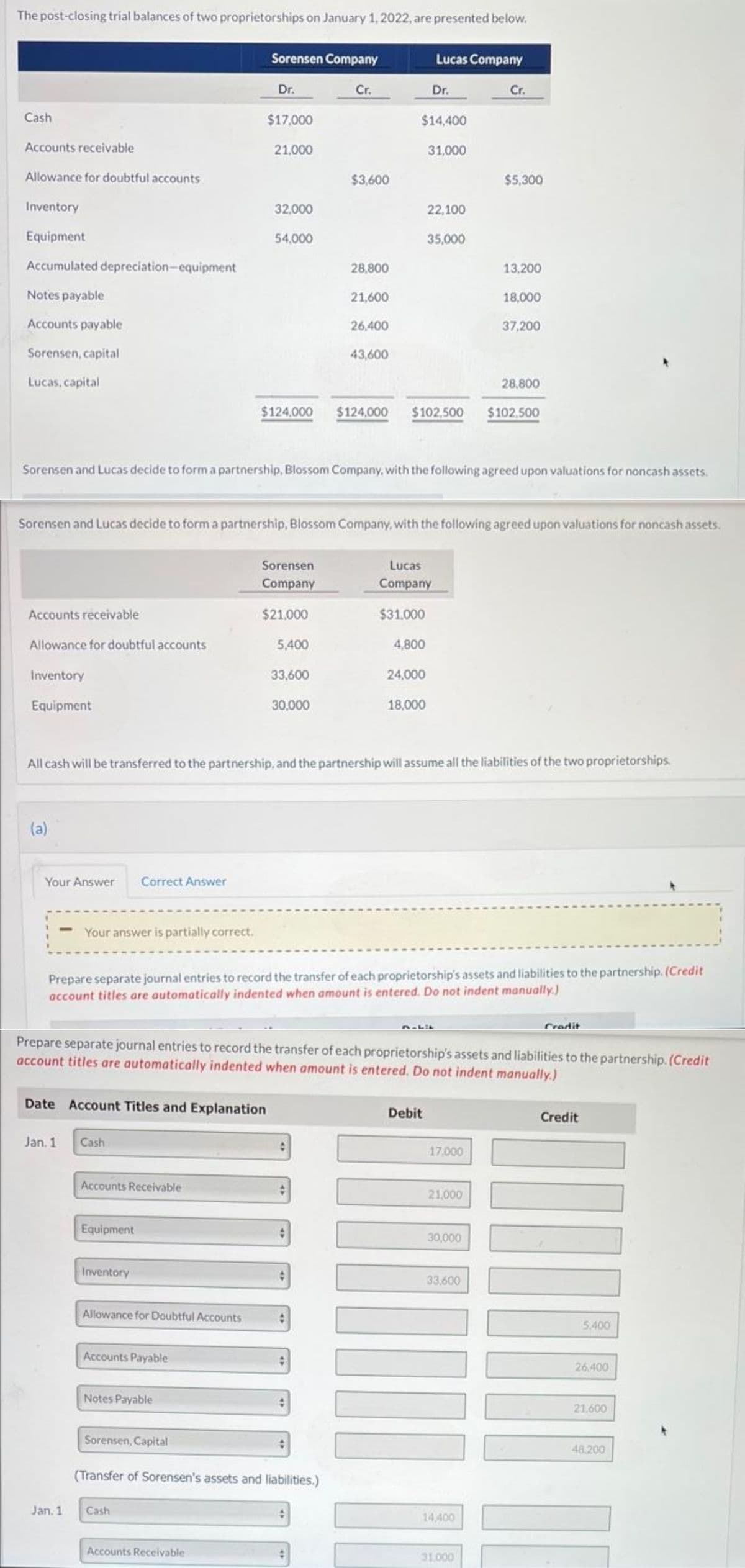

The post-closing trial balances of two proprietorships on January 1,2022, are presented below. Sorensen Company Lucas Company Dr. Cr. Dr. Cr. Cash $17,000 $14,400 Accounts receivable 21,000 31,000 Allowance for doubtful accounts $3,600 $5,300

The post-closing trial balances of two proprietorships on January 1,2022, are presented below. Sorensen Company Lucas Company Dr. Cr. Dr. Cr. Cash $17,000 $14,400 Accounts receivable 21,000 31,000 Allowance for doubtful accounts $3,600 $5,300

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PB: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

Transcribed Image Text:The post-closing trial balances of two proprietorships on January 1,2022, are presented below.

Sorensen Company

Lucas Company

Dr.

Cr.

Dr.

Cr.

Cash

$17,000

$14,400

Accounts receivable

21,000

31,000

Allowance for doubtful accounts

$3,600

$5,300

Inventory

32,000

22,100

Equipment

54,000

35,000

Accumulated depreciation-equipment

28,800

13,200

Notes payable

21,600

18,000

Accounts payable

26,400

37,200

Sorensen, capital

43,600

Lucas, capital

28,800

$124.000

$124,000 $102,500 $102.500

Sorensen and Lucas decide to form a partnership, Blossom Company, with the following agreed upon valuations for noncash assets.

Sorensen and Lucas decide to form a partnership, Blossom Company, with the following agreed upon valuations for noncash assets.

Sorensen

Lucas

Company

Company

Accounts receivable

$21,000

$31.000

Allowance for doubtful accounts

5,400

4,800

Inventory

33,600

24,000

Equipment

30,000

18,000

All cash will be transferred to the partnership, and the partnership will assume all the liabilities of the two proprietorships.

(a)

Your Answer

Correct Answer

Your answer is partially correct.

Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership. (Credit

account titles are automatically indented when amount is entered. Do not indent manually.)

Cradit

Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership. (Credit

account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Jan. 1

Cash

17,000

Accounts Receivable

21,000

Equipment

30,000

Inventory

33.600

Allowance for Doubtful Accounts

5,400

Accounts Payable

26,400

Notes Payable

21,600

Sorensen, Capital

48.200

(Transfer of Sorensen's assets and liabilities.)

Jan. 1

Cash

14,400

Accounts Receivable

31,000

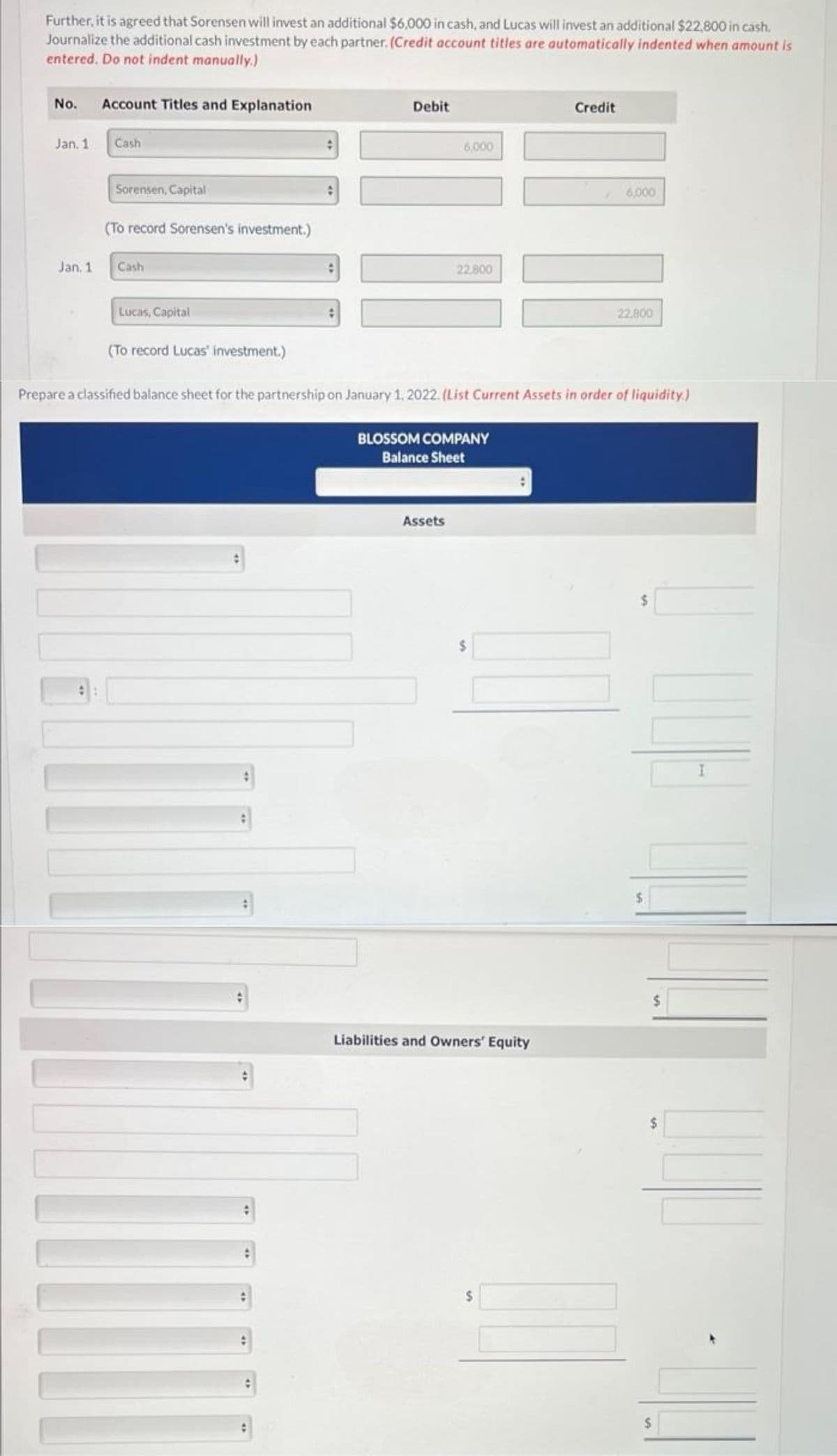

Transcribed Image Text:Further, it is agreed that Sorensen will invest an additional $6,000 in cash, and Lucas will invest an additional $22,800 in cash.

Journalize the additional cash investment by each partner. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

No.

Account Titles and Explanation

Debit

Credit

Jan. 1

Cash

6,000

Sorensen, Capital

6,000

(To record Sorensen's investment.)

Jan 1

Cash

22.800

Lucas, Capital

22,800

(To record Lucas' investment.)

Prepare a classified balance sheet for the partnership on January 1, 2022. (List Current Assets in order of liquidity.)

BLOSSOM COMPANY

Balance Sheet

Assets

Liabilities and Owners' Equity

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning