The post-closing trial balance of Wildhorse Corporation at December 31, 2022, contains the following stockholders’ equity accounts. Preferred Stock (15,800 shares issued) 790,000 Common stock (260,000 shares issued) 2,600,000 Paid-in Capital in Excess of Par – Preferred Stock 260,000 Paid-in Capital in Excess of Par-Common Stock 388,000 Common Stock Dividends Distributable 260,000 Retained Earnings 992,320 - A review of the accounting

The post-closing trial balance of Wildhorse Corporation at December 31, 2022, contains the following stockholders’ equity accounts. Preferred Stock (15,800 shares issued) 790,000 Common stock (260,000 shares issued) 2,600,000 Paid-in Capital in Excess of Par – Preferred Stock 260,000 Paid-in Capital in Excess of Par-Common Stock 388,000 Common Stock Dividends Distributable 260,000 Retained Earnings 992,320 - A review of the accounting

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 3MC: Prince Corporations accounts provided the following information at December 31, 2019: What should be...

Related questions

Question

The post-closing

Preferred Stock (15,800 shares issued) 790,000

Common stock (260,000 shares issued) 2,600,000

Paid-in Capital in Excess of Par – Preferred Stock 260,000

Paid-in Capital in Excess of Par-Common Stock 388,000

Common Stock Dividends Distributable 260,000

-

A review of the accounting records reveals the following.

- No errors have been made in recording 2022 transactions or in preparing the closing entry for net income.

- Preferred stock is $50 par, 6%, and cumulative; 15,800 shares have been outstanding since January 1, 2021.

- Authorized stock is 20,800

shares off preferred , 520,000 shares of common with a $10 par value. - The January 1 balance in Retained Earnings was $1,190,000.

- On July 1, 19,400 shares of common stock were issued for cash at $18 per share.

- On September 1, the company discovered an understatement error of $92,400 in computing salaries and wages expense in 2021. The net of tax effect of $64,680 was properly debited directly to Retained Earnings.

- A cash dividend of $260,000 was declared and properly allocated to preferred and common stock on October1. No dividends were paid to preferred stockholders in 2021.

- On December 31, a 10% common stock dividend was declared out of retained earnings on common stock when the market price per share was $18.

- Net income for the year was $595,000.

- On December 31, 2022, the directors authorized disclosure of a $208,000 restriction of retained earnings for plant expansion. (Use Note X)

Complete two picturs and

Compute the allocation of the cash dividend to preferred and common stock.

|

Allocation of the cash dividend to preferred stock

|

$enter a dollar amount | |

|---|---|---|

|

Allocation of the cash dividend to common stock

|

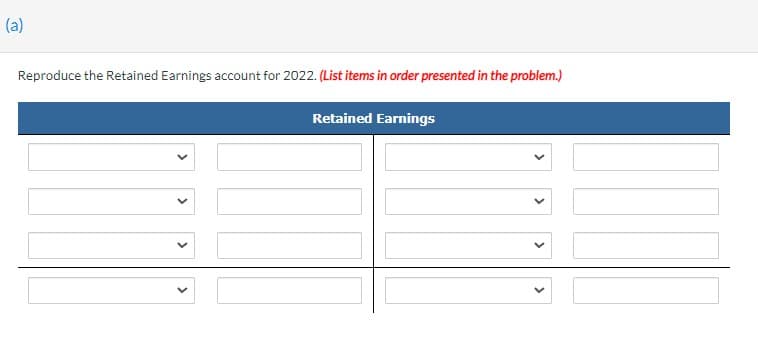

Transcribed Image Text:(a)

Reproduce the Retained Earnings account for 2022. (List items in order presented in the problem.)

Retained Earnings

>

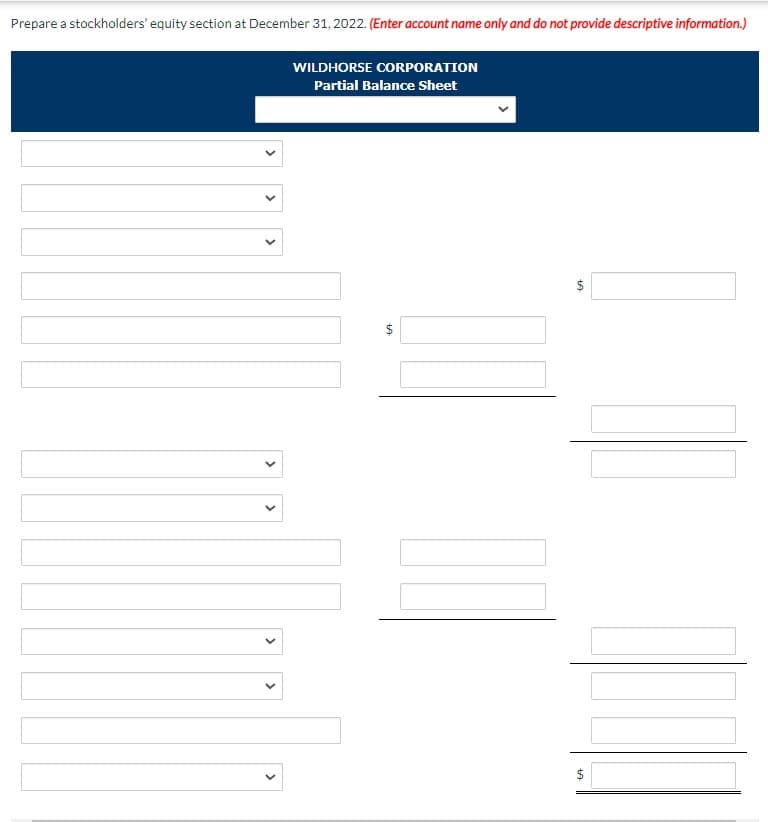

Transcribed Image Text:Prepare a stockholders' equity section at December 31, 2022. (Enter account name only and do not provide descriptive information.)

WILDHORSE CORPORATION

Partial Balance Sheet

$

$

>

>

>

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning