.587. (Round to three decimal places as needed.) Tax Rate Frequency 0.00–0.49 The population standard deviation is $ 1.000. 0.50-0.99 12 (Round to three decimal places as needed.) 1.00–1.49 7 Compare these results to the values found using the actua 1.50–1.99 8 2.00-2.49 O A. The grouped mean is slightly larger, while the grou 2.50–2.99 4 3.00-3.49 3 O B. The grouped mean is slightly smaller, while the grd 3.50–3.99 1 O C. The grouped values are both slightly smaller. 4.00–4.49 1 D. The grouped values are both slightly larger.

The population mean is $ 1.587. (Round to three decimal places as needed.) Tax Rate Frequency 0.00–0.49 The population standard deviation is $ 1.000. 0.50-0.99 12 (Round to three decimal places as needed.) 1.00–1.49 7 Compare these results to the values found using the actua 1.50–1.99 8 2.00-2.49 O A. The grouped mean is slightly larger, while the grou 2.50–2.99 4 3.00-3.49 3 O B. The grouped mean is slightly smaller, while the grd 3.50–3.99 1 O C. The grouped values are both slightly smaller. 4.00–4.49 1 D. The grouped values are both slightly larger.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 22PFA

Related questions

Question

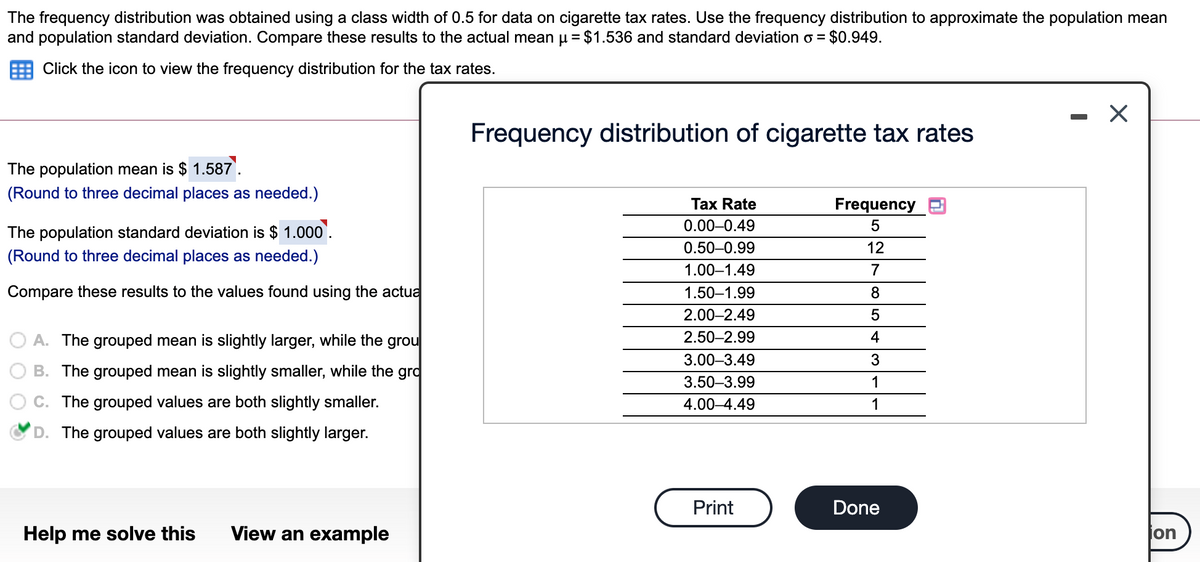

The frequency distribution was obtained using a class width of 0.5 for data on cigarette tax rates. Use the frequency distribution to approximate the population mean and population standard deviation. Compare these results to the actual mean μ=$1.536 and standard deviation σ=$0.949.

Transcribed Image Text:The frequency distribution was obtained using a class width of 0.5 for data on cigarette tax rates. Use the frequency distribution to approximate the population mean

and population standard deviation. Compare these results to the actual mean u = $1.536 and standard deviation o = $0.949.

Click the icon to view the frequency distribution for the tax rates.

Frequency distribution of cigarette tax rates

The population mean is $ 1.587.

(Round to three decimal places as needed.)

Tax Rate

Frequency

0.00-0.49

5

The population standard deviation is $ 1.000`.

0.50-0.99

12

(Round to three decimal places as needed.)

1.00–1.49

7

Compare these results to the values found using the actua

1.50–1.99

8

2.00–2.49

5

O A. The grouped mean is slightly larger, while the grou

2.50–2.99

4

3.00–3.49

3

B. The grouped mean is slightly smaller, while the grd

3.50–3.99

1

C. The grouped values are both slightly smaller.

4.00–4.49

1

D. The grouped values are both slightly larger.

Print

Done

Help me solve this

View an example

jon

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt